In many ways Arsenal enjoyed a very good 2015/16, as they

finished second in the Premier League, thus clinching qualification for the

Champions League for the 19th successive season. Not only was this a place

higher than the previous year, but this was also achieved by overtaking

Tottenham Hotspur on the last day of the season (“and it’s 5-1 to Newcastle”).

However, given that Arsenal outperformed of all the big boys

(as disgraced former England Manager Sam Allardyce used to affectionately describe

them), it was still something of a disappointment to finish well behind

surprise package Leicester City.

As chief executive Ivan Gazidis observed, “We have to be

disappointed, certainly not satisfied, to end up second. We wanted more than

that and I think that there were chances during the season. You can’t say

second place is a disaster, but it’s not what we are about.”

It was a classic Arsenal case of “so near and yet so far”,

so perhaps should not have been that surprising to their supporters, especially

as they did not purchase a single outfield player the preceding summer.

However, it has been a different story this summer, as Arsène

Wenger has addressed some of the shortcomings in his squad, splashing out £93

million to recruit Granit Xhaka, Shkodran Mustafi and Lucas Perez, who have all

made contributions to a promising start.

In fact, Arsenal have quietly ramped up their spending in

the last four years, averaging net spend of £49 million a season, compared to

net sales of £6 million over the previous seven years. As Gazidis explained, “We

are in a position that we were not in four or five years ago where we don’t

have to sell our best players. We can go and sign world-class players if and when

the manager identifies them.”

The chief executive pointed out that since Stan Kroenke

became Arsenal’s majority shareholder, the club had actually invested around

£350 million in transfer fees, including the likes of Mesut Özil and Alexis Sánchez.

This is true, though fails to mention that around £160 million was recouped in

the same period from player sales – and that all this expenditure was funded by

the football club and not the owner.

That said, the question is whether they could have done even

more. The frequent criticism of the club’s innate conservatism in the transfer

market has evidently touched a nerve, as there have been a series of

justifications from senior executives as to why the famous, hefty cash pile has

not been fully utilised.

"Mustafi Me"

Gazidis patiently explained, “What is clear is that big

spending is not the solution to all problems”, adding, “it’s not just about

spending money, but about how you spend your money and doing it wisely.”

Arsenal chairman Sir Chips Keswick has clearly been given

the same playbook: “We are not afraid to spend substantial sums, but it is

important that the money is used wisely.”

Nobody would argue with that, but even after the increased

spending it does feel as if the club is not as ambitious as it could be and it

does rather bring to mind the old Hamlet quote, “the lady doth protest too

much.”

Three years ago Gazidis had raised the fans’ hopes when he

boasted, “We should be able to compete at a level like a club such as Bayern

Munich. We can do some things which would excite you. I say that this is an extraordinarily

ambitious club.”

Contrast that to this summer’s lecture: “We can't afford to

outgun competitors that have far more money – we have to be very careful, very

selective. That means we can’t afford to make huge mistakes in the transfer

market.”

This seeming desire to play the poor relation appears

strange, not least because Arsenal have actually become one of the biggest

spenders in recent seasons. Since 2013 Arsenal’s net spend of £197 million is

the third highest in the Premier League, only surpassed by the “unprecedented”

expenditure of the two Manchester clubs, City £389 million and United £342

million, though they did splash out nearly twice as much as the Gunners.

Wenger himself has always insisted that he would have no

problems spending if the right players to strengthen the squad were available, “I

would spend £300 million if I find the right player – and if I have £300

million”, though he has also described the current spending levels as “quite

scary”.

“Le Professeur” has further explained that English clubs

suffer from having to pay a premium, as everyone knows that they are awash with

money from the new TV deal, though this does make it even more perplexing that

Arsenal did not spend their riches before when prices were much lower.

A couple of years ago £50 million would have bought two

world-class players, while it is now barely enough for one. When Wenger was

asked about the rise in transfer fees, he said, “We knew that would happen, it

was not difficult to anticipate.” Well, precisely, so why keep the powder dry?

In the latest accounts for the year ended 31 May 2016,

Arsenal’s cash balance has very slightly fallen by £2 million to £226 million,

but the upward trend remains intact despite the higher spending. In the decade

since Arsenal moved to the Emirates Stadium, cash has risen by more than 500%

from £36 million to nearly a quarter of a billion.

In 2015/16 Arsenal’s cash balance has been overtaken by the

cash machine that is Manchester United with £229 million, but the Gunners are

far higher than the rest of the Premier League with the closest challengers in

2014/15 being Manchester City £75 million, Newcastle United £48 million and

Crystal Palace £29 million.

To further place this into perspective, Arsenal’s cash

balance is more than Real Madrid, Barcelona and Bayern Munich combined.

The club is very sensitive on this issue with Sir Chips

Keswick even noting that it was his “duty to point out that after excluding

debt service reserves (£35 million) and amounts owed to other clubs on past

transfers (£42 million), the balance reduces to £149 million.”

It is also true that this figure is inflated by the

seasonality of cash flows, e.g. season ticket receipts for the new season and

advance sponsorship, so Arsenal’s cash balance will always be at its highest

when its annual accounts are prepared. The club has to pay a good proportion of

its annual running expenses out of this cash, though it is equally valid that

other money will flow into the club during the course of the season, such as TV

distributions, including the huge new contract, and merchandise sales.

In other words, there is still substantial money available

to spend. It’s clearly not as much as the £226 million in the books, but there

would be enough available in the January transfer window to further boost the

squad if necessary.

Looking at Arsenal’s cash flow statement, we can clearly see

evidence of a change in approach: in the six seasons between 2007 and 2012

Arsenal spent just a net £4 million on player purchases, while they have spent

a net £138 million in the last four seasons.

In 2015/16 Arsenal generated an impressive £94 million from

operating activities, spending a net £54 million on transfers (a new record)

and £41 million on other things: £20 million on financing the Emirates Stadium

(£12 million interest plus £8 million debt repayments), £13 million on capital

expenditure (e.g. investment in London Colney training facilities and redevelopment

of Hale End Academy) and £8 million on tax.

This is nothing new. Since 2007 Arsenal have produced a very

healthy £722 million operating cash flow, though a draining £251 million has

had to be used for stadium financing (£159 million on loan interest and £92

million on debt repayments) with a further £117 million on infrastructure

(“hugely important investments which, whilst not grabbing headlines, will help

underpin our long-term future” per Keswick) and £22 million on tax.

Only 20% (£141 million) of the available cash flow has been

spent in the transfer market, though virtually all of that (£137 million) has

been in the last four seasons. The other notable “use” of cash in that period

is to increase the cash balance, which has risen by a cool £191 million.

Major shareholder Alisher Usmanov has noted that Wenger had been

put in a very difficult position, as the shareholders did not put any money in

to finance the new stadium, which meant that the quarter of a billion incurred

to date on stadium financing was not available to improve the squad. That’s obviously

correct, but it is equally true that Arsenal have left a lot of available money

in the bank to attract one of the lowest interest rates in history, while

transfer inflation has been running amok.

While on the subject of Arsenal’s cash, a recent report by

CSS Investments Limited stated that Arsenal only had £4 million to spend in the

transfer market (£54 million if the club made use of an overdraft facility).

This embarrassing “analysis” simply deducted all of

Arsenal’s short-term net payables/receivables from Arsenal’s cash balance to produce

their £4 million figure, thus assuming that the club would have zero creditors

and debtors, while generating nothing from their operations during the year.

This is patently absurd, which can be easily demonstrated by

applying the same approach to the other Premier League clubs. If we do that,

all but four of the clubs in the top flight would have nothing to spend, as

their available cash would be negative. In any case, it’s a relief that Arsenal

haven’t actually gone bust, even though they spent £86 million this summer.

Arsenal duly delivered another set of solid financial

results in 2015/16 with the chairman commenting, “we’ve enjoyed a season of

progress both on an off the pitch”, though profit before tax fell by £15

million from £18 million to £3 million. The decrease was smaller after tax, as

the tax charge was £2 million lower, but this still declined by £13 million to

£2 million.

The fall in profit was despite revenue growing by £21

million (6%) from £329 million to £351 million (excluding £3 million from

property development that brought total revenue to £354 million), mainly due to

strong growth in broadcasting income, which rose by £16 million (13%) to £141

million. This was due to the new Champions League deal and record Premier

League distributions.

This was supported by commercial income rising by £4 million

(4%) to £107 million and player loans

being £2 million higher at £3 million, though match day revenue dipped slightly

to just under £100 million.

"The Leader"

On the other hand, profit from player sales was £27 million

lower at just £2 million, while a “quiet year” for property development reduced

profit from this segment by £11 million to just £2 million.

Continued investment in the squad resulted in the wage bill

climbing £3 million to £195 million and player amortisation rising by £5

million to £59 million. Against that, depreciation and other expenses were £3

million lower.

Interest payable was down £6 million, though this was partly

due to the implementation of accounting standard FRS 102, which meant that the

prior year comparative was increased by £6 million (to reflect the change in

fair value of the interest rate swap used to fix the interest rate on the

floating rate stadium bonds).

Traditionally Arsenal have been one of the few profitable

football clubs, but the impact of the

last TV deal has helped change this with only six Premier League clubs

reporting a loss in the 2014/15 season. In fact, Arsenal’s £25 million profit (before

restatement) was only the 5th highest that season, behind Liverpool £60 million,

Newcastle United £36 million, Burnley £35 million and Leicester City £26 million.

Only three Premier League club have so far published their

2015/16 accounts with Arsenal’s £3 million pre-tax profit being just ahead of

Stoke City £2 million, but a long way behind Manchester United’s impressive £49

million.

Profit from player sales can have a major influence on a

football club’s bottom line, as best shown in 2014/15 by Liverpool, whose

numbers were boosted by £56 million from this activity, largely due to the sale

of Luis Suarez to Barcelona. Similar large sums were made that season by

Southampton £44 million, Chelsea £42 million and Tottenham £21 million.

In this way, the lack of major sales adversely impacted

Arsenal’s bottom line in 2015/16. The main element in their £2 million profit

was a sell-on fee for former youth player Benik Afobe’s transfer to Bournemouth.

Despite the improving profits at other clubs, Arsenal’s

financial record is still one of the most consistent around with the club

reporting profits 14 seasons in a row. You have to go back as far as 2002 to

find the last time that they made a loss. Since then, they have made total

combined profits of £278 million.

This is an astonishing achievement in the cutthroat world of

football where success is very largely bought, though it is worth noting that

profits have been much lower as of late. Indeed, the 2015/16 £3 million profit

is the lowest in the Emirates Stadium era.

However, Arsenal’s 2014/15 profit was boosted by £29 million

of player sales and £13 million from property development. In fact, over the

years much of the club’s excellent financial performance has been down to

profits from player sales (e.g. £65 million in 2011/12, £47 million in 2012/13)

and property development (e.g. £13 million in 2010/11, £11 million in 2009/10).

These are likely be lower in future, as Arsenal no longer

have to make “forced” player sales, while the property development is largely

coming to an end, which means that Arsenal will be more reliant on their core

business.

The chief financial officer Stuart Wiseley confirmed this

view, “Improved player retention is a direct consequence of the club’s improved

financial position over the last five years with a clear trend away from

transfer profits as an essential component of the profit and loss account.”

There was limited activity in the property business profit

in 2015/16 with profit of just £2 million. There should be money coming from

the sale of the development sites at Holloway Road and Hornsey Road, though

various complex agreements still need to be concluded.

To get an idea of underlying profitability, football clubs

often look at EBITDA (Earnings Before Interest, Depreciation and Amortisation),

as this strips out player trading and non-cash items. On this basis, Arsenal’s

profitability has improved considerably in the last three seasons after many

years of decline, with EBITDA rising from £25 million in 2013 to £82 million in

2016.

That’s one of the best in the Premier League (around the

same level as Manchester City), but it is still over £100 million below

Manchester United’s astonishing £192 million. Now that United have reduced

their financing costs to a more manageable level, they basically have at least

£100 million more than any other English club to spend on players – every

season.

Arsenal’s revenue hardly moved at all between 2009 and 2011,

but has grown by an impressive 44% (£108 million) since 2013. Most of the

growth (£55 million) is down to improved TV deals, which have driven a 63%

increase in broadcasting revenue, though the previously under-performing

commercial division has risen by £44 million (71%), mostly due to new deals

with Emirates and Puma. Match day income has also increased in that period, but

only by £7 million (8%).

Despite Arsenal’s revenue rising by £21 million (6%) to £351

million, the gap to Manchester United has significantly widened to £164 million,

as the Red Devils’ grew their revenue by £120 million (30%) to £515 million.

In fairness, United are in a class of their own in the

Premier League, while Arsenal are now almost the same level as Manchester City

(£352 million) and ahead of Chelsea (£314 million) and Liverpool (£298 million),

though all these clubs are likely to increase when their 2015/16 figures are

announced.

It should also be emphasised that Arsenal’s revenue is well

ahead of the other English clubs: £150 million more than Tottenham (£196

million) and at least £200 million more than everybody else, including

champions Leicester City, who only earned £104 million.

Clearly having more revenue is important, with Wenger

stating that budget is closely correlated with success on the pitch, “The clubs

who have better financial resources have the better teams”,

However, the Frenchman has also argued that it is not the be

all and end all, “Manchester United is the richest club in the world, so not

many teams can compete on a financial amount, but I feel that it doesn’t make

any difference, because on the pitch we can compete and that is most important.

Football is not a financial competition: Leicester has shown that last year.”

Arsenal stood at seventh place in the Deloitte 2015 Money

League, only behind Real Madrid, Barcelona, Manchester United, Paris

Saint-Germain, Bayern Munich and Manchester City, which is obviously excellent.

However, there are three major challenges for Arsenal here.

(1) The leading clubs continue to grow their revenue at a

faster rate, e.g. in 2015/16 Real Madrid and Barcelona increased revenue by £25

million and £31 million respectively, compared to Arsenal’s £21 million, even

before their massive new kit supplier deals commence.

(2) The weakening of the Pound since the Brexit vote means

that continental clubs will earn much more in Sterling terms, e.g. the 2015

Money League was converted at €1.31, while the current rate is around €1.15.

(3) The Money League highlights the increasingly competitive

nature of England’s top flight with no fewer than 17 Premier League clubs in

the top 30 – even before the lucrative new TV deal.

The growth in broadcasting income in 2015/16 means that this

now accounts for 40% of Arsenal’s total revenue, ahead of commercial income

30%. The importance of match day income, even though it is around £100 million,

has consequently diminished from 44% to 28% since 2009.

Nevertheless, Gazidis noted, “Whilst our match day revenue

is now ranked behind both broadcasting and commercial as a source of income, it

remains vitally important to the club and is a key differentiator to competitor

clubs with smaller, less modern venues.”

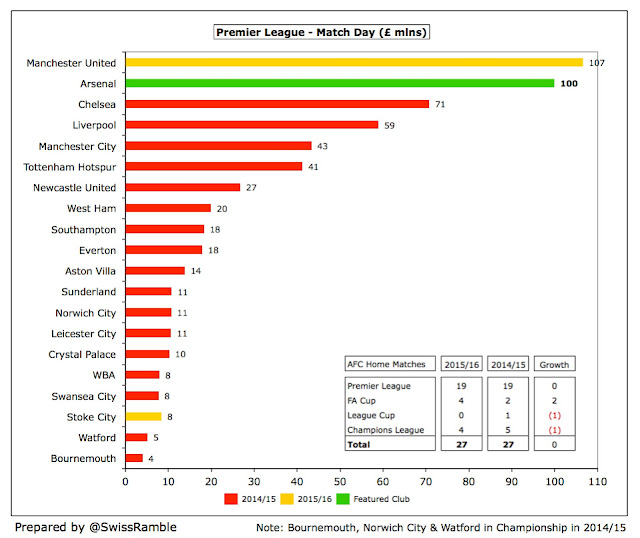

This can be seen by looking at the importance of match day

revenue to Premier League clubs in the 2014/15 season, where Arsenal were the

only one above 30% with the nearest being Manchester United and Chelsea at 23%.

In fact, no club in the Money League top 30 generates a larger proportion of

its revenue from match day.

However, match day income did dip slightly by £0.5 million

to £99.9 million in 2015/16. Even though Arsenal staged the same number of home

games (27), the mix was different with one Champions League game less plus no

involvement in the FA Cup semi-final.

This meant that Manchester United overtook Arsenal’s match

day income with £107 million following their return to the Champions League.

This was boosted by their average attendance of 75,000, though Arsenal’s is the

second highest in England at just under 60,000.

Of course, Arsenal do have very high ticket prices, arguably

the highest in the land depending on how you view the number of games included

in the season ticket package.

The good news is that the club has frozen ticket prices for

the 2016/17 and 2017/18 seasons, which means that ticket prices will have been

held flat for nine of the 12 seasons at the Emirates Stadium with

inflation-only increases in the other three years. Arsenal are also providing a

further £4 discount for their away supporters attending Premier League matches

in addition to the £30 cap announced by the Premier League.

Arguably, Arsenal could still do more here in light of the

massive new TV deal and there is no doubt that the fans are not delighted to

contribute so much money to effectively grow the club’s bank balance. As a

comparison, Everton reduced season ticket prices by more than 5% this season.

Gazidis said that the board wished to “strike a balance

between the expense of coming to games for our supporters and the club’s

ever-increasing costs and expenditure as it develops on and off the pitch”, but

he slightly ruined the effect by adding, “demand for tickets continues to far

exceed supply”, reducing it to an issue of basic economics.

Arsenal’s share of the Premier League television money rose

£4 million to £101 million in 2015/16, as they received a higher merit payment

for finishing one place higher and received more facility fees for being

broadcast live more often. This represented the highest distribution in the top

flight, even ahead of champions Leicester City, as the smaller merit payment

for finishing one place lower was more than offset by higher facility fees for

having 12 more games broadcast live.

This is even before the increases from the mega Premier

League TV deal in 2016/17. Based on the contracted 70% increase in the domestic

deal and estimated 40% increase in the overseas deals, the top four clubs will

receive around £150 million, i.e. around £50 million more a season.

"Beautiful Vision"

Although this is clearly great news for the clubs, it is

somewhat of a double-edged sword for the elite, as it makes it more difficult

(or at the very least more expensive) to persuade the mid-tier clubs to sell

their talent.

As Gazidis put it, “In the past the big clubs could

financially bully the smaller clubs. It would be unthinkable that a smaller

club would be able to hold on to its best player if Manchester United or

Arsenal came knocking at the door.” Wenger validated the new paradigm: “The

clubs don’t need the money in England and maybe that’s why they only weaken if

the price is high.”

Sir Chips confirmed that this was one of the reasons why

Arsenal had spent more this summer: “The new broadcast revenue has provided a

further competitive stimulus to the Premier League. We know that competition

will be even tougher this season. Accordingly, we have made further significant

investment into what was already a very competitive squad.”

Arsenal did not announce how much they received from the

Champions League, but my estimate is €51

million, up from €36 million in 2014/15, based on the increases in the 2016 to

2018 cycle, namely higher prize money plus significant growth in the TV

(market) pool, thanks to BT Sports paying more than Sky/ITV for live games.

The Champions League payment is partly influenced by a

club’s progress in the tournament, but it is also dependent on where it

finishes in the previous season’s Premier League. In this way, Arsenal’s

2016/17 revenue will be boosted by finishing second in the 2015/16 Premier League,

compared to third the year before, exacerbated by the stronger Euro exchange

rate.

Wenger has played down the value of Champions League

qualification to Arsenal, “What has changed over the years is that the impact

of the finances in the Champions League is not as big any more. For a period in

the past the money was vital to us.” That said, it is clear that it is still

financially beneficial, especially if it is compared to the Europa League,

where Tottenham, for example, only earned €6 million in 2014/15.

Even though Arsenal have not done that well recently, i.e.

the last time that they got past the last 16 was 2010, it is still a major revenue

differentiator to their domestic rivals. For example, in the five years up to

2014/15 they received €153 million, over €100 million more than Tottenham and

Liverpool.

Commercial revenue increased by £4 million (4%) from £103

million to £107 million, comprising £82 million from commercial deals and £25

million from retail and licensing, largely due to new secondary partnerships.

This was a much lower growth rate than the previous two

years, but the club had called this out, when announcing that both the primary

partnership deals, with Emirates and Puma, are in place for the medium-term. It

also pales into insignificance compared to Manchester United, whose commercial

income shot up by 36% in 2015/16 to £268 million, which is an astonishing £161

million more than Arsenal.

United may be out of sight in England, but it is

disappointing that Arsenal’s commercial income is still lower than Manchester

City £173 million, Liverpool £116 million and Chelsea £108 million. Of course,

Arsenal are in turn miles above other Premier League clubs, e.g. Tottenham £60

million, Aston Villa £28 million and Everton £26 million.

Arsenal’s commercial shortcomings can be clearly seen if we

compare their revenue with the other nine clubs in the 2014/15 Money League top

ten. OK, the £123 million shortfall against PSG is largely due to the French

club’s “friendly” agreement with the Qatar Tourist Authority, but there are

still major gaps to other clubs in commercial terms, e.g. Bayern Munich £108

million, Real Madrid £85 million and Barcelona £82 million.

Arsenal’s £150 million Emirates deal covers a 5-year

extension in shirt sponsorship from 2014 to 2019 plus a 7-year extension in

stadium naming rights from 2021 to 2028. The club has not divulged how much of

the deal is for naming rights, so I have used the straightforward £30 million

annual figure, though my own estimate would put the pure shirt sponsorship at

around £26 million.

That’s pretty good, but it has since been overtaken by new

sponsorship deals at Manchester United with Chevrolet (around £56 million a

year at the latest USD exchange rate) and Chelsea with Yokohama Rubber (£40 million).

It’s a similar story with the Puma kit supplier deal, which

is worth £30 million a year. This is one of the best kit deals around, but is

still dwarfed by Manchester United’s extraordinary £75 million deal with

Adidas, while Chelsea will switch to Nike for £60 million from the 2017/18

season.

At the time it was signed, United described theirs as the

“largest kit manufacture sponsorship deal in sport”, though it has since been

reportedly overtaken by new agreements signed by Barcelona (Nike) and Real

Madrid (Adidas), which would be worth £125 million and £115 million

respectively (at the current exchange rate).

Despite an increase in the number of partnerships, the

concern is that Arsenal’s commercial performance will continue to place them at

a competitive disadvantage relative to other leading clubs, even though owner

Stan Kroenke believes that the Arsenal brand is a “big opportunity” for the

club.

However, further substantial increases are only likely to

come as a result of success on the pitch, which again makes you wonder why the

available cash has not been spent on strengthening the squad.

Arsenal’s wage bill increased by 2% (£3 million) to £195

million in 2015/16, though the underlying growth was higher, as the prior year

comparative was inflated by a double charge for Champions league qualification

bonuses (August 2014 via a play-off).

However, as a result of the revenue growth, the wages to

turnover ratio was cut from 58% to 56%. This is higher than the 46-50% achieved

between 2008 and 2010, but is still very reasonable and is at the lower end of

the Premier League.

Arsenal’s wage bill has risen by 57% (£71 million) since

2011, one of the fastest growth rates. This was justified by the CFO thus: “In

light of the strong correlation between player wage expenditure and on-field

success, a progressive wage bill, where growth is rational and responsible,

should be regarded as a positive outcome.”

Manchester United’s high growth in 2015/16 means that their

wage bill of £232 million is once again the highest in England, at least until

Manchester City and Chelsea publish their accounts. Their gap to Arsenal has

thus increased from £11 million to £37 million.

Of course, Arsenal’s wages are way ahead of most other

Premier League clubs with the nearest challengers (in 2014/15) being Liverpool

£166 million, Tottenham £101 million and Aston Villa £84 million.

Arsenal need to consider the Premier League’s Short Term

Cost controls, which restrict the annual

player wage cost increases to £7 million a year for the three years up to

2018/19 – except if funded by increases in revenue from sources other than

Premier League broadcasting contracts.

This will be a challenge, as Arsenal soon need to extend the

contracts of Özil and Sánchez. Given the limited opportunity to raise ticket

prices, this again places pressure on Arsenal to grow commercial revenue.

It also helps explain Arsenal’s caution in the transfer

market, as Wenger explained, “If clubs are wrong, they will have these players

with high wages who cannot move anywhere else.”

What is more difficult to explain is the 15% increase in

Ivan Gazidis’ remuneration from £2.299 million to £2.648 million. Nice work if you

can get it.

Although there is a natural focus on wages, other expenses

also account for a sizeable part of the budget at leading clubs, though

Arsenal’s decreased by £2 million to £70 million in 2015/16. These cover the

costs of running the stadium, staging home games, supporting the commercial

partnerships, travel, medical expenses, insurance, retail costs, etc.

The good news is that Stan Kroenke’s company has waived its

“entitlement” to any fee for “strategic and advisory services”, which were

apparently worth £3 million the previous year.

Another cost that has had a major impact on Arsenal’s profit

and loss account is player amortisation, reflecting the recent increased

investment in transfers. This expense has shot up from £22 million in 2011 to

£59 million in 2016.

As a reminder of how this works, transfer fees are not fully

expensed in the year a player is purchased, but the cost is written-off evenly

over the length of the player’s contract. As an example, Özil was reportedly

bought for £42.5 million on a five-year deal, so the annual amortisation in the

accounts for him is £8.5million.

However, Arsenal's player amortisation is still by no means

the largest in the Premier League. Those clubs that are regarded as big

spenders logically have the highest amortisation charges, e.g. Manchester City

£70 million and Chelsea £69 million in 2014/15, while Manchester United’s

cheque-book strategy since Sir Alex left has driven their annual amortisation

up to an incredible £88 million in 2015/16.

There have been a few misguided reports in the media that

Arsenal have paid off their stadium debt, but the reality is that the debt

incurred for the Emirates development continues to have an influence over

Arsenal’s strategy.

Although this has come down significantly from the £411

million peak in 2008 to £233 million, it is still a heavy burden, requiring an

annual payment of around £20 million, covering interest and repayment of the

principal. Arsenal’s debt comprises long-term bonds that represent the

“mortgage” on the stadium £194 million, derivatives £24 million and debentures

held by supporters £14 million.

The interest payable of £13 million is more than twice as

much as any other Premier League club (£5-6 million at Sunderland, West Ham,

Manchester City and Tottenham) – with the notable exception of Manchester

United, even though they reduced this to £20 million in 2015/16.

Although the net debt stands at only £6 million, thanks to

those large cash balances, the gross debt of £233 million remains the second

highest in the Premier League, only behind Manchester United, whose borrowings

rose to £490 million, largely due to the impact of unfavourable exchange rate

movements on the USD denominated debt.

Apart from financial debt, it is worth noting that Arsenal

also owe a net £42 million to other football clubs for transfers, though this

is down from £66 million the previous year, and have spent more than £90

million on new players since the financial year-end.

"The patience of a Santi"

Even though some other clubs are still well ahead

financially, Arsenal are still better placed than most. Gazidis, for one, is bullish:

“We are in a strong position to continue moving forward at every level of the

club. Our ultimate ambition is clear: to win major trophies and make Arsenal

fans at home and around the world proud of this great club.”

That sounds a lot better than Stan Kroenke’s throwaway

comment that “If you want to win championships, then you would never get

involved”, which hardly inspires confidence that the board is committed to maximising

the club’s chances of competing at the top level.

"Come on, Alex, there's nothing to it"

It would be a fitting tribute to Wenger’s 20-year

anniversary at Arsenal to go one step better than last season by winning the

Premier League again, but the competition this year looks stronger with City

resurgent under Guardiola, and United, Liverpool, Chelsea and Tottenham all

looking to bounce back from their various misfortunes.

Unfortunately, Arsenal failed to invest their available cash

when this would have gone a lot further, which very much feels like a missed

opportunity. Obviously, spending big is in itself no guarantee of winning

trophies, but it does tend to give a club its best chance of success.

However, this summer Arsenal did start to act like a big club, finally recognising the new realities of the transfer market. Allied to exciting Academy products like Alex Iwobi and Hector Bellerin, this gives cause for quiet optimism for the future, though it’s still too early to say whether this team will deliver.

However, this summer Arsenal did start to act like a big club, finally recognising the new realities of the transfer market. Allied to exciting Academy products like Alex Iwobi and Hector Bellerin, this gives cause for quiet optimism for the future, though it’s still too early to say whether this team will deliver.

Excellent analysis as usual.

ReplyDeleteI've often wondered whether the financial crash and subsequent downturn in the property market affected Arsenal's financial planning, accounting for some of the transfer stinginess in the years after the stadium move. Do you think that's likely to have been the case?

ReplyDeleteI do wonder how Chelsea, Liverpool and City are above Arsenal in commercials. Whats your view, is it anyhwo down to quality of our marketing team?

ReplyDeleteExcellent analysis, as usual, Mr Ramble. However, you have taken Mr Kroenke's comment out of context. He was asked about being involved in the running the sporting side of a sports franchise as an owner, and he said that he absolutely loves to win, and that you have to get people you trust to take care of the sports side of it for you, because if you are interested in winning titles, you don't get involved in the sporting side of the franchise. Obviously, the entire comment doesn't make as good a soundbite as the last sentence, and doesn't fit into the narrative of him as a man who only cares about money.

ReplyDeleteIt's like when Iverson got tagged with the "What's practice?" thing. He was in a press conference, days after his best friend was murdered, and the 76ers had just been beaten in the playoffs, and a reporter asked him about him missing practice. And his response in a nutshell (delivered with a tone of barely restrained incredulity) was, "I'm dealing with some serious personal issues, we just lost the game, and you're asking me about practice?" But, all that was played over and over was the last part, "We talking about practice?" which was utterly unfair to an exceptionally gifted player who DID in fact practice his butt off.

Agree completely with The Law about Kroenke's comments (and Iverson's) being taken out of context.

ReplyDeleteI think Kroenke is OK, not great; he'll do his best to maximise Arsenal's chances, but without risking any more of his money. Fair from a business perspective, but it means Arsenal will always struggle against the "win at all costs" billionaires.

From a selfish perspective, I would be delighted if someone bought the club, invested $1bn without any hope of seeing a return, which allowed Arsenal to compete directly with the top 3/4 clubs in terms of transfer fees/wages, while also drastically cutting the cost of going to the Emirates. It's not fair to criticise Kroenke for not doing that, but as it's happening elsewhere Arsenal fans can legitimately feel a little bit envious!

Also, I agree with Swiss Rambler that Arsenal missed a trick - stockpiling young players would have been a better use for the cash than sitting in the back, especially if they foresaw the coming transfer inflation. The Chelsea model seems wise (if soul-destroyingly commercial) in hindsight; you benefit from the capital appreciation of the players, loan fees etc, but aren't required to pay high wages (like if you invested in players at their peak)

ReplyDeleteComplaining to the world that English clubs pay a premium for players is very two faced, when all other clubs know full well that Arsenal are cash rich.....they might have been able to get better deals by not stockpiling the cash in the first place, especially when interest rates are so low.

ReplyDeleteEpic post

ReplyDeleteGreat Analysis!

ReplyDeleteJust imagine if Arsenal keep winning the epl regularly like rf,it would really attract more sponsors.Arsenal could do with a cl triumph.

ReplyDeleteThen the sponsorship floodgates would really open.

Wow.

ReplyDeleteSensational analysis.

So useful for the next AGM.

Based on this, I'm actually happy with Arsenal's tragectory!

Amazing, This is sensational.

ReplyDeleteDo you have an estimate of when Arsenal is expected to pay off the stadium debt? I looked around online but wasn't able to find a definitive number, though I imagine it has to be sometime around 2025-2030, right?

ReplyDelete