It has been a mixed start to the season for Arsenal, as

promising away performances at champions Manchester City and a rejuvenated

Liverpool have been balanced against a disappointing home defeat to Chelsea.

However, there is an air of quiet optimism among the fans that Arsène Wenger’s

new-look side will be able to mount a challenge once the new players have fully

gelled. It certainly feels better than last year when the Gunners were on the

wrong end of an 8-2 thrashing by Manchester United.

In fact, Arsenal recovered well after that disastrous start

to finish in a creditable third position, securing qualification for the

Champions League for a hugely impressive 15 seasons in a row. Even Wenger was

moved to describe this feat as a “miracle”, citing the thrilling 5-2 victory

over Spurs in the North London derby as the turning point. Nevertheless, it was

a close run thing, as Arsenal only made sure of qualifying with a last day

victory at West Brom.

The team’s inconsistent performances can be partly

attributed to the significant amount of turnover in the playing squad,

exacerbated by losing some of the club’s best performers each summer. Last year

Cesc Fàbregas returned to his spiritual home at Barcelona, while Samir Nasri moved

north to join Manchester City’s project. In the recent transfer window, it was

the turn of leading scorer Robin Van Persie to head towards Manchester, though

he opted for Old Trafford, while Alex Song joined the long list of Arsenal

players transferred to Barcelona.

"Mertesacker - the power of Per-suasion"

Good arguments can be put forward that each of these sales

may have made sense individually, e.g. RVP was in the last year of his

contract, while the offer for Song was too good to refuse given his tactical

indiscipline, but taken together they do give the impression that Arsenal have

become a selling club, not overly bothered if their best players leave.

At least Arsenal appeared to have more of a plan this

summer, recruiting international replacements before the departures, including

the highly talented creative midfielder Santi Cazorla from Malaga, the

experienced German forward Lukas Podolski from FC Köln and last season’s top

scorer in Ligue 1

Olivier Giroud from Montpellier. Furthermore, the return of Jack Wilshere and

Abou Diaby after lengthy absences through injury enabled the club to wheel out

the tried-and-tested “like a new signing” line.

However, many fans remain baffled that a club of Arsenal’s

immense financial resources did not aim higher in the transfer market, such as

buying a striker of the calibre of Napoli’s Edinson Cavani or Atlético Madrid’s

Radamel Falcao. Of course, either of these would have broken Arsenal’s transfer

record by some distance, but the money is clearly available to fund a purchase

of this magnitude.

"Cazorla - Spanish eyes"

To the outside world, it appears that Arsenal have paid

rather more attention to strengthening their balance sheet, as opposed to the

squad, an impression that was reinforced by last week’s announcement of a hefty

profit for the 2011/12 season, described by Peter Hill-Wood as “another healthy

set of full year results.”

As is the chairman’s style, that was a beautifully

understated description of a thumping great profit before tax of £36.6 million,

which was up from £14.8 million the previous year. This was split between £34.1

million from the football business (up from £2.2 million in 2010/11) and £2.5

million from property development (down from £12.6 million).

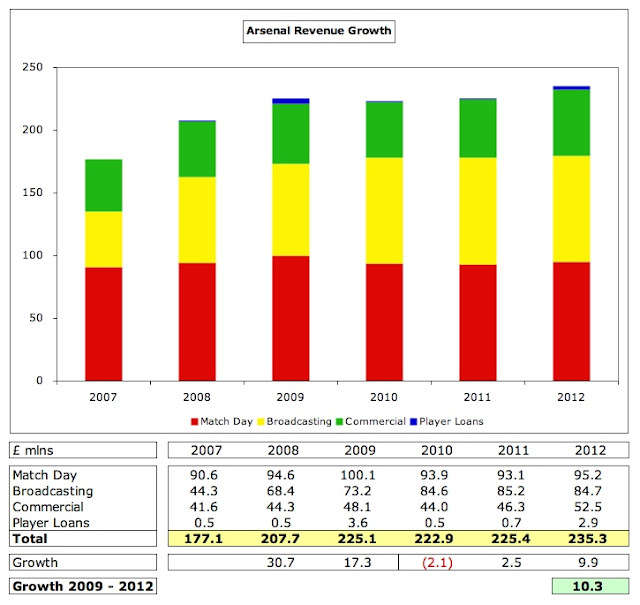

The massive £32 million increase in football profit was

mainly due to profit on player sales rising £59 million to an enormous £65

million, largely from Fàbregas and Nasri, though recurring revenue also rose

£10 million to £235 million with more than half of the growth coming from

commercial operations.

However, this was offset by substantial increases in staff

costs of £40 million: wages climbed 15% (£19 million) from £124 million to £143

million; player amortisation surged 70% (£15 million) to £37 million after last

summer’s acquisitions; and a £6 million impairment charge was booked to reduce

the value of players “deemed to be excluded from the Arsenal squad.”

Net interest charges continued to fall, down to £13.5

million from £14.2 million (£18.2 million in 2009/10).

As anticipated, there was a further slow-down in the

property business with turnover falling from £30.3 million to £7.7 million, as

the Highbury Square development is now almost entirely sold.

Chief executive Ivan Gazidis was at pains to emphasise the

club’s self-sustaining model, claiming that the club “can and will forge its

own path to success”, though he must be concerned about the continuing decline

in operating profits, which have fallen from a £31 million peak in 2008/09 for

the football business. In fact, excluding property development, the club

actually reported an operating loss of £18 million last season, compared to the

previous year’s £9 million operating profit. This £28 million turnaround was

due to operating expenses (£38 million) rising much faster than revenue (£10

million).

Nevertheless, the bottom line is that Arsenal once again

made another sizeable profit, even if it was largely on the back of player

sales. There is no doubt that the club’s record off the pitch has been superb,

especially in the unforgiving world of football, where large losses are

frequently the order of the day. In fact, the last time that Arsenal reported a

loss was a decade ago in 2002, amply demonstrating its self-financing ethos.

The last five years have been particularly impressive, at least financially,

with Arsenal accumulating staggering profits of £190 million, an average of £38

million a year.

Arsenal have consistently been one of the most profitable

clubs in the world, though they are not quite the only leading club to make

money. Both the Spanish giants have recently reported large profits for

2011/12: Barcelona £41 million (€49 million) and Real Madrid £27 million (€32

million). In addition, Bayern Munich have been profitable for 19 consecutive

years. Manchester United slipped to a £5 million loss (before tax) last season,

dragged down by £50 million of interest charges, though they made a £30 million

profit the previous year.

At the other end of the spectrum, clubs operating with a

benefactor model reported enormous losses. Manchester City’s £197 million loss

in 2010/11 was the largest ever recorded in England, while Juventus, Inter,

Chelsea and Milan all registered losses of around £70 million. As Gazidis put

it, “we see clubs struggling to keep pace with the financial demands of the

modern game.”

That said, the arrival of UEFA’s Financial Fair Play (FFP)

regulations, not to mention the economic difficulties of many of the clubs’

owners, has produced a clear change in behaviour. Milan and Inter have been

selling their experienced, more expensive players, while City were relatively

restrained in the transfer market (by their own exalted standards) this summer.

Even Chelsea’s spending has been on younger players with a future resale value.

So far, so good, but Arsenal’s profits have been very

reliant on player sales and (to a lesser extent) property development. In

2011/12, if we exclude the £2.5 million profit from property development and

the £65.5 million profit from player sales, the football club would actually

have made a sizeable loss of £31.3 million.

No other leading club has been so dependent on player sales

as part of its business model. In fact, over the last six years, selling the

club’s stars has been responsible for £178 million (or over 90%) of the £195

million total profit. That’s great business, but it makes it very difficult to

build a winning team, as Arsenal seem to be perpetually two pieces short of the

complete jigsaw.

There’s little sign of this slowing down either, as the

sales of Van Persie and Song were made after the 31 May accounting close, so

will be included in next year’s accounts, contributing another £37 million of

profit.

These “once-off” sales are all well and good, but they have

been disguising Arsenal’s increasing operational inefficiency. This can be seen

by the decline in cash profits, known as EBITDA (Earnings Before Interest,

Taxation, Depreciation and Amortisation), which has virtually halved from a

peak of £66 million in 2008/09 to £35 million last season. That’s still pretty

good for a football club, but, to place it into context, it is less than 40% of

the £92 million generated by Manchester United, who also forecast growth to

£107-110 million this season.

This may be a tiresome accounting term, but it is important,

as it represents the cash available for a club to spend – unless it sells

players or increases debt. Assuming no change in overall strategy, this means

that Arsenal will continue to sell players unless/until they grow revenue or

cut their wage bill.

As Gazidis explained, “The reason we talk about the

financial results at all is that it provides the platform for us to be

successful on the field.” Given this truism, let’s look at some of the

challenges facing Arsenal.

1. How will the club grow revenue?

Looking at the club’s revenue of £235 million, which is the

fifth highest in Europe, it is difficult to imagine that this could be an

issue, especially as it is only surpassed by Manchester United in England (£331

million in 2010/11, £320 million in 2011/12), while it is way ahead of clubs

like Liverpool £184 million, Tottenham £164 million and Manchester City £153

million.

However, there are three problems here: (a) the gap to the

top four clubs is vast; (b) Arsenal’s revenue has hardly grown at all in the

last few years; (c) other clubs have continued to grow their revenue.

Real Madrid and Barcelona generate around £200 million more

revenue than Arsenal. Even though this shortfall would come down if the current

exchange rate of 1.25 Euros to the Pound were used instead of the 1.11

prevailing when Deloitte produced their survey, the disparity would still be

around £150 million, which makes it difficult to compete.

Although revenue rose £10 million last season to £235

million, this is effectively the only revenue growth since 2009, when revenue

was £225 million. The largest increase in this three-year period came from

broadcasting, which rose £11 million from £73 million to £85 million in 2012,

as a result of centrally negotiated deals for the Premier League and UEFA (for

the Champions League), so Arsenal’s board cannot take a great deal of credit

for that.

Much was made of commercial revenue rising £5.6 million to

£52.5 million, but this is only £4.4 million higher than the £48.1 million

received in 2009. In other words, this crucial revenue stream has only grown by

a miserable 9% in three years. Even though Gazidis stated in an interview with

the club website that commercial partnerships were “well ahead of our five-year

plan”, I would suggest that to date there has is not exactly been a

scintillating return on investment in the expensive new commercial team.

"Giroud - handsome devil"

The most important revenue stream for Arsenal, match day

income, has actually fallen from £100 million to £95 million, despite ticket

prices being raised last season.

It is imperative that Arsenal manage to find ways to

profitably grow their revenue, as Gazidis acknowledged during the results

presentation, “Our activities to increase revenue are important. Increased

revenues allow us to be more competitive and to keep pace with the ever present

cost pressures in the game.” The club’s Chief Commercial Officer, Tom Fox,

re-iterated this, when he described his role as “to build and grow the multiple

revenue streams at the club in order to maximise the money available for the

board and the manager to spend on the squad.”

Arsenal’s real revenue problem is that while they have

struggled to increase their revenue, other leading clubs have continued to grow

their business. In the three years since 2009, Real Madrid and Barcelona both

grew revenue by around £90 million. Madrid have just announced record-breaking

£411 million (€514 million) revenue for 2011/12, while Barcelona are not far

behind with £381 million (€476 million).

For English clubs, United’s revenue fell back to £320

million in 2011/12 after their earlier Champions League exit, but still

represented growth of £42 million since 2009, while the 2012/13 revenue outlook

they provided to analysts was a mighty £350-360 million. The only leading club

whose growth was anywhere near as low as Arsenal’s was Chelsea, but their

2011/12 figures will be much higher, due to the Champions League victory and

new commercial deals.

Arsenal’s Achilles’ heel from a revenue perspective has been

commercial income, which is extremely low for a club of Arsenal’s stature. Even

after the 13% increase to £53 million in 2011/12, this still pales into

insignificance compared to the likes of Bayern Munich £161 million, Real Madrid

£156 million and Barcelona £141 million.

The story is no better in England, as Arsenal’s £53 million

is less than half of Manchester United’s £118 million. While Arsenal have

barely registered any commercial growth since 2009 (just £4 million), others

have steamed ahead, including Manchester City (£41 million growth) and

Liverpool (£17 million growth). The discrepancy will be even worse when those

two clubs publish their latest accounts, as the 2010/11 figures do not include

the increases for new sponsorship deals with Etihad and Warrior respectively.

Arsenal’s problems in this area can be highlighted by a

comparison with Manchester United, who admittedly are the commercial benchmark

for English clubs. Back in 2007, Arsenal’s commercial income of £42 million was

just £14 million lower than United’s £56 million, but since then Arsenal’s

revenue has only risen 26% to £53 million, while United’s has rocketed 110% to

£118 million, leading to an annual difference of £65 million. Mind the gap,

indeed.

Arsenal’s weakness in this area arises from the fact they

had to tie themselves into long-term deals to provide security for the stadium

financing, which arguably made sense at the time, but recent deals by other

clubs have highlighted how much money Arsenal leave on the table every season.

The Emirates deal was worth £90 million, covering 15 years

of stadium naming rights (£42 million) running until 2020/21 and 8 years of

shirt sponsorship (£48 million) until 2013/14. Following step-ups the shirt

sponsorship deal is worth £5.5 million a season, which compares very

unfavourably to the amounts earned by the other leading clubs, who have all

improved their deals in recent seasons, so Liverpool, Manchester United and

(reportedly) Manchester City earn £20 million from Standard Chartered, Aon and

Etihad respectively.

In fact, no fewer than eight Premier League clubs now have a

more lucrative shirt sponsorship than Arsenal. As well as the usual suspects,

Arsenal’s deal is behind Sunderland’s barely credible £20 million deal with

Invest in Africa, Tottenham £12.5 million (Aurasma £10 million plus Investec

£2.5 million), Newcastle £10 million (Virgin Money) and Aston Villa £8 million

deal (Genting).

The news is no better with Arsenal’s kit supplier, where the

club signed a 7-year deal with Nike until 2011, which was then extended by

three years until 2013/14. This now delivers £8 million a season, compared to

the £25 million deal recently announced by Liverpool with Warrior Sports and

the £25.4 million paid to Manchester United by Nike.

Gazidis talks a good match, “we continue to be successful in

attracting top brands to sign on as commercial partners”, but the reality is

that Arsenal have been outpaced in this area. Yes, they have indeed signed some

new sponsors, such as Carlsberg, Indesit, Betsson, Bharti Airtel and Malta

Guinness, while other like Citroen and Thomas Cook renewed for a higher sum,

but there has been little tangible revenue improvement. Furthermore, Manchester

United continue to attract more secondary sponsors than Arsenal, including

seven since 1 July 2012 alone.

Indeed, much of the commercial revenue growth was down to

the overseas tour to Malaysia and China, which is something of a double-edged

sword, as it may well have had a detrimental effect on the players’ pre-season

preparation.

"Jenkinson - corporal punishment"

More positively, Arsenal will have a fantastic opportunity

for what Gazidis calls “a significant uplift in revenue” when the main

sponsorship deals are up for renewal at the end of the 2013/14 season. If they

could match the £45 million currently received by United and Liverpool for main

shirt sponsor and kit supplier, that would imply a £32 million increase in

revenue.

Great stuff, but the trouble is that the bar is being

continually raised in sponsorship deals, so United have recently announced a

truly spectacular deal with Chevrolet. Not only will this rise to an

astonishing £45 million ($70 million) in 2014/15, but the sponsor will even pay

them £11 million in each of the previous two seasons – while Aon are still the

sponsors. Not only that, but United have also persuaded DHL to pay £10 million

a season to sponsor their training kit.

In other words, there is no guarantee that Arsenal’s new

sponsorship deals will ride over the hill like the seventh cavalry to save

them, especially if the brand is damaged by a failure to qualify for the

Champions League (though that has not prevented Liverpool from securing superb

deals). Gazidis has said that “in terms of the financial impact, it will be as

significant a step forward as the stadium was in 2005”, but his commercial team

will have to significantly up its game – or Tom Fox will be considered about as

effective “in the box” as Franny Jeffers.

Match day income of £95 million is the fourth highest in

Europe, only behind Real Madrid, Manchester United and Barcelona, but that

makes the club very reliant on the revenue generated in the stadium – “more so

than any other club”, as Gazidis stated. Wenger confirmed its importance, “We

are very lucky because we have good support and the income of our gates is very

high.” Indeed, the £3.3 million that Arsenal generate per match is more than

twice the amounts earned by Tottenham and Liverpool.

However, this revenue stream seems to have reached

saturation point, as Arsenal continue to register capacity crowds of 60,000 and

their ticket prices are among the highest in the world. In fact, match day

income was actually higher in 2008/09 at £100 million, largely due to the high

number of home games played (or old-fashioned success on the pitch).

Furthermore, revenue per match has also fallen from the peak of £3.5 million in

2009/10.

Indeed, after the deeply unpopular 6.5% ticket price rise in

2011/12, most prices were frozen for this season, though 7,000 Club Level

members were asked to pay an additional 2%. The media made great play of the

cheapest tickets for the match against Chelsea (an A category game) being an

obscene £62, though they have been less voluble about the 28% reduction in

prices for C category games from £35 to £25.50. In addition, Arsenal have

introduced a number of pricing initiatives, e.g. discounting lower-tier tickets

to £10 for the Capital One Cup game against Coventry City.

The other issue here is what would happen if Arsenal failed

to qualify for the Champions League, even if the inferior Europa League was on

offer, as the season ticket includes the first seven cup games from European

competition and the FA Cup. The club would surely have to issue credits,

potentially leading to a 10-20% reduction in revenue.

The majority of Arsenal’s television revenue comes from the

Premier League central distribution with the club receiving £56 million in

2011/12, unchanged from the previous season. Each club gets an equal share of

50% of the domestic rights (£13.8 million) and 100% of the overseas rights

(£18.8 million) with the only differences down to merit payments (25% of

domestic rights) and facility fees (25% of domestic rights), based on how many

times each club is broadcast live. This methodology is very equitable with

Arsenal only receiving £4.4 million less than champions Manchester City.

However, the signing of the £3 billion Premier League deal

for domestic rights for the 2014-16 three-year cycle, representing an increase

of 64%, will “provide clubs with a significant boost to their revenue” per

Gazidis. If we assume (conservatively) that overseas rights rise by 40%, that

would increase Arsenal’s share by around £30 million (using the same allocation

system).

Of course, other English clubs’ revenue would also rise,

though lower placed clubs would not receive as much in absolute terms, but this

would certainly help Arsenal’s ability to compete with overseas clubs,

especially Madrid and Barcelona, who benefit from massive individual deals.

The other major element included in TV revenue is the

distribution from the Champions League, which was worth around £24 million (€28

million) to Arsenal in 2011/12. The amount earned depends on a number of

factors: (a) performance – a club receives more prize money the further it

progresses; (b) the TV (market) pool allocation – half depends on the progress

in the competition, half depends on

the finishing position in the previous season’s Premier League; (c)

exchange rates – the 2011/12 figure was adversely affected by the Euro’s

weakness.

In this way, Chelsea earned more than twice as much last

season as Arsenal with €60 million after their triumph in Munich.

Interestingly, Manchester United (€35 million) also earned more than Arsenal,

despite being eliminated at the group stage, as their share of the market pool

was higher after winning the previous season’s Premier League, while Arsenal

finished fourth. Potentially, Arsenal could increase their revenue by €30

million if they managed to emulate Chelsea’s success, but, by the same token,

they could lose €30 million if they missed out on qualification to Europe’s

flagship tournament.

However large the differences are between the English clubs

that qualify for the Champions League, it is still much better than the Europa

League, where the highest amount earned by an English representative was the

€3.5 million that went to Stoke City. Financially, the Champions league is the

only game in town, especially now that the prize money for the 2012 to 2015

three-year cycle has increased by 22%.

2. Are expenses out of control?

Last season saw the first operating loss in many years after

expenses rose at a much faster rate than revenue. In particular, the wage bill

shot up 15% from £124 million to £143 million, despite the sale of Fàbregas and

Nasri, two of the highest earners. Part of the increase was presumably due to

rushing in the likes of Per Mertesacker, André Santos and Park-Chu Young last

summer without enough time for meaningful salary negotiations.

In addition, a once-off charge of £2.2 million was included

to top-up the pension provision, while Arsenal’s lack of trophies and

commercial growth did not prevent Gazidis’ package rising 24% to £2.15 million

(salary £1.366 million, bonus £675,000, pension £100,000).

The explosive wage growth is nothing new. In fact, since

2009 wages have gone up £39 million (38%), while revenue has only grown by £10

million (5%), leading to a significant worsening in the wages to turnover ratio

from 46% to 61%. This is by no means terrible (most Premier League teams have a

ratio above 70%, while Manchester City notched up 114% in 2010/11), but is of

concern, especially as Manchester United have managed to maintain their ratio

around 50%. Though not the only reason, this helps to explain why so little has

been spent in the transfer market.

The problem is that wages in football resemble a sporting

arms race, as other clubs continue to set the agenda, notably Manchester City,

who have increased their wage bill from £36 million to £174 million in just

four years. Arsenal’s wage bill of £143 million is now the fourth highest in

England, behind City, Chelsea £168 million (2011) and Manchester United £162

million (2012).

Arsenal’s performance in regularly finishing third or fourth

in the Premier League means they have slightly outperformed expectations based

on the wage bill, though Tottenham fans would note that they ran them very

close last season with £30 million less wages.

"Wenger - train of thought"

One issue at Arsenal is the equitable wage structure, which

means that the top salaries are not enough to attract the world’s best, while

fringe players like Sébastien Squillaci and Marouane Chamakh are handsomely

rewarded for sitting in the stands. Arsenal’s wage bill is sufficient to sign

world-class players, but that would mean reducing the salaries of lesser

lights. This has been tacitly admitted by Gazidis: “Can we compete at top

salary levels? Yes we can, but we have an ethos at the club - the way Arsène

expresses it is that it is not about individual players, it is what happens

between them.”

The difficulty is in getting the unwanted players off the

payroll at their high wages, hence loans for Nicklas Bendtner, Denilson and

Park when the club would have preferred to sell them. However, there are signs

that the club is now acting on this with numerous departures this summer and

the hard line over contract discussions with Theo Walcott. This is a tricky

balancing act for the board: if they extend contracts too early, they risk

paying over the odds in wages; if they wait until the last minute, they risk

losing the player for nothing on a Bosman.

The other expense impacted by investment in the squad,

player amortisation, has also risen significantly from £22 million to £37

million. For those unfamiliar with this concept, amortisation is simply the

annual cost of writing-down a player’s purchase price, e.g. Mikel Arteta was

signed for £10 million on a 4-year contract with the transfer reflected in the

accounts via amortisation, which is booked evenly over the life of his

contract, so £2.5 million a year.

Many of the players that have been sold were fully amortised,

so amortisation was reduced much by the departures, but it has increased

following investment in new players. To give this some perspective, it’s still

a lot less than Manchester City (£84 million), but significantly more than

previous years.

3. Where has all the money gone?

After so many years of large profits, it is difficult for

most supporters to understand where all the money has gone. Gazidis is adamant

that it has been spent on football, “We generate revenue and we reinvest all of

that revenue in football. We don't pay dividends, the money doesn't come out of

the club. All of the money we make is made available to our manager and he has

done an unbelievable job in managing that spend.”

That’s sort of true, but the reality is that very little has

been spent on bringing in new players with net player registrations of just £4

million in the last six years. Instead, the vast majority has been gone on the

new stadium, property and other infrastructure (e.g. enhancements to Club

Level, “Arsenalisation” projects, new medical centre) with more planned for

development at the Hale End youth academy.

Since 2007 Arsenal have generated a very healthy £376

million operating cash flow, but have spent £71 million on capital expenditure,

£110 million on loan interest and £64 million on net debt repayments, while the

cash balances have risen by £118 million. Astonishingly, only 1% (one per cent)

of the available cash flow has been spent in the transfer market.

Although Arsenal have laid out a fair bit of cash on buying

players in the last two seasons (nearly £90 million), this has been more than

compensated by big money sales, so their net spend has still been negative. In

fact, since they moved to the Emirates stadium, they have made £49 million in

the transfer market, where they are the only leading English club to be a net

seller.

Of course, Manchester City and Chelsea have been the big

spenders in recent years, splashing out £444 million and £235 million

respectively since 2006/07. Little wonder that Peter Hill-Wood complained, “At

a certain level, we can’t compete.” That said, in the same period, Liverpool,

Manchester United and Tottenham have also all spent considerably more than

Arsenal.

Following the elimination of the property debt, the club has

managed to reduce its gross debt to £253 million (down £5 million from last

year), leaving just the long-term bonds that represent the “mortgage” on the

Emirates Stadium (£225 million) and the debentures held by supporters (£27

million). Once cash balances of £154 million are deducted, net debt is now only

£99 million, which is a significant reduction from the £318 million peak in

2008.

Despite the high interest charges, it is unlikely that

Arsenal will pay off the outstanding debt early. The bonds mature between 2029

and 2031, but if the club were to repay them early, then they would have to pay

off the present value of all the future cash flows, which is greater than the

outstanding debt. In any case, the 2010 accounts clearly stated, “Further

significant falls in debt are unlikely in the foreseeable future. The stadium

finance bonds have a fixed repayment profile over the next 21 years and we

currently expect to make repayments of debt in accordance with that profile.”

4. How much is available to spend?

This question is provoked by Arsenal’s incredibly high cash

balances of £154 million, which are significantly higher than any of their

competitors with Manchester United the closest with £71 million (down from £151

million in 2011). Of course, not all of this is available to spend for a couple

of reasons: (a) the seasonal nature of cash flows during the year, e.g. the May

balance will always be high following the influx of money from season ticket

renewals, but this money is used to pay annual expenses, including wages; (b)

as part of the bond agreements, Arsenal have to maintain a debt servicing

reserve, which was £34 million in 2012.

Nevertheless, there is clearly still a large amount of cash

available to spend, especially as the cash balance does not include £26 million

to come from the Queensland Road property development (though this is only

payable in instalments over the next two years) and more (£10 million?) from

the two remaining “smaller projects” on Hornsey Road and Holloway Road. It also

excludes any money from this summer’s transfer activity with the accounts

giving a positive net impact of £11 million.

Although this is probably the figure most fans want to know,

it is actually almost impossible to calculate what could be spent in the

transfer market for many reasons. For example, most transfers are funded by

stage payments, so all the money is not needed upfront. In addition, Arsenal

could easily take on some additional debt, given the strength of the balance

sheet. Nevertheless, I estimate that Arsenal could safely spend £50-60 million

from cash resources.

"Diaby - king of pain"

The other point that people often raise when discussing the

transfer fund is that it would also have to fund a new signing’s wages, so if

the club bought a player for £25 million on a five-year contract at £100,000 a

week, that would represent a commitment of £50 million. That is undoubtedly

true, but it is a little disingenuous, as it ignores the fact that this would

be at least partially offset by the departure of an existing player, not least

because of the limitations imposed by the 25-man squad rule, as highlighted by

Wenger himself.

5. Will FFP come to Arsenal’s rescue?

It is no secret that Arsenal hope that UEFA’s FFP

regulations will reward their prudent approach, as these aim to force clubs to

live within their means, thus restricting the ability of benefactor-funded

clubs to spend big on players. Indeed, Gazidis stated that the advent of FFP

meant that “football is moving powerfully in our direction”, while the results

press release was actually entitled, “Results confirm Arsenal strongly placed

to meet UEFA’s new financial rules.”

On top of that, there are discussions at the Premier League

to introduce similar rules domestically. However, although there are some signs

of clubs modifying their behaviour, Arsenal’s faith in the new system may not

work out as planned.

First, there is much leeway in the FFP rules, e.g. clubs are

allowed to absorb aggregate losses of €45 million (around £36 million),

initially over two years for the first monitoring period in 2013/14 and then

over three years, as long as they are willing to cover the deficit by making

equity contributions. In addition, certain costs such as depreciation on fixed

assets, stadium investment and youth development can be excluded from the

break-even calculation.

Furthermore, there is a sliding scale of sanctions for

offenders, so it is far from certain that clubs will be excluded from UEFA

competitions. This is without considering the threat of a legal challenge from

a leading club.

Second, it is evident that FFP will benefit those clubs that

have the highest revenue, as they will be able to spend more on their squad,

but, as we have seen, other clubs continue to power ahead, so Arsenal are

likely to always have a shortfall against some clubs.

"I am Vito Mannone!"

With the new commercial deals in 2014 plus more money from

better central TV deals for the Premier League and Champions League, Arsenal

should surpass £300 million revenue in two years, but Real Madrid and Barcelona

are already around £400 million, while Manchester United are projecting

£350-360 million next year.

That said, Arsenal’s revenue will place them in the revenue

elite (“the top five clubs in the world with separation from the rest”, said

Gazidis), so they will be very handily placed to benefit from FFP, though it is

unlikely to act as some kind of magic potion to solve all of their financial

issues.

In many ways, Arsenal’s self-sustaining approach has been

admirable, though it has often felt like the club has been overly cautious.

Gazidis speaks of avoiding “the many examples of clubs across Europe struggling

for their very survival after chasing the dream and spending beyond their

means”, but Arsenal are a long way from such an awful predicament. As we have

seen, Arsenal do face issues around lack of revenue growth and an ever

increasing wage bill, but they still have much more room to manoeuvre than

most.

"Vermaelen - Tommy, can you hear me?"

The price of Arsenal’s self-sustaining model has been to

regularly sell the club’s best players, while charging the highest ticket

prices in the country, so this is not quite the financial Utopia that has often

been portrayed in the media. For the fans, it must be particularly galling that

the club’s two majority shareholders, Stan Kroenke and Alisher Usmanov, are

both billionaires, but there is little sign of either making any investment

into the squad.

Arsenal’s financial results are undoubtedly impressive and

they have done well to consistently finish in the top four, but whether the

current strategy is enough to bridge the gap to the leaders and actually win an

important trophy is debatable.

The board wastes no opportunity in telling supporters how

ambitious the club is, e.g. last month Peter Hill-Wood argued, “We have a

pretty good chance of challenging for the Premiership. I don’t see why we

cannot win it this year”, but

whether the fans believe that this is credible is another matter,

especially when the club does not use all the resources at its disposal.

Thank you, I really think there are a lot of gems in this analysis, and although I am not a financial expert, this analysis is an interesting read and really explains some of the behaviours of Arsenal in the transfer market.

ReplyDeleteSummary

Gazidis pull your finger out commercially(again!)

Players wages look high, given all the transfers out

FFP is not a robust strategy, it will not propel us the league or have an impact on other clubs

Another excellent post. Particularly appreciated the general discussion on wages as it answered a question I had been kicking around since last week: how can the wages be going up so much when the best players are being shipped out?

ReplyDeleteForgive me, but I do have a general accounting question. What is the purpose of reporting EBITDA? While it is a common practice, it has always struck me that if a company can reasonably anticipate payments on taxes, interest, etc. then what is the point of reporting earnings that do not reflected the actual revenues and profit?

EBITDA can be a useful measure for cash profits, but I agree that it can be dangerous to look at it in isolation. As the great investor Warren Buffet once cautioned, “References to EBITDA make us shudder. It makes sense only if you think that capital expenditure is funded by the tooth fairy.”

DeleteYour reference to the two billionaires not "making any investment" !? creates the impression that you do believe tooth fairy funding.

DeleteNo, no it doesn't.

Deletewow

ReplyDeleteI imagine you are going to get slaughtered with questions :-) but here goes my two cent..

ReplyDelete1. Would you say selling top players or generating profits from players sales has been club's policy (or a need) for the last 3-4 years..

2. Do you feel it's club's policy to do the minimum for the 4th and CL thus limiting investment in the squad

Judging from your articles the last few years I would say both yes...

Do you think the wage bill structure, along with slow growth in revenue, is the biggest obstacle in having a squad that will compete for trophies...

Why do you think such conservative handling of the money? As you said even if don't make a profit it's not like we are going to instantly go broke...

and great analysis.. as usual I might add..

I think selling players has been partly a policy to compensate for low commercial revenue and interest payments, but has also partly been driven by players wanting to leave, due to lack of success (winning trophies) and the (relatively) low wages for top talent.

DeleteThe wage bill structure is certainly a major issue, as it prevents the recruitment/retention of the absolutely top talent.

I can only guess that the club is holding the excess cash as a buffer against not qualifying for the Champions League.

Great post again.

ReplyDeleteJust a suggestion, what about writing about top clubs in smaller leagues (not top 4), would be great Portugal, the Netherlands or another league. An ideal start point would be the EC's report about the investing in youth academies (Sporting Club, Ajax, RC Lens, Feyenoord or even Dinamo Zagreb would be pretty interesting!).. again, just a suggestion.

I have occasionally written about clubs from smaller leagues, e.g. Ajax, PSV, Porto, Lille, but it is not always easy to get hold of enough information to write a detailed analysis.

DeleteYou can see a list of all the clubs that I have analysed on the right side of the blog.

There is also a disparity in terms of what teams in the top financial bracket can pay in terms of salary which is gorwing exponentially against the other teams making it harder for unwanted players to be off loaded.

DeleteWe have seen it this summer in concert with the FFP rulings and the softening of the market due to financial weakness on the continent.

Thereby, we have been less able to ween off our excess players and free up the wage bill.

Would love to see an indepth on this situation and how FFP may/may not help at all.

Wow, that is pretty amazing and exhaustive analysis. As a Liverpool fan I am happy to see that we are starting to play the attractive football that I've admired Arsenal for. Any chance you could do that type of analysis for Liverpool so I can know if FSG really has them headed in the right direction?

ReplyDeleteThanks. I actually reviewed Liverpool in May, which you can find here: http://swissramble.blogspot.ch/2012/05/liverpool-keep-car-running.html

DeleteAny way you can send this to Gazidis? Perhaps he thinks these minimal rises in commercial revenue are respectable gains and hasn't been made aware of how the opposition are blowing us out of the water on the commercial front? Considering Wenger knows quite a bit about business and economics then it could be assumed that this puts a lot of pressure on his shoulders and he finds a share of responsibility for balancing the books when that really shouldn't be his job. Still, if it means buying players like Cazorla for £12 million then it has the odd benefit.

ReplyDeleteawesome!!!!!!!!!!!!!!!!!!!!!!!

ReplyDeleteCould you do FC BARCELONA one day???? That'd be amazing if you could

Thanks. I've looked at Barcelona a couple of times in the past, though admittedly not for a while. You can find the last pieces here:

Deletehttp://swissramble.blogspot.ch/2010/08/whats-happening-with-barcelonas.html

http://swissramble.blogspot.ch/2012/04/truth-about-debt-at-barcelona-and-real.html

Great article as always Swiss.

ReplyDeleteLets hope Wenger has realised this equality wage structure is bollix I know its a balancing act but the fact we couldnt sell Alumnia, Squllaci, Denilson, Chamakh, Arshivan, Bendther and Park should drive home its seriously flawed it is.

No point of watching the pennies and blowing money on very bad contracts on very average players and although I dont want players to be paid 200K a week etc we cant compete with that.... the top players should be on alot more money than reserve players. It's a no brainer for me.

We also have alot of playing staff thats contibuting to the wages cost again linked to better managment of player contracts.

Lastly really wish I could click my figures until these commerical deals are up, they are disgracfully. I know at the time they made sense but didnt someone in our managment team have the cope on to try and insert break clauses or uplifts based on other PL teams future deals????

Someone needs a kick in the hole most likely the person who allowed V Persie and Theo contract to run into the last 12 months. It shouldnt happen and this its not the first time Flamini and Wiltord being other examples.

IMO that happens once if a first team player who has two years left and wont sign on then its bye bye and he is sold to the highest bidder end of.

Good post as ever Kieron, a question on the sponsorship deal section if you don't mind. As you note these are getting bigger and bigger and they are leaving Arsenal behind at the minute, but won't Arsenal's new deals immediately catch them up?

ReplyDeleteThat is to say that when the shirt sponsor and supplier deals are negotiated for 2014 onwards the amounts agreed will reflect the going rate at the time (which will surely be in the mid 40m's or even perhaps the low 50's which would outstrip the recent pool/spurs figures if these deals continue to get more and more lucrative), it's not as though they'll be negotiating for 2010 prices.

I realise that the 2014 deals will likely end later than Liverpool's ones with Warrior/Standard charter will expire/be renegotiated for more lucrative terms but perhaps for those years before that happens Arsenal could actually be in the more advantages position and as these things only seem to go up and up it's likely that, unless a peak is reached, Arsenal's deals after the next one might surpass Liverpool's next deal. And that will just keep happening as football doesn't have a centralised kit deal like the NFL and sponsorship contracts come up for renewels on different years.

And even so there's no need for the club to enter into the sort of long term guarunteed money contracts they did when moving to the grove that have seen them left in the dust, whatever happens with them going forward will likely be at a pace in keeping with what all other clubs are doing.

All that being said there is obviously an issue of concern with the commercial side of the club, and for me that's the area of secondary contracts and partnerships. Why aren't our players doing humilating ads that expose their lack of acting talent for all sorts of shit on the telly like United players are??

Yes, that's a fair point. As I said in the article, the bar keeps getting raised higher and higher with sponsorship deals, so it's difficult to estimate what the new deals will be worth in 2014. Fingers crossed that this is when the famous five-year plan delivers.

DeleteYour last paragraph made me LOL!

Problem is all the top clubs are £20/25m and United are £50m so arsenal will be lucky to get £25m tops

DeleteThe flip side of that same problem is that United have now locked their main income stream for the next 7 years from 2014. That is a long time for others to catch up. Kudos to them for being commercial trailblazers though.

DeleteBrilliant!

ReplyDeleteReally loved this. Thanks for all the trouble and time you put in. It has really opened a whole new world for me. Good job.

As an AFC fan it is sad, however to see black on white that we are not spending anywhere near what we could.

We really are much further behind the really "big clubs" than we let on, are we not? Every Arsenal fan who posits that the club has money and refuses to spend it ought to take time out and get an education out of this piece. One thing is certain, we desperately need FFP to have any hope of closing the gap between us and the likes of City. There just doesn't seem to be any other way so long as the self-financing model is the option the club insists on.

ReplyDeleteNice piece, once again @swissramble. It was well worth the wait

"Every Arsenal fan who posits that the club has money and refuses to spend it ought to take time out and get an education out of this piece."

DeleteReally? Did you actually read that post? "The last five years have been particularly impressive, at least financially, with Arsenal accumulating staggering profits of £190 million, an average of £38 million a year."

You might want to revise that statement.

Yes, but mostly due to player sales, which is what most fans gripe about. Plus there's the buffer he alludes to for the risk of non-qualification to the CL, which is prudent. As well, the opaque nature of cash flows, timing and the availability for player acquisitions.

DeleteWhat is evident is that the club are actually well positioned should they meet revenue objectives. Short term laggard but potentially medium to long-term competitive. Remember, you don;t have to be the highest earning club to win title, just somewhere near it.

Great article.

ReplyDeleteIt reminded me of something I've been wondering about recently: Bayern, Barca and Madrid all have huge commercial revenues, a fair bit higher than Man Utd's, yet Utd seem to have higher (or comparable) shirt sponsorship & kit deals to the other 3 clubs. Utd also have the £10m DHL training kit deal and a seemingly endless list of "secondary" sponsors. So how are Bayern, Barca & Madrid generating much more than Utd in commercial revenue?

United's new sponsorship deals were not included in the latest Deloitte Money League comparison, which was based on 2010/11 accounts. The DHL deal started in 2011/12, while the Chevrolet sponsorship only starts (in full) in 2014/15.

DeleteFor a reasonably detailed analysis of Bayern's commercial strength, you could look at this old piece http://swissramble.blogspot.ch/2012/02/bayern-munich-opportunities-lets-make.html

Thanks. Interesting to see how the host of "premium" and "classic" sponsors has boosted Bayern's commercial income. It reflects badly on the management at Arsenal looking at their relative lack of secondary sponsors.

DeleteOut of curiosity, was the payment for naming rights to the Emirates a lump sum, or is there any chance of them being renegotiated early?

ReplyDeleteI would be surprised if that deal was renegotiated early, unless it was somehow tied in to a renewal of the shirt sponsorship.

DeleteFor me it seems disingenuous to call Arsenal's model 'self-sustaining' when it seems that they only remain largely positive in cash terms due to the yearly subsidy they receive through player sales to benefactor backed clubs like Manchester City and financial powerhouses like Manchester United and Barcelona. Maybe they will get away with it because of increased revenue from elsewhere but I do wonder what impact FFP might have on the Arsenal 'self sustaining' financial model if these other clubs are no longer willing or able to spend big on whichever above average player Arsenal have been made available each summer?

ReplyDeleteMy guess would be that we would see wages return to more sensible (if you could call it that) levels. The benefactor backed clubs have exponentially driven up wages in football as a whole which has affect Arsenal massively. If salaries were lower, other revenues would be more than enough to carry Arsenal through a financial year.

DeleteGreat blog as always! I have a couple of requests and it would require a scenario where you would be, say the CEO of Arsenal and the ideal situation we could compete in:

ReplyDelete1. If all Commercial Deals were renewed, what would our Shit/Kit sponsorship be like or acceptable amount be in 1-2 years (in terms of pounds/season)? (Ignore Stadium naming as it is a fair while away)

2. Any other avenues of increase in commercial revenue contribute to the yearly cashflow?

3. In the 25 man squad, how many marquee players (say over 100k pounds per season), starting players (80-100k) and squad players (30-80k) players can we afford in this ideal situation financially?

It would involve a lot of assumptions in terms of current player salaries and getting a few players off the books etc. But the only way we can compete with Man U, City, Chelsea in terms of attracting players is by paying the money to the players and achieving success on the pitch. We need to be winning trophies whilst paying high wages, because most players CAN do that with United/City/Chelsea.

Such a shame we have not managed our finances and commercial revenue better. All this profits is such smoke and mirrors and as an avid Arsenal fan, you cannot help but feel deceived.

Pay me £2.1 million a year and I'll give you an answer ;-)

DeleteDo you know how wages are reflected in the accounts? If player x signs a 4 year deal for $16 million, but the actual salary is broken down as follows: Year 1 - $3million

ReplyDeleteYear 2 - $3million

Year 3 - $5million

Year 4 - $5million

Is the salary reflected in wages on a straight-line basis, or recognised on a cash basis in the accounts to match what is actually paid?

If it is a cash basis accounting treatment, how prevalient are backloaded contracts in the premier league? Arsenal?

It would be accounted for on a cash basis. I don't know how many back-loaded contracts exist, but my guess is that it's relatively few.

DeleteMaybe not full on backloading, but would contracts not include an annual step up for inflation/COLA? While I have zero knowledge of player contracts, I would imagine this wouldn't be unusual and for example an average cost of living adjustment across the squad of 5% would go some of the way of explaining why wages are consistently increasing year on year. Do you think this is the case?

DeleteExcellent and lucid read, as ever. The main themes, commercial revenue shortfalls compared to rival clubs because of covering the stadium financing, and the importance of net transfer spend to the bottom line are consistent with your previous analyses. The decline in operating profit seems a new twist, and disturbing if it heralds a trend. Cash in the bank also seems to have peaked, although that should be noted with the usual caveat about not drawing too firm conclusions from one six-months of figures. The inability of the club to increase commercial revenue more than it has does seem surprising in the light of the management resources being devoted to it. Is this simply because the shirt sponsorship and stadium naming rights are the big nuts, and they can't be renegotiated yet, or is there more to it?

ReplyDeleteClearly, a large part of the disappointing commercial revenue is due to the restrictions around the main sponsorship deals, but IMO they should really have done more with the secondary deals.

DeleteTrue.

DeleteI would think it is easier to position for a better deal retrospectively which is what United have done for the Aon years rather than before the fact.

Might be a bit tricky for us because of existing agreements in place.

Do you think it is possible that Stan/Usmanov buy out the Arsenal debt and charge interest free loan repayments? Wouldn't that be much better for the club. Furthermore it would also endear the fans much more to the owners.

ReplyDeleteAlas.

It's possible, though Kroenke has shown little appetite to clear the club's debt. Usmanov has actually suggested such a policy, but he would only do it if the club gave him greater influence.

DeleteAs always you make the numbers plain for all to see for all this is a great education for all gooners wish they would all spend 10 minutes to read it will as always share the link on the hope they will thanks

ReplyDeleteI got a question regarding the annual report published by Arsenal last week.(link below)

ReplyDeleteIn the balancesheet there is a post "Creditors: amounts falling due within one year" on (145,159).

Could anyone here point out what this post actually is?

I'm thinking this probably is some interest-bearing short term debt related to season tickets, club shop, running cost, etc. And liabilities related to different real estate projects.

Am i far off in my suggestions.

Thanx for any answers.

http://www.arsenal.com/assets/_files/documents/sep_12/gun__1348755692_ARSENAL_HOLDINGS_PLC_year_end_.pdf

Page 53 of the Annual Report (in your link above) gives a break-down of the main liabilities included in short-term creditors, though not enough detail to fully answer your question.

DeleteYou might find a piece that I wrote about debt helpful: http://swissramble.blogspot.ch/2012/04/truth-about-debt-at-barcelona-and-real.html

This is an incredible blog post. I have only read a couple of your posts before but this one is fantastic. I hope a news outlet signs you up! The style of writing was great and the information was first class. Good job!

ReplyDeleteIf the FFP rules do come in, this could be bad for smaller clubs as the large clubs with the biggest revenues will expand at a faster rate leaving smaller clubs in the dust. Arsenal are by no means a small club in that regard but we are not top 3. How many businesses operate with 5 top companies? Smartphones are made by Samsung and Apple, with HTC falling behind in 3rd and that is a massive growth market.

Perhaps an unforeseen consequence of FFP could be a widening of the gap between the top clubs and the lower clubs, which for me isn't a good thing. The premier league is the best league because of this competition. However I do appreciate that no business can continue if clubs are losing £30 million a season... It's a tough one. Football is perhaps the only business where money can be lost every season because there will always be some millionaire philanthropist throwing his cash in an effort to play a real life championship manager.

Personally I feel a wage cap is needed for the continued growth of football, as well as a transfer cap. Anyway great post and I shall follow this blog now :)

Excellent article. As an Arsenal fanatic for over 60 years it hurts now just to be a revenue stream but it is still worth it!!!

ReplyDeleteGreat blog as always but other than a one-off flutter of £50 or £60m to in an attempt to usurp Abramovich/Mansour which is almost certainly doomed to failure there aren't any proposals for alternative strategies are there.

ReplyDeleteCompare commercial growth to the highest figure (£48m in 2009)in the last 5 years (which I think was attributed to a none off boost) doesn't paint an entirely accurate picture of commercial growth. Take an average of the previous 5 years and last years growth of 17% reflects a little better on the clubs commercial development. The bigger sponsorship numbers are still a couple of seasons away but that they're there is clear for all to see.

There are quite a few alternatives, which I did not explore here, but have looked at in previous posts on Arsenal.

DeleteTwo points on commercial growth:

1. I deliberately chose 2009 as the starting point, as this is the closest to Tom Fox's start date (September 2009).

2. I added comparisons against other leading clubs to provide some context, namely while Arsenal's commercial growth has been virtually non-existant, others have made great gains.

Clearly, much of this is down to the restrictions on the main sponsorship deals, but that should not have prevented more progress on secondary sponsors.

Thank you for your dedication to Arsenal and the time you spend to enlighten us about what's going on "behind the scenes" at Arsenal. I do really appreciate your articles, I've read them all (12 !) and I've learnt so much. But considering I'm not an Englishman (neither an accountant) I sometime struggle to fully understand financial vocabulary.

ReplyDeleteI couldn't understand the part about "Where has all the money gone ?" (part 3 in this article)

I have a few questions and I hope you -or someone else- can answer me (with simple words, so I can get it):

_ What does "Operating Activities" mean ? What does the £376m of operating activities since 2007 refer to ?

_ What does "Interest Payments", "Capital Expenditure" and "Debt Repayments" mean and/or refer to ?

In your previous article (Arsenal's Mystery Dance, 28 February 2012), to the question "Where has all the moeny gone ?", you wrote this :

________

Unsurprisingly, it’s all about the new stadium, property and other infrastructure (e.g. the new medical centre at London Colney) with £180 million going on capital expenditure and £111 million on loan interest. Since these loans peaked in 2008, another £156 million (net) has been used to repay debt. And of course the cash balances continue to rise…

________

I couldn't understand how loan interest could be so heavy ? I tought the interest rate on the Stadium Debt was at a 5.5% rate ? And where does the £156m you're talking about come from ?

To put it simply, I just would like to understand where has all the money gone , and what "money" do you refer to when you talk about "all the money" ? Sorry if I sound stupid, I know that's exactly what you're explaining, but because of my poor English, I think I missed the point, or just misunderstood something.

_ am I right if I understand that "Net Cash Inflow" of £88.5m from 2006 to 2011 (Arsenal's Mystery Dance) means all the profits the club has made since 2006 that haven't been re-invested ? It means those £88.5m went into the Cash Balance, right ? It would explain how the cash Balance rose so much in the last few years, right ?

Arsenal had serious cash problems in the early 2000s. The club reported a huge loss in 2002, and according to Peter Hill-Wood, at the time the club survived on Cash Balance. Maybe it could explain why Arsenal has become so cautious, keeping so much "powder dry" and saving cash for a "rainy day" ?

Well, I hope someone can give me some ansewers about those questions, it would be a really huge help ! Thanks a a lot.

Even though I try very hard to explain the finances in layman's terms, I appreciate that it's not always totally straightforward, so I'll try to clarify a little.

ReplyDeleteIf you look at the Cash Flow table (the first in that section), you will see the first line is Operating Profit/(Loss), which is simply recurring revenue (i.e. excluding player sales) less expenses. You can see that in the detailed Profit and Loss account table towards the beginning of the piece (it's the lowest blue line). This was a loss of (16.3)m in 2012.

However, that operating loss includes some non-cash expenses, such as depreciation, player amortisation and player impairment (total of 53.7m), so these have to be added back to get a pure cash profit. You then have to make some working capital adjustments (9.7)) for things like paying creditors earlier or later than booked in the P&L, which will give you the "clean" cash flow from operating activities.

That cash flow is then available to spend on various items. In Arsenal's case, almost all of it has been spent on paying for the new stadium and other infrastructure. So, capital expenditure is the investment into those assets, interest payments are on the loans/bonds taken out to fund that investment, while debt repayments are exactly that (also including some for property development). The final figure in the cash flow statement is simply the increase in cash balances.

Thank you for your explanations Sir, I'm very grateful to you !

DeleteThanks for the thorough and in-depth review of AFC's accounts, I don't believe that there is another blog (let alone "paid for" publication) out there that does this to the same quality.

ReplyDeleteI won't be surprised to see your article being paid the "greatest compliment" in various Newspapers over the coming days.

As an Arsenal fan and Season Ticket holder, I and many others find ourselves having to ask the question as to whether the continuous sale of world class players and their replacement with capable but bargain basement replacements or young prospects for the future, is a de-facto long term club policy or a short term fix to boost competiveness whilst tied to long term (but uncompetitive) commercial deals.

This article and previous ones provide some hope that there is light at the end of the Tunnel. Nonetheless all Arsenal Fans (and fans of almost all other clubs) need to accept that we'll (they'll) never match ManUre, Arcelona or Real in the spending race, let alone Chelski, PSG or Citeh with their petrodollar funded losses.

I like attending and watching football matches and I'm an optimist in matters AFC, but unless there is a level playing field to allow true competition, then you'd have to question the wisdom of forking out so much dosh each year on a seaon ticket simply to watch AFC hopefully reach fourth place in the league, even though we're told it is as just like winning a trophy.

To that extent, FFP is the only hope that a club outside the ones mentioned above will have a realistic chance of challenging for and maybe occasionally winning the Premier League and Champions League on a regular basis.

In my darker moments I find myself asking whether every club running at a loss are mad short termists and AFC are the lone voice of reason, or whether there is another game afoot that Club Owners want to be in on (European / World Super League anyone ?), think of the TV rights packages that could be sold.

Kind Regards

Gotang

Top, top analysis mate.

ReplyDeleteHave you ever compared how Arsenal spend their wage bill compared to the others?

There's obviously a fair bit more than players in the wage bill but how does what we have add up to £143m?

Man City £174 million

Chelsea £168 million (2011)

Manchester United £162 million

How do these guys end up spending double what we will on a case by case basis and yet only add up to £20m-£30m more? Who is getting more at Arsenal than their equivalent at each of these clubs - clearly not the big names?

Good stuff as ever Swiss but I would take issue with your 'buy Falcao or Cavani' point. Not only would they cost £40M+ in transfer fee but their wages would be over £200K a week - a commitment of £90M over five years. Plus it would fuel internal wage inflation heading us in the direction of Chelsea and City (who must be pushing the £200M pa when this year's numbers appear).

ReplyDeleteThanks. Let me explain my thinking about a big money striker:

Delete1. Napoli and Atletico Madrid manage to have Cavani and Falcao, even though their wage bills are about a third of Arsenal's £143m, so we have a significantly higher spending capacity overall. Napoli's is £42m (€52m), while Atleti's is £51m (€64m).

2. I'm not sure that they would command £200k a week. For example, Cavani's annual salary (per a survey published by La Gazzetta dello Sport) is €4.5m, which is equivalent to £3.6m (or £69k a week). Sure, he would expect a big increase for his next move, but doubling it to £140k might be sufficient.

3. Much, if not all, of his salary could be funded by removing some of our current forwards from the wage bill, e.g. Chamakh, Park and Bendtner, who are reportedly all earning at least £50k a week.

4. If we had better players, then the chances of success should improve, which would mean more prize money and better sponsorship deals. Obviously no guarantee, but it does improve the odds.

very true. The current list of players that need to be moved are : Bendtner, Arshavin, Chamak, park, Squallachi, Denilson, Rosicky, one of the keepers (Vito/Fab) and maybe Diaby.

DeleteThis will probably free up potentially around 500K per week. so even if we get 3-4 players in the wage bracket of 100K I think we would be in saving around 5-10 million every year (Does arsenal pay the players even when the season is not in progress?)

Ahhhh.....I didn't know Swiss was an Arsenal supporter.

Delete...that is IF you can move the rejects (Bendtner, Arsharvin, Chamakh etc) in the current soft market and with the disparity between wages that are paid by certain clubs (including ouselves) increasing against those that used to be able to be paid for by 'second tier' clubs (financially)

Delete+ Once you increase on a big player, you are also likely to feel some pressure from other 'less significant' players who believe they should be on a higher pay scale (like say Song). Your overall pay scale would have to go up again BEFORE 2013-2014 kicks in.

I'm sure Wenger may have considered loading on another striker BUT with the inability to shed of some of the current excess players, there may have been some hesitancy in piling on the wage bill before an improvement in the sponsorship/commercial issues.

IMHO

But the problem with thinking like this is surely if we are going to achieve the best commercial deals we need to be successful on the pitch, which means having top players, so in the long run it might make more sense to spend on another 2-3 top players in order to compete for the top prizes so we can acheive 'mega' commercial deals rather than run of the mill ones.

DeleteCertainly Wenger's and/or the boards strategy on wages has backfired on them and we must stop paying average players big money, if they leave so be it, they don't seem to have helped us win anything anyway.

The lack of growth of commercial revenue v. Man U is only partly explained by the shirt and training kit sponsor deals. To what extent do you think it is explained by sales of marque players (being fabregas, nasri and van persi)?

ReplyDeleteGood point. It's impossible to quantify, but I'm sure that it has made a difference. Star players have certainly contributed to the commercial success at Real Madrid, Barcelona and Bayern Munich.

DeleteInfact RealMadrid had supposedly recouped the entire Ronaldo Trnafer fees in the first two years thru shirt sales. I think Arsenal now do not have a marquee player who is identified strongly with Arsenal brand and selling quality for commercial products.

DeleteUnless Arsenal win something and one of the players Santi/Alex/Giroud/Jack have an outstanding season, I don't see things moving up next year either. They are the players with the best potential to market.

I am not what you call a numbers person. But I have been diligently reading up on your articles on arsenal finances as I truly want to understand whether the Board is trying to pull one over the fan base. This is the first time the article makes enough sense to my rather limited financial intellect. Truly appreciate the breakdown and explanation.

ReplyDeleteI think the biggest question mark is on the wage bill and Commercial revenue. I think Arsenal have to be more transparent. If you can clarify some of the questions, it would be really helpful.

1) how much is the board is payed as salaries and is it comparable to other top clubs?

2) How big is the Commercial team and how much are they paid? How big is ManU's and what is the earnings to cost ratio of ManU team as compared to Arsenal? - I am taking ManU as a touchstone.

3) Can Arsenal buy back the kit/Shirt deal and sell on this year itself? I read Chelsea have done so. Or is the Arsenal's reputation as gentleman dealers going to play a part of decision making process?

3)

Great article, l wonder if you have a bit more information on the wage bill, my understanding is that Arsenal include everyone in this not just the players, which may not be the case with other clubs?

ReplyDeleteThanks. Yes, the wage bill includes all employees, not just the players, but that is also the case for other clubs. There is a fairly standard way of reporting staff costs in the accounts. In other words, the wage bill comparisons are on a like-for-like basis.

DeleteFantastic article though there is a point to be made about the huge wage bill.

ReplyDeleteBecause Arsenal have purchased so many new players recently, a lot of them is in the start of their contract. This means there will be very few contract renegotiations in the next 2 years for all the important players, whist both Squillaci and Arshavins contracts will end next summer. Futhermore Podolski, Cazorla, Arteta, Mertesacker and Sagna will be in their 30's at the end of their contracts which may very well be their last for the club .

To sum up, the wage bill has indeed grown very rapidly in recent years, but is unlikely to continue its meteoric rise in the coming years due to the current contract situations amongst the key members of the squad.

Can you please just answer me one question that nobody has yet been able to answer. If we made a £30+m profit over the last year then why is our cash balance at the end of the year still around £150m like it was at the start of the year? Surely it should be up at around £180m?

ReplyDeleteBecause cash is also used for items not included in the profit and loss account, such as investment in the stadium and repayment of debt. In addition, the purchases of players are only reflected in the P&L via amortisation, not the full purchase price.

DeleteHere's an answer that I gave to a similar, earlier question that might help your understanding:

"If you look at the Cash Flow table (the first in the section on Where's the Money Gone?), you will see the first line is Operating Profit/(Loss), which is simply recurring revenue (i.e. excluding player sales) less expenses. You can see that in the detailed Profit and Loss account table towards the beginning of the piece (it's the lowest blue line). This was a loss of (16.3)m in 2012.

However, that operating loss includes some non-cash expenses, such as depreciation, player amortisation and player impairment (total of 53.7m), so these have to be added back to get a pure cash profit. You then have to make some working capital adjustments (9.7)) for things like paying creditors earlier or later than booked in the P&L, which will give you the "clean" cash flow from operating activities.

That cash flow is then available to spend on various items. In Arsenal's case, almost all of it has been spent on paying for the new stadium and other infrastructure. So, capital expenditure is the investment into those assets, interest payments are on the loans/bonds taken out to fund that investment, while debt repayments are exactly that (also including some for property development). The final figure in the cash flow statement is simply the increase in cash balances."

West Upper

ReplyDeleteExcellent analysis as usual - thanks for taking the trouble to prepare this.

Key take outs for me:

1. Be prepared to reward merit NOT mediocrity - this applies to back office staff as well as the players.

2. Intense focus is required on driving Commercial revenue up - heads should roll if this is not accomplished.

3. On the field success is key - 7 years without a trophy and counting. The board should demand that Wenger discloses and agrees his strategy for addressing this. As you say we have been close at times in the past few seasons but an unnecessarily miserly approach has meant we have drawn a blank.

Great article, love reading your stuff and look forward to the next one. I remember reading ages ago in a world soccer article that as part of a deal with the local council to build the new stadium, Arsenal had to invest money in improving the local London underground stations but this got scrapped due to problems which I can't remember. How much worse would had this been for Arsenal if they were also forced to do this.

ReplyDeleteMany people comment on wages... It is not only the problem of Arsenal and football in general. I suggest everyone to analyse the wages and contracts in the NHL ice-hockey to understand the massive problems they have. For example, Rick DiPietro signed years ago a 15-year-contract, but has basically been injured all the time. There are many long-term contracts to cheat the salary cap, but basically the clubs pay for the potential. Just like in football! The only difference is that the ice-hockey players don't whine and moan a new contract every two years like in football.

ReplyDeleteI find it incredible that Arsenal's wage bill is £143.4 million. If you take off Wenger's (£6 million) and Gazidas (£2 million) and say another £25 million for the various backroom staff, directors, other employees, and non-first team footballers (does that sound about right?), that leaves £110 million to distribute to the 25 Premier League players.

ReplyDeleteOr put another way, the 25 players earn an average of £84,615 a week. If I increase 'other wages' to £40million (surely too high), they earn an average of £73,077 a week.

Given half of those 25 players aren't even in the first team and some can't be on particularly high wages (I can't see the Ox/Wilshere/Scquillaci etc. negotiating their way to those salaries before establishing themselves) who is getting that amount of money?! Maybe Podolski/ Santi/ Vermaelen/ Waclott/ Arsharvin, but who else is there? For a club that can't keep hold of players like Nasri/possibly Theo/Adebayor/Toure etc. partly due to wages, Arsenal is sure spending a lot of money on them. I know football clubs don't like to reveal their players' wages, but I can't get my head around where Arsenal is spending this amount on wages. Any ideas?

There are a number of players whose futures are uncertain at the club but who are still on the fringe that we are unable to shed at the moment and that may weigh into the thinking I believe with regard overstretching in terms of wages when bringing in new players at the moment.

DeleteSadly, that has as always left us one or two players short of the full puzzle and reliant on certain younger players in upping their game.

Mind you, I still don't understand the thinking with regard Song (vis-a-vis Walcott's situation)

Song has 3 seasons left on contract. If rumours were true (which they never are of course)< he was angling for an increase from 55K per week (obscene money for most of us as is) to 80K. That's not a huge amount in context with things and considering he covers an area which we are quite obviously short on (hence the pursuit of Sahin) and ependant on return of injury prone (Diaby) or injured players (Jack or young players (Coquelin)

Meanwhile, Walcott is perfectly replaceable in the market (Affelay was hankering for a move, or Konoplyanka)