Even though Swansea City’s form has not been great, it still

came as something of a surprise when manager Garry Monk was sacked this month,

not least because the customary smooth succession to a capable replacement

seems to have foundered. There have reportedly been talks with former Argentina

and Chile coach Marcelo Bielsa, but coach Alan Curtis remains in charge for the

time being.

With the Swans hovering close to the relegation zone, this

feels like it might be the first genuine setback since the club’s steady

recovery from near insolvency, when their financial difficulties inevitably

spilled onto the pitch and they only avoided demotion to the Conference in 2003

by the skin of their teeth.

Since those trying times Swansea have become somewhat of a

model club, surging up the leagues until they secured promotion to the Premier

League in 2011. They are owned by a consortium of local businessmen and fans

with a 21% share being held by the Supporters’ Trust. Furthermore, they have

moved from the ramshackle, run-down Vetch Field to a spanking new stadium.

"Williams, it was really nothing"

People noted this success and started to talk of the

“Swansea Way”, partly due to the way that the club has been run, but also

referring to an attractive, passing style of play. They have been prudent,

spending their funds wisely, as they are acutely aware of the problems off the

pitch in their recent past.

The approach was summarised by chairman Huw Jenkins thus:

“We don’t have dramatic changes. We make sure managers are comfortable and take

on board our philosophy and stick to it. We run a common sense business and

when clubs change their playing squads to suit a new manager, it seems

completely wrong to us.”

The fruits of their labour have been clear for all to see,

as Swansea won the Capital One Cup in 2012/13, thus qualifying for the Europa

League. There was a series of encouraging mid-table finishes, culminating in

what Jenkins described as “the best season in the club’s history” in 2014/15,

as Swansea registered their highest Premier League finish of 8th (the second

best of all time in the top flight) with their highest ever total of 56 points.

"Don't bet against the Fed"

However, things can quickly change and there has been a

marked dip this season following an indifferent summer recruitment campaign.

Portuguese international Eder has been ineffective, while French defender

Franck Tabanou has been virtually non-existent and the new strike force of

Andre Ayew and Bafetimbi Gomis has mainly flattered to deceive.

This led to Monk’s departure with the club clearly worried

about the implications of dropping down to the Championship. As Jenkins

explained, “With the recent uncertainty surrounding the club, the decision has

been made in the best interests of Swansea City and its supporters.”

The riches available in the Premier League can be seen in

Swansea’s accounts for the 2014/15 season, as the club broke through the £100

million revenue barrier for the first time. Despite this feat, profit after tax

was £0.6 million lower at £1.1 million, though profit before tax actually rose

£0.4 million to £1.7 million, as the latest accounts had a tax charge of £0.6

million, while the previous year benefited from a £0.4 million tax credit.

Importantly, Swansea changed their financial year-end from May

to July in order to be more aligned to the football season, so the 2014/15

accounts cover 14 months. This means that costs are a fair bit higher than a

normal year, as these are incurred over the whole period, while revenue is only

slightly higher, as there is no additional match day or broadcasting income in

June and July.

This helped contribute to wages increasing by £19 million

(31%) to £83 million and other expenses rising £6 million (51%) to £19 million.

Player amortisation and depreciation were also £2 million higher, though player

impairment was reduced by £4 million.

Revenue rose by £5 million (5%), largely due to broadcasting

income increasing by £4.5 million (6%) to £85 million, but there was also

growth in commercial income, up £1.7 million (21%) to £10 million, and player

loans, up £0.5 million to £1 million. On the other hand, match income was down

£1.5 million (16%) to £7.7 million, mainly due to the lack of Europa League

games.

All this meant that Swansea’s operating profit fell £18

million, though this was offset by the £19 million increase in profits from

player sales, mainly due to Wilfried Bony’s transfer to Manchester City.

The expenses growth reflected the cost of playing in “the

best league in the world”, as Swansea’s finance director Don Keefe observed,

“These latest financial results continue to reveal the club’s desire to

maintain investment to improve performance standards and, in particular, to

compete successfully in the Premier League.”

Given the cost impact of a 14-month accounting period,

making any sort of profit is not to be sniffed at, though it has become less of

a rarity in the Premier League these days. In fact, no fewer than 15 of the 20

clubs in the top flight made money in 2013/14 (the last season for which all clubs

have published their accounts).

Swansea’s achievement is even more impressive if you

consider that half of the eight Premier League clubs to have published their

2014/15 results have reported worse figures, namely Everton, Manchester United,

Southampton and West Ham. This is fairly typical in the years when there is not

a new TV deal, as there is relatively little revenue growth, while wages keeps

going up.

Nevertheless, Swansea’s annual profits in the last couple of

years are among the lowest in the Premier League. For example, in the prior

season their profit of £1 million was way behind Tottenham Hotspur £80 million,

Manchester United £41 million, Southampton £29 million and Everton £28 million.

To an extent, this merely highlights the major impact that

once-off player sales can have on a football club’s profitability. To reinforce

this point, in 2014/15 Southampton made £44 million from player sales, mainly

due to the transfers of Adam Lallana and Dejan Lovren to Liverpool plus Calum

Chambers to Arsenal, while the previous season saw Tottenham Hotspur make an

amazing £104 million (largely from the mega sale of Gareth Bale to Real Madrid)

and Chelsea £65 million (David Luiz to Paris Saint-Germain).

In stark contrast, Swansea were the fourth worst in the

Premier League at making money from this activity in 2013/14, generating just

£5k. Fortunately, this significantly improved in 2014/15, when they made £19

million from player sales. Most of this was from Bony’s record move to City,

but there were also gains from the sales of Michel Vorm to Tottenham and Chico

Flores to Lekhwiya in Qatar.

Swansea’s focus on the bottom line is evidenced by them

being consistently profitable over the last four seasons, making a total of £41

million profits before tax since promotion to the Premier League. Most

impressively, Swansea had profits of £17 million and £21 million in 2012 and

2013 respectively. Indeed the latter profit was the highest achieved in the top

tier that particular season.

The last time that Swansea made a loss was £11 million in

2011, which could ironically be considered as the price of success, because

promotion triggered hefty bonus payments to the players and management staff

plus additional transfer fees.

As we have seen, when football clubs make large profits it

is often down to major player sales. This was certainly the case for Swansea in

2013, when the £21 million profit was essentially due to transfers, mainly Joe

Allen to Liverpool, Scott Sinclair to Manchester City and Danny Graham to Sunderland.

Very little will come Swansea’s way from player sales in

2015/16, unless they make sales in the January window, as they have only earned

around half a million to date from Jazz Richards’ transfer to Fulham.

Profits can also be boosted by other exceptional items. In

Swansea’s case, they have made £7 million in compensation fees for management

“transfers” in the last few years: £5 million from Liverpool in 2012 for

Brendan Rodgers and his staff; £2 million from Wigan Athletic for Roberto

Martinez in 2010. In contrast, next year’s books will have to absorb a £3

million severance payment to Monk.

As transfers can have such a major impact on reported

profits, it is worth exploring how football clubs account for these deals. Even

though this is fairly technical, the fundamental point is that when a club

purchases a player the costs are spread over a few years, but any profit made

from selling players is immediately booked to the accounts.

So, when a club buys a player, it does not show the full

transfer fee in the accounts in that year, but writes-down the cost (evenly)

over the length of the player’s contract. Therefore, if Swansea were to spend

£15 million on a new player with a 5-year contract, the annual expense would be

only £3 million (£15 million divided by 5 years) in player amortisation (on top

of wages).

However, when that player is sold, the club will straight

away report the profit, which is basically the sales proceeds less any

remaining value in the accounts. In our example, if the player were to be sold

3 years later for £18 million, the cash profit would be £3 million (£18 million

less £15 million), but the accounting profit would be much higher at £12

million, as the club would have already booked £9 million of amortisation (3

years at £3 million).

Notwithstanding the accounting treatment, essentially the

more that a club spends, the higher its player amortisation. Thus, Swansea’s

player amortisation has shot up from just £1 million in 2011 to an £18 million

peak in 2015, reflecting the years of higher spending in the transfer market

since promotion to the Premier League.

However, Swansea’s financial results have also been

influenced by the £7 million of impairment charges they have booked since 2011,

most notably £4.7 million in 2014. This happens when the directors assess a

player’s achievable sales price as less than the value in the accounts.

Going back to our example, if the player’s value were

assessed as £4 million after 3 years instead of the £6 million in the accounts,

then they would book an impairment charge of £2 million. Impairment could thus

be considered as accelerated player amortisation. It also has the effect of

reducing the annual player amortisation going forward.

In any case, Swansea’s player amortisation is still one of

the lowest in the Premier League and is obviously miles behind the really big

spenders like Manchester United (£100 million), Chelsea (£72 million) and

Manchester City (£70 million).

Despite the use of impairment charges, the higher spending

means that player values on the balance sheet have increased from just £3

million in 2011 to £50 million in 2015. Moreover, this accounting treatment

actually understates the value of Swansea’s squad, as it does not fully reflect

the real market value of its players.

Given all the accounting complexities arising from player

trading, clubs often looks at EBITDA (Earnings Before Interest, Taxation,

Depreciation and Amortisation). Admittedly, this is a horrible acronym, but it

simply shows how profitable a club is from its core business.

On the face of it, the steep decline in Swansea’s EBITDA

from £23 million to £3 million in 2015 should be a little concerning, but this

is partly due to the 14 month accounting period last year, which includes more

costs. In reality, EBITDA has been solidly positive at Swansea since promotion

with last year’s increase driven by the new TV deal in 2014.

That said, this also outlines the challenge for clubs like

Swansea, as the EBITDA is significantly higher at the leading clubs, even though

they have much larger wage bills: Manchester United £120 million, Manchester

City £83 million, Arsenal £64 million, Liverpool £53 million and Chelsea £51

million.

Swansea’s massive revenue growth from £12 million in 2011 to

£103 million in 2015 has been very largely due to the club’s elevation to the

top flight, which the accounts noted, “amply demonstrates the rewards of

gaining promotion.”

In effect, there have been two revenue uplifts: first, from

£12 million to £65 million in 2012, which highlights the enormous disparity in

TV money between England’s top two leagues; second, the increase from £67

million to £99 million in 2014, thanks to the new TV deal commencing that

season.

In fact, virtually all of the £39 million revenue growth

since the first season back in the top flight is from TV (£36 million), even

though commercial income has nearly doubled from £5.2 million to £10.0 million

and match income is up a third from £5.8 million to £7.7 million.

Swansea’s achievement in finishing 8th in the Premier League

is really put into perspective when you compare their revenue to other clubs:

in 2013/14 their revenue of £99 million was only the 13th highest in the top

tier.

It should be a similar story in 2014/15, as their revenue

growth of £5 million is in line with many of the clubs that have reported to

date (Southampton £8 million, West Ham £6 million, Manchester City £5 million

and Everton £5 million), though Arsenal’s new commercial deals resulted in a

hefty £31 million increase.

Either way, the fact remains that their revenue of £103

million is overshadowed by the elite clubs. At the top of the pile, Manchester

United’s revenue of £395 million (reduced in 2014/15, due to not qualifying for

Europe) is around four times as much as Swansea, while significant sums are

also generated by Manchester City £352 million, Arsenal £329 million and

Chelsea £320 million.

More encouragingly, Swansea now have the 29th highest

revenue in the world, according to the Deloitte Money League, which allows them

to pay higher wages than famous clubs such as Ajax and Lazio. They are within

striking distance of European thoroughbreds such as Hamburg £101 million,

Benfica £105 million, Roma £107 million and Marseille £109 million.

The problem is that these additional riches do not help

Swansea much domestically, as there are no fewer than 14 Premier League clubs

in the world’s top 30 clubs by revenue (and all of them are in the top 40).

What is striking is that no club in that top 30 has a higher

reliance on TV money than Swansea, where a staggering 82% of their total

revenue comes from broadcasting. That leaves only 11% from commercial

activities and just 7% from match day income.

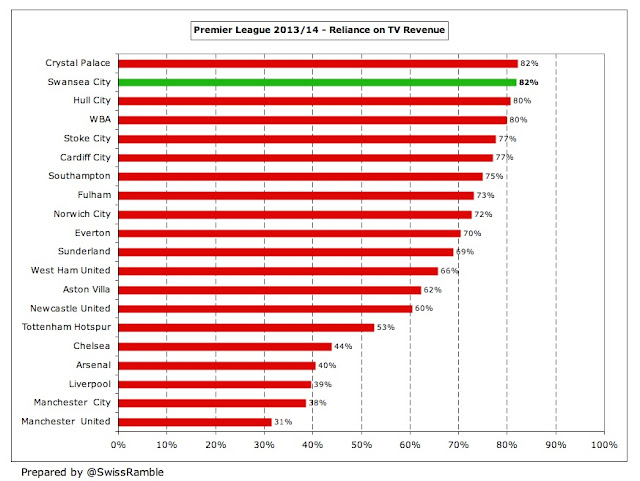

Unsurprisingly, only Crystal Palace (also 82%) are more dependent on TV for their revenue, but in fairness the majority of Premier League clubs are also heavily reliant on this revenue stream. In fact, all but the top six clubs get at least 60% of their income from broadcasting.

In 2014/15 Swansea’s share of the Premier League TV money

rose 9% from £74 million to £81 million. The distribution of these funds is

based on a fairly equitable methodology with the top club (Chelsea) receiving

£99 million, while the bottom club (QPR) got £65 million.

Most of the money is allocated equally to each club, which

means 50% of the domestic rights (£22.0 million in 2014/15), 100% of the

overseas rights (£27.8 million) and 100% of the commercial revenue (£4.4

million). However, merit payments (25% of domestic rights) are worth £1.2

million per place in the league table and facility fees (25% of domestic

rights) depend on how many times each club is broadcast live.

In this way, Swansea were helped by their attractive style

of football, as they were broadcast live 12 times, which was more than, say,

Stoke City (9 times) and so was worth an additional £1.5 million (£10.3 million

less £8.8 million). Each place in the league table is worth around £1.2

million, so Swansea’s 8th place merited £16.2 million, compared to receiving

£11.1 million the previous season for coming 12th.

The blockbuster new TV deal starting in 2016/17 only

reinforces the need to stay in the Premier League. My estimates suggest that

Swansea would receive an additional £37 million under the new contract for

finishing in the same position as 2014/15, increasing the total received to an

incredible £117 million.

This is based on the contracted 70% increase in the domestic

deal and an assumed 30% increase in the overseas deals (though this looks to be

on the conservative side, given some of the deals announced to date). Of

course, if they were to finish lower in the league table, they would earn a bit

less.

Given the figures, it is obvious why Swansea are so scared

of relegation and why they felt they had to sacrifice Monk. If they were to

drop down, they would get around £38 million in the Championship, including a

£35 million parachute payment and £2 million distribution from the Football

League, compared to at least £92 million in the Premier League.

Of course, this would be considerably higher than those

Championship clubs without parachute payments, who receive only £5 million, but

it’s still a considerable reduction in revenue that would require major cuts in

the wage bill, i.e. selling the club’s better players.

As the club’s accounts stated, “The major risk continues to

be relegation from The Barclays Premier League and the adverse effect it would

have on liquidity, operational activity and our ability to realise future

plans.”

Swansea’s 2013/14 figures had been boosted by their Europa

League adventures, but only to the tune of €4 million, even though they got out

of their group, memorably defeating Valencia in the Mestalla Stadium, before

being eliminated by Napoli in the last 32.

Match day revenue fell 16% (£1.5 million) from £9.2 million

to £7.7 million, due to the lack of Europa League competition (six home games)

in 2014/15. This revenue stream peaked at £9.9 million in the 2012/13 season,

largely thanks to progress in the domestic cups, including three home matches

in the run to Wembley for the Capital One Cup triumph against Bradford City.

Swansea’s match day income is significantly lower than many

other Premier League clubs. At the other end of the spectrum, Manchester United

and Arsenal earn around £100 million match day income or more than ten times as

much as Swansea. Put another way, they earn more in three matches than Swansea

do in an entire season.

In fairness, Swansea should be commended for their ticket

pricing strategy, as they have not raised prices in the five years they have

been in the Premier League. In fact, they cut season ticket prices by £10 for

the 2015/16 season and have announced a price freeze for the 2016/17 season.

According to the BBC’s Price of Football survey, Swansea have the second

cheapest “most expensive” season tickets in the Premier League.

Vice-chairman Leigh Dineen explained the thinking: “We will

continue to work hard on reducing the price of football for our supporters

wherever and whenever we can. Our supporters will always remain the lifeblood

of this club and the Board of Directors believe these season ticket prices

remain exceptional value for money to watch quality football at the Liberty

Stadium.”

Furthermore, the club also agreed to subsidise the price of

tickets purchased through the Jack Army membership scheme for away fixtures, so

that no adult would pay more than £22 for a game.

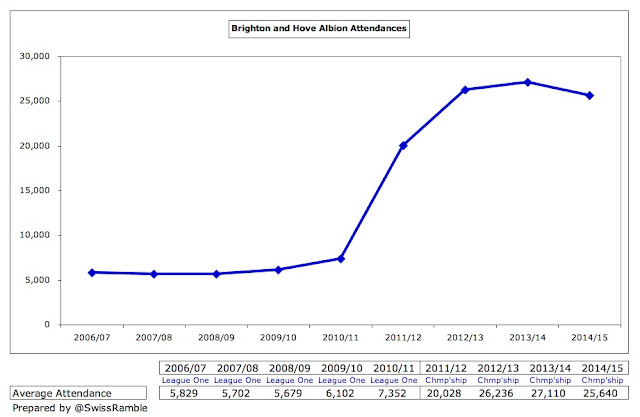

Swansea’s advancement through the leagues has been matched

with increases in attendances, facilitated by the move to the Liberty Stadium

in the summer of 2005. Last season’s average attendance of 20,555, slightly

higher than the previous year, is more than 12,000 higher than the last season

at the old Vetch.

However, this was still one of the lowest attendance in the

Premier League, only ahead of Burnley and QPR in 2014/15. The problem is that

the Liberty Stadium is too small to satisfy demand with around 98% of the

capacity being sold and a lengthy waiting list for season tickets.

Therefore, the club has started negotiations with the local

council to buy the Liberty, as it would not want to invest in a facility where

it is only a tenant. It currently shares the stadium with rugby union side Ospreys on a 50-year lease.

Although planning permission has been granted for a stadium

expansion to increase the capacity from just under 21,000 to 33,000, there is

still much to agree with the local council before any development.

"I could be happy"

As finance director explained: “Any plans for an expansion

of the East Stand at the Liberty Stadium cannot go ahead until we have

negotiated a fair and equitable deal with the City and County of Swansea which

is in the best interests of the club and not to the detriment of our available

resources.”

The potential purchase price has been reported as £20-25

million, but the club would want a long-term payment schedule (over 15-20

years) to reduce their risk, especially if they were to be relegated.

Jenkins emphasised that any stadium expansion should not

damage the playing squad, “so the club is not held back financially when it

comes to the No. 1 priority of putting a team on the pitch and making sure we

remain competitive in the Premier League.”

Commercial income was up an encouraging 21% (1.7 million)

from £8.3 million to £10.0 million, but this was still one of the lowest in the

Premier League, only above Crystal Palace and Hull City in 2013/14. To place

this into context, the top five earners here are Manchester United £196

million, Manchester City £173 million, Chelsea £109 million, Liverpool £104

million and Arsenal £103 million. No wonder that Jenkins has admitted that the

club is “miles behind” rivals commercially.

However, there are some signs of improvement, as the shirt

sponsorship with Chinese financial services firm Goldenway (with their GWFX

brand adorning the shirt) doubled from £2 million to £4 million a season when

it was extended by two years until the end of the 2015/16 season – “the largest

agreement in the club’s proud 102-year history”.

Similarly, the kit supplier deal originally signed with

adidas in 2011 was extended in 2014. No financial details were divulged, but it

is estimated to be worth £1.5 million per season.

The reported wage bill shot up 31% (£19 million) from £63

million to £83 million, thus increasing the wages to turnover ratio from 64% to

79%, but this is misleading, as the figures include 14 months of wages, while

revenue is effectively only 12 months (match day and broadcasting are

unchanged).

If we were to pro-rate the wage bill for 12 months, then it

would be a more respectable £71 million with a wages to turnover ratio of 69%.

That would still represent a 12% (£8 million) increase in wages, but that would

be altogether more reasonable.

Even so, this would still be one of the highest wages to

turnover ratios in the Premier League with only West Brom, Fulham and

Sunderland reporting worse ratios (in the previous season). In fairness,

Swansea have significantly improved from a horrific 149% in 2011 (though the

wage bill was inflated that season by bonus payments linked to promotion).

Interestingly, the wages in Swansea’s first season back in

the big time were amazingly low at £35 million – unsurprisingly the smallest

wage bill in the Premier League in 2011/12.

Swansea’s wages, heavily based on performance-related

contracts, are among the lowest in the top tier, though they have been steadily

increasing, so in 2013/14 they had the 13th highest wage bill. This is partly

due to the increase in staff numbers, e.g. football headcount rose from 167 to

222 in 2014/15.

Clearly, they still managed to over-achieve by finishing 8th

last season, but Jenkins does not like to use that argument as an excuse:

“We’ve never accepted that because of the money, we should be grateful and

happy where we are. There is always the challenge to compete and you’ve got to

find ways of doing that.”

That is more important than ever when you see how the wage

bills of the mid-term clubs are converging around the £70 million level, e.g.

West Ham £73 million, Southampton £72 million, Swansea £71 million, Stoke City

£67 million.

It is only recently that Swansea’s directors started

receiving payment for their efforts, but it is worth noting that the highest

paid director (presumably Jenkins) earned £517k in 2014/15, down from £550k in

2013/14, though that included a £275k bonus for retention of Premier League

status. Both payments are significantly up from the £250k earned in 2012/13.

The promotion effect can also be seen in the club’s

activities in the transfer market. In the six seasons before promotion to the

Premier League, there was hardly any gross spend, but this has now increased to

average annual expenditure of around £16 million, including the signings of

Wilfried Bony, Federico Fernandez, Ki Sung-Yeung, Pablo, Kyle Naughton, Jonjo

Shelvey, Eder and Jefferson Montero.

However, even with this increase, Swansea are hardly

recklessly extravagant, as big money sales have produced a very low net spend.

Their approach was summarised in the accounts thus: “we will continue year on

year to improve our playing squad, but in a sensible and cost effective

manner.” It should therefore be no surprise that Swansea are among the lowest

spenders in the Premier League.

In the last two years Swansea actually had net sales of £3

million, one of only two clubs with a surplus in the transfer market (Southampton

being the other one). As might be expected, the spending league table is lead

by Manchester City and Manchester United, but Swansea have also been

comfortably outspent by the likes of Crystal Palace, Leicester City,

Sunderland, Bournemouth and Watford.

Swansea have made their strategy very clear: “The secret is

to balance spending to maintain and improve performance on the pitch so we

remain in the Premier League, and spending on new projects considered important

to the wellbeing of the club going forward.” It’s a tricky balance that has

worked well for the club, though they might come to regret the lack of quality

recruitment this summer if they don’t avoid the dreaded drop.

After three years of enjoying net funds (cash higher than

debt), Swansea returned to a net debt position of £22 million in 2014/15,

comprising gross debt of £25 million less £3 million cash. Gross debt comprised

a £15 million overdraft, £8 million of other loans, £1 million owed to group

undertakings plus £0.6 million of hire purchase contracts.

It should be noted that total creditors have been rising and

increased £37 million in 2014/15 alone to a hefty £73 million. In addition,

Swansea have contingent liabilities of £6 million (up from £3 million) for

potential future transfer payments, dependent on player appearances and club

success, and a possible £19 million of additional signing-on fees

(significantly up from £2 million).

Although Swansea’s debt is still one of the smallest in the

Premier League (with five clubs having debt above £100 million), this situation

is one that will need careful monitoring following last season’s increase and

potential future commitments.

To be fair, Swansea have been investing in the club

infrastructure, specifically on new training bases at Fairwood (first team) and

Landore (academy), including £3 million in 2014/15 and £6.9 million in 2013/14.

This will be of long-term benefit to the club, but cash is tight, as noted by

the finance director: “we recognise that we need further injection of funds before

we can commit to any more significant capital investment programmes.”

This is highlighted by last season’s cash flow statement.

Although Swansea generated £6 million from operating activities, further

boosted by a new £8 million loan, they spent £24 million on players, £3 million

capital expenditure and £1 million on dividends, thus requiring a £15 million

overdraft.

Since promotion, Swansea have had £76 million of available

funds, largely driven by £57 million cash from operating activities, supplemented

by a £13 million increase in the overdraft plus a net £6 million increase in

net loans. They have spent £53 million (70%) on bringing in new players and

invested £18 million on infrastructure plus £4 million in dividends.

Interestingly, the player investment in the cash flow

statement is a lot higher than the net spend reported in the press, which could

be due to a number of reasons, such as the timing of stage/conditional payments

for player sales or high agent and signing-on fees (not included in transfer

figures).

There has been some noise about the dividends paid to

Swansea’s directors, but most fans seem to think that this is fair reward for

all their efforts in first saving and then running the club so well.

Swansea’s unique ownership structure, with 21% held by the

Supporters Trust and a fan elected on the board, has been described by the

Premier League’s chief executive, Richard Scudamore as “ideal”, but the need

for outside investment is clear, especially when you compare their cash balance

with their Premier League rivals: Swansea have less than £3 million, while 11

clubs have more than £20 million.

Indeed, last season they held discussions with American

businessmen John Jay Moores and Charles Noell, the former owners of Major

League baseball team the San Diego Padres, who were reportedly seeking to

acquire an initial 30% stake (rising to 66% in a few years), but these came to

nothing and they seem to have moved their interest to Everton.

"You're gonna hear me roar"

The club is keen to focus on developing its academy and is

hopeful that its investments will help secure the Category One status. The good

news is that the Premier League has already promoted Swansea’s U21 and U18

teams to the higher level this season, pending an audit of its facilities. As

academy manager Nigel Rees said, “It means the boys will be competing against

some of the very best players and teams at their age level. It’s all part of

their development by creating a clear pathway towards the first team.”

Swansea’s recovery from near disaster at the turn of the

Millennium is a fabulous story (“Jack to a King”), as a fading, provincial club

climbed back up the leagues, all the time playing entertaining football and

running the club in the right way.

However, football can be a harsh mistress, so no club can

afford to rest on its laurels. To continue their impressive progress, Swansea

will need to appoint the right man to manage the team in order to retain their

Premier League status. There will be many hoping that they can do it.