It is said that lightning never strikes twice in the same

place, but tell that to Norwich City supporters, who saw their club relegated

from the Premier League for the second time in three seasons, while again

posting a tidy profit.

As the club admitted, “2015/16 has been a disappointing

season, culminating in relegation to the Championship after only one year in

the Premier League.” It must therefore have been particularly galling for supporters

to see the club report a £13 million profit before tax and clear debt instead

of spending more in an attempt to avoid relegation.

However, this is a little misleading, as the club explained,

“Operating profit was much higher than planned due to a significant proportion

of salary costs being performance-related in terms of remaining in the Premier

League, and therefore not paid.”

They continued, “As a club, our No. 1 objective this season

was always to retain our Premier League status. We have fallen short of that

target and work is already under way to learn from the mistakes that

contributed to our failure this season.”

This statement followed the resignation in May 2016 of chief

executive David McNally, who had been closely associated with the club’s conservative

strategy, though this is perhaps better described as aiming to combine sporting

success with financial prudence.

"Howson Is Now?"

This balanced approach was epitomised by former chairman

Alan Bowkett’s comments after Norwich’s promotion in 2014/15: “We are pleased to

report that the club was successful in returning to the Premier League at the

first attempt whilst maintaining a robust financial position.”

Although this stance is eminently sensible, it is also

somewhat of a double-edged sword, as better recruitment might have helped the

club escape from relegation. Indeed, manager Alex Neil admitted that Norwich

“didn’t add as many as we would have liked” before the 2015/16 season.

The club attempted to rectify this mistake in the January

transfer window by splashing out in a desperate attempt to beat the drop, but

it felt like it was too little, too late. They also found themselves on the

wrong end of a sellers’ market, for example having to shell out a chunky £8.5

million for Steven Naismith, which would be difficult to describe as money well

spent.

To an extent, Norwich’s cautious approach is understandable,

given their experience of financial problems in the not-too-distant past, when

they suffered from “crippling debts” following relegation to League One in

2009. As director Michael Wynn Jones noted, “We were firefighting all the way.

We could have gone bankrupt.”

"Bring me Klose"

Those worrying days appear to be firmly in the past, as

Norwich have now cleared all their external debts. While some have questioned

whether it would have been better to use any available cash to improve the

squad rather than reduce debt, the club did not have much choice, as the terms

of the debt restructuring stated that the loans would be repaid after the club

reached the Premier League (with its associated riches).

That said, new chairman Ed Balls (yes, the one embarrassing

himself on Strictly Come Dancing) has continued to preach caution: “We are

trying to show you can have a community club without big, massive debts, which

runs things financially well, and can deal with coming down and getting back up

again.”

On his appointment in December 2015, Balls had neatly

encapsulated Norwich’s near-acceptance of being a so-called yo-yo club: “We’ve

now been in the Premier League for four years out of five, but I don’t think

anybody yet feels our long-term future as a Premier League club is secure.”

Ironically, Norwich’s focus on “ensuring the financial

position remains strong” should again help improve their chances of promotion,

as Bowkett explained after the previous relegation in 2014, “The good news is

that this surplus has enabled us to construct one of the strongest squads in

the Championship. Due to our strong balance sheet we are able to totally focus

on planning our return to the Premier League.”

Indeed, Norwich made a £13.0 million pre-tax profit (£9.4

million after tax) in 2015/16, which was a £21.1 million improvement on the

£8.1 million loss they registered the previous season in the Championship.

The main driver was a £45.7 million (86%) increase in

revenue from £52.2 million to £97.8 million, largely due to broadcasting income

rising by £41.6 million (145%) from £28.7 million to £70.3 million, though

there was also growth in commercial income of £3.2 million (25%) to £16.0

million and gate receipts of £0.8 million (7%) to £11.5 million.

As Balls observed, “These figures once again underline the

huge gap in revenues between the Premier League and the Championship.” In fact,

if we include other operating income of £2.7 million for player loans (as most

other clubs do), then Norwich’s total income would be £100.6 million, the first

time that they have broken through the £100 million barrier.

"Tettey Picker"

Profit from player sales also rose by £7.6 million (56%)

from £13.6 million to £21.2 million, mainly due to the sales of Nathan Redmond

to Southampton, Lewis Grabban back to Bournemouth, Bradley Johnson to Derby

County and Gary Hooper to Sheffield Wednesday.

On the other hand, expenses rose across the board,

especially wages, which increased by £16.2 million (87%) from £51.0 million to

£67.2 million. Player amortisation also climbed by £5.5 million (42%) to £18.6

million, while the club had a player impairment charge of £3.8 million (none in

2014/15).

There was also a £2.5 million credit the previous season against

the onerous contracts provision booked in 2013/14, while other expenses surged

31% (£3.8 million) to £16.1 million.

Of course, most Premier League football clubs make money

these days, largely on the back of the TV deals, so it is not a major surprise

that all five clubs that have to date published their 2015/16 accounts have

posted profits.

Norwich’s £13 million profit was bang in the middle, a fair

way behind the two Manchester clubs (United £49 million, City £20 million), but

much higher than Arsenal £3 million and Stoke City £2 million.

However, it should be pointed out that that Norwich did

benefit from £21 million of once-off player sales in 2015/16, which is the

highest of those clubs that have so far reported in 2015/16, slightly above Manchester

City.

Profit from player sales can have a major influence on a

football club’s bottom line, as best shown in 2014/15 by Liverpool, whose

numbers were boosted by £56 million from this activity, largely due to the sale

of Luis Suarez to Barcelona. This was the major factor in Liverpool being the

most profitable Premier League club that season.

After four years of increasing losses in the Championship

and League One between 2008 and 2011, Norwich returned to profits following

promotion to the Premier League, especially the first season back in 2011/12,

when the club made its highest ever pre-tax profit of £16 million.

Since then the profit has fallen, partly due to investment

in the playing squad and partly due to the impact of performance-related bonuses.

The profits in both relegation seasons (2014 and 2016) were heavily influenced

by non-payment, while the 2015 loss of £8 million was the opposite story, as it

included £11 million of promotion bonus payments.

Many clubs have effectively been subsidising their

underlying business with profitable player sales, but this has not really been

the case at Norwich City, at least until the last two seasons, when they

averaged £17.4 million profit from this activity, compared to just £1.3 million

in the previous eight seasons.

In fact, without the £21 million from player sales in

2015/16, Norwich would have reported an £8 million loss. Similarly, the 2014/15

loss would have been as much as £22 million, if we were to exclude £14 million

of player sales, largely due to the transfers of Leroy Fer to QPR and Robert

Snodgrass to Hull City.

However, next year’s accounts are likely to feature looks a

return to low profits from player sales, unless someone is sold for big money

in the January window.

To get an idea of underlying profitability and how much cash

is generated, football clubs often look at EBITDA (Earnings Before Interest,

Depreciation and Amortisation), as this metric strips out player trading and

non-cash items.

In Norwich’s case this again clearly demonstrates the

difference between the top two tiers of English football, as it was minus £10

million in the Championship in 2014/15 and £19 million in 2015/16. However,

this does imply that Norwich were bigger spenders last season, as their EBITDA

was much higher at £33 million in their 2014 relegation season.

Looking at Premier League EBITDA, Norwich are a long way

behind the elite with Manchester United leading the way with an astonishing

£192 million, followed by Manchester City £109 million and Arsenal £82 million.

That said, Norwich were still higher than bigger clubs like

Everton £18 million and Chelsea £16 million and three times as much as Stoke

City £6 million – though we should once more note the effect of not paying

bonuses.

Norwich’s most significant revenue growth in the past few

years took place following promotion to the Premier League in 2011, when

revenue shot up by £51 million in a single season.

Since that initial season back in the top flight in 2012,

revenue has grown by a further £24 million (32%), though virtually all of that

increase is attributable to the higher TV deal in 2014 with broadcasting up by

£21 million (44%) to £70 million. In the same period, commercial income has

risen by £2 million (14%), while gate receipts are basically flat.

To quote The Cure, Norwich’s revenue growth outside the

centrally negotiated TV deals has come to a “grinding halt”. This is a major

challenge for the board.

Despite Norwich’ growth to £98 million in 2015/16, their

revenue was still among the lowest in the Premier League, so it is little

wonder that they found themselves in the relegation zone. That said, much of

the difference between clubs in the bottom half of the table is simply linked

to the smaller TV merit payments, which are based on league position, so it’s a

little “chicken and egg”.

Interestingly, the Canaries’ good league finishes in their

first two seasons back in the top flight were pretty much in line with their

position in the revenue league: in 2011/12 they finished 12th when they were

13th in the revenue league; in 2012/13 they came a creditable 11th (12th

highest revenue).

Of course, Norwich’s revenue was still miles behind the

leading clubs. In fact, the top three clubs all earn at least £350 million:

Manchester United £515 million, Manchester City £392 million and Arsenal £351

million. In other words, United’s revenue was more than five times as much as

Norwich, giving them over £400 million more to spend every season, which is a

sobering thought.

By the same token, in 2015/16 Norwich had one of the highest

revenues in the world. Deloitte have not yet published their annual Money

League for 2015/16, but Norwich’s £98 million (£101 million including player

loans) would have broken into the top 30 the previous season.

For some context, it would have been higher than Napoli and,

for that matter, Valencia, Sevilla, Hamburg, Stuttgart, Lazio, Fiorentina,

Marseille, Lyon, Ajax, PSV Eindhoven, Porto, Benfica and Celtic.

As Deloitte observed, “This is again testament to the phenomenal

broadcast success of the English Premier League and the relative equality of

its distributions, giving its non-Champions League clubs particularly a

considerable advantage internationally.” Great stuff, but it did not really

help Norwich much domestically, as no fewer than 17 Premier League clubs

feature in the top 30 clubs worldwide by revenue, making it even more

competitive.

Clearly, all that lovely TV money has been the main driver

of Norwich’s growth, contributing an incredible 72% of the club’s total revenue

in 2015/16, up from just 10% in League One in 2009. Commercial income accounted

for 16%, while gate receipts were worth only 12%.

This is a fairly common business model in the Premier

League, e.g. in 2014/15 no fewer than nine clubs earned more than 70% of their

revenue from broadcasting. Of course, it’s a different story in the

Championship, as Alan Bowkett explained, “You are looking at gate receipts

being about 11% in the Premier League, but they were 20% of our income in the

Championship.”

His figures were slightly out, but the point is clear: the

supporters are more important (at least in revenue terms) in the Championship.

Norwich received £67 million in distributions from the

Premier League TV money in 2015/16, which represented a £42 million increase

over the previous season’s £25.0 million parachute payment in the Championship.

Most of the Premier League money is distributed as equal shares to the 20

clubs: 50% of the domestic deal, 100% of the overseas deals and the central

commercial income.

However, merit payments (25% of domestic rights) are worth

£1.2 million per place in the league table and facility fees (25% of domestic

rights) depend on how many times each club is broadcast live. In this way,

Norwich were disadvantaged by being shown live just eight times and, well,

finishing in 19th place.

Obviously Norwich will receive a lot less money in the

Championship, even though they are protected to some extent by a parachute

payment, which I have estimated at £39.5 million, though the club’s finance

director Steve Stone said that this would be “just north” of £40 million.

This will be added to the £2.1 million given to all

Championship clubs from the Football League’s own TV deal, but Norwich will still

have to contend with a £25 million cut in TV money. In fairness, while they are

cushioned by the parachute payment, they will still earn a lot more (around £28-36

million) than most Championship clubs, who will receive a solidarity payment

from the Premier League of £3.6 million.

As Ed Balls said, “The accounts show that if you are in the

Premier League, you get a lot more money. But if you come down, you see a big

fall in finances, because you lose the TV revenue.” Although that might appear

to be a contender for the Sybil Fawlty “bleeding obvious” award, the big man’s

not wrong.

The other point worth emphasising is that Norwich will only

benefit from parachute payments for two years (£31.7 million in the second

season), as they were relegated after one season in the Premier League. In

contrast, Newcastle and Aston Villa will receive three years of parachute

payments.

Balls again, “We are in a stronger position now than the

last time we were in the Championship, because the parachute payments are

higher than they were. But that indicates we need to invest that money in

getting back into the Premiership as soon as we can. It is certainly fair to

say that the best chance of going back is within year one or year two, and it

definitely gets more difficult after that.”

That advantage was seen in the last promotion season in

2014/15 when Norwich enjoyed the second highest broadcasting income. However,

it is clearly not a panacea, as the other clubs with sizeable parachute

payments that year did not exactly pull up any trees (Fulham, Cardiff City,

Reading and Wigan Athletic). Indeed, Wigan were actually relegated to League

One.

There is never a good time to be relegated, but Norwich’s

timing was particularly bad, as they have missed out on the mega new Premier

League TV deal that started in 2016/17. Based on the contracted 70% increase in

the domestic deal and an estimated 40% increase in the overseas deals, the top

four clubs will receive around £150 million, while even the bottom club will

trouser around £100 million.

As Bowkett said before relegation, “We want to be

competitive and we want to be in the Premier League. With the new TV deal

coming in, that will help the Norwiches and the West Broms of the world.”

Match day revenue rose 7% (£0.8 million) from £10.7 million

to £11.5 million, despite the number of home games falling from 24 to 21 due to

fewer teams in the Premier League. This was offset by the average attendance

rising from 26,368 to 26,973.

Norwich’s match day income was a perfectly respectable 12th

place in the Premier League, though at the other end of the spectrum, Arsenal

and Manchester United both earn over £100 million of match day revenue.

Only five clubs in the top flight had lower average

attendances than Norwich in 2015/16: Bournemouth, Watford, Swansea City, WBA and

Crystal Palace. In fairness, attendances have been very good at Norwich and

held up well the last time they were in the Championship, when they had the

second highest crowds in the division, only behind Derby County. As Bowkett

said at the time, “It was very important to us that we maintained our gate

receipts.” They even managed to attract around 25,000 in League One in 2009.

As a reward to their loyal supporters, Norwich froze season

ticket prices for a third consecutive year in 2016/17. This means that the adult

ticket price per match equates to just £26.29. In addition, the club raised the

threshold for junior season tickets from 17 to 18 years. Another interesting

initiative in 2015 was an offer of a three-year season ticket at the 2015

prices.

This level of support has induced the club to investigate

the possibility of expanding Carrow Road to increase the stadium capacity from

27,000 to 32,000. However, that plan has been shelved for the time being, as it

would require a substantial loan to finance the development. Bowkett admitted

that this was only likely to happen with a sustained stay in the Premier

League: “the new TV deal over three years would allows us to bring forward the

stadium expansion plans.”

Commercial revenue increased by 25% (£3.2 million) from

£12.8 million to £16.0 million. This comprises commercial income £10.0 million,

catering £4.4 million, UEFA solidarity payments £0.8 million and other income

£0.9 million. The amount of catering income is striking, but you would perhaps

expect this to be a good source of revenue from a club that includes the famous

cook Delia Smith among its owners.

Despite this increase, Norwich’s commercial income is still

far below the leading English clubs, e.g. the two Manchester clubs grew their

commercial revenue again in 2015/16: United to an astonishing £268 million and

City to £178 million. That said, Norwich’s £16 million was the same level as

Stoke City and ahead of clubs like Crystal Palace, Southampton and WBA, so it’s

hard to be overly critical.

The disparity is most evident when comparing the shirt

sponsorship deals. Norwich have been with insurance company Aviva since 2008,

recently extending their deal by one year to the end of the 2016/17 season.

Although that is “a record ninth year”, it is not exactly a resounding vote of

confidence and pays only around £1 million a season.

Of course, this deal is a long way behind the elite, e.g.

Manchester United – Chevrolet £47 million (£56 million using the latest USD

exchange rate); Chelsea – Yokohama Rubber £40 million; and Arsenal – Emirates

£30 million. In fairness, most clubs outside the absolute elite have struggled

to secure such massive deals, so Norwich will hope that they are back in the

Premier League before negotiating a new deal.

Italian kit supplier, Errea, who have been with Norwich

since 2011, last year announced an eight-year extension until 2024. Figures are

undisclosed, but they will again be nowhere near as much as the top clubs, e.g.

United's deal with Adidas is worth a cool £75 million a season. One recent

innovation was a back-of-shirt sponsorship with digital advertising company, bid stock.

In 2015/16 the wage bill surged 32% (£16 million) from £51

million to £67 million in the Premier League. The 2014/15 wage bill was

reported as £48.5 million in the accounts, but this included a £2.5 million credit

for onerous contracts, which should really be treated as an exceptional item. Furthermore,

that season included £11 million of performance bonuses linked to promotion, so

the “clean” wage bill was effectively £40 million.

That meant that the wages to turnover ratio in the

Championship was 76%, which is very respectable for that league. In the Premier

League, this fell to 69%, but this was actually towards the higher end of the

top flight. We should expect a deterioration in this ratio this season

following the relegation, even though the club has confirmed that all players

have relegation clauses in their contracts.

Compared to the last time Norwich were in the premier

League, wages rose by £18 million (36%), while revenue only increased by £3 million

(4%) in the same period, which highlights the club’s investment in players.

Another interesting comparison is the player wages to

turnover ratio, a statistic that few clubs provide. This shows an increase from

40% to 55% in the Premier League (2013/14 compared to 2015/16) and a similar

increase in the Championship from 47% to 67% (2010/11 vs. 2014/15), which

demonstrates how far Norwich have pushed the boat out on player wages.

The number of employees also rose in the Premier League, up

from 275 to 304, mainly due to football staff (119 to 138), though other staff

increased as well (149 to 159).

Some fans have drawn attention to the high £1.35 million

pay-off to former chief executive, David McNally. This was described as

“compensation for loss of office” by the club. Although this seemed a lot to

give a man who had resigned, it was maybe fair recognition for his efforts. As

Balls commented, “The reality is that David made a really strong contribution

to this club for a number of years.”

If there is any criticism to be made about McNally’s

remuneration, it should really be for the hefty £367,500 bonus he received in

2013/14 “for achieving non-football-related targets and objectives”. Not bad,

considering that the main football-related target, i.e. Premier League

survival, was clearly not achieved.

That said, it was always going to be a struggle for Norwich,

given how low their wage bill is compared to other Premier League clubs. Indeed,

in that relegation season in 2013/14 only Crystal Palace and Hull City had

lower wage bills. It is likely to be a similar story when all the 2015/16

accounts are published, though Norwich’s wage bill would have been higher if

those Premier League survival bonus payments had been made.

Nevertheless, to place this into context, it would still be miles

behind the leading clubs, who all pay around £200 million: Manchester United

£232 million, Chelsea £216 million, Manchester City £198 million and Arsenal

£195 million.

Of course, the boot is likely to be on the other foot in the

Championship this season, as Norwich will again be boosted by parachute

payments. In fact, in 2014/15 the Canaries benefited from the highest wage bill

in the division of £51 million. Even if we exclude the £11 million promotion

bonus payment, the resulting £40 million was only surpassed by Cardiff City’s

£42 million.

Although there is a natural focus on wages, other expenses

can also account for a fair part of the budget, and these rose by 31% (£4

million) to £16 million in 2015/16. These cover the costs of running the

stadium, staging home games, supporting commercial partnerships, travel,

medical expenses, insurance, retail costs, etc.

Another cost that can have a major impact on the profit and

loss account is player amortisation, which reflects investment in transfers.

Basically the more that a club spends, the higher its player amortisation.

In this way, Norwich’s player amortisation surged from just

£1 million in the Championship in 2011 to £19 million in the Premier League in

2016. The financial results were also influenced by £4 million of impairment

charges. These are booked when the directors assess a player’s achievable sales

price as less than the value in the accounts, so this is likely to be for

misfiring forward Ricky van Wolswinkel.

The accounting for player trading is fairly technical, but

it is important to grasp how it works to really understand a football club’s

accounts. The fundamental point is that when a club purchases a player the

transfer fee is not fully expensed in the year of purchase, but the cost is

written-off evenly over the length of the player’s contract, e.g. Alex

Pritchard was bought from Tottenham for a reported £8 million on a four-year

deal, so the annual amortisation in the accounts for him is £2 million.

Despite the increase, Norwich’s player amortisation of £19

million was one of the lowest in the Premier League and is obviously miles

behind the really big spenders like Manchester City (£94 million), Manchester

United (£88 million) and Chelsea (£69 million.

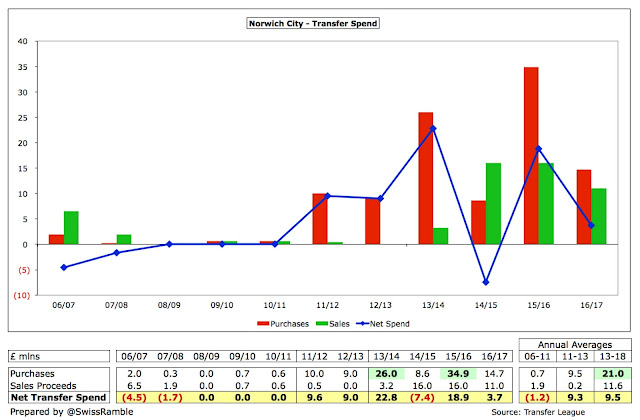

As would be expected, Norwich increased their spending in

the transfer market after they were promoted to the Premier League in 2011 with

average annual gross spend rising from £0.7 million to £9.5 million. In fact,

they have really ramped up player investment in the last four seasons with

annual gross spend averaging £21 million.

More specifically, they actually spent the most in the

Premier League relegation seasons: £35 million in 2015/16 and £26 million in

2013/14. So the problem has not been so much a lack of ambition or spending,

but poor recruitment, exemplified by the Dutch duo of van Wolswinkel and Leroy

Fer.

Their choices for strikers have been particularly frustrating,

with Gary Hooper also not shining, though Cameron Jerome battles on. It’s not

been any better in the loan market with Dieumerci Mbokani and Patrick Bamford

contributing just seven goals between them last season.

As might be expected, the spending has reduced following

relegation, but Norwich still splashed out £15 million in the summer on Alex

Pritchard, Nelson Oliveira from Benfica and Sergi Canos from Liverpool, though

this expenditure was almost completely offset by the sale of Nathan Redmond to

Southampton.

The club has frequently stated that “investment in the

playing squad continues to be our priority”, which is reflected in them having

one of the highest net spends in this season’s Championship: their £38 million

over the last four seasons is only below Newcastle United £72 million and Aston

Villa £41 million.

Clearly, all these clubs have benefited from their time in

the Premier League, but it should be acknowledged that Norwich have succeeded

in holding on to their key players this summer. Usually when a club is

relegated, it has to sell, either to balance the books or because the players

want to leave. Often they go on a free, simply to get their expensive wages off

the books. It is testament to Norwich’s financial strength that they have not had

to do this.

As well increasing player investment, Norwich have also

managed to resolve their debt issues. Five years ago gross debt peaked at £24

million and in 2010 the club was actually in breach of certain covenants with

its principal lenders, AXA Investment and the Bank of Scotland,

necessitating a long-term financial

restructuring plan that rescheduled payments. In particular, the club owed its

bondholder AXA a significant amount, taking out two loans of £7.5 million, one

at 7.67% and one at 7.24%, which were securitized on future revenue streams.

Since those torrid times, the club has managed to eliminate

all debt, either external or owed to its shareholders, apart from a working

capital facility provided by Barclays Bank (£2.7 million) and preference shares

classified as debt (£1.4 million), giving reported gross debt of £4.1 million.

The external debt had to be repaid after reaching the

Premier League as part of the deal with AXA, while last year the club also repaid the interest-free directors

loans from Delia Smith and her husband Michael Wynn-Jones (£1.529 million) and

the deputy chairman Michael Foulger (£460,000), the latter being used to help

buy former fan favourite Grant Holt.

In fact, Norwich’s gross debt of £4 million was one of the

lowest in the Premier League, only above two clubs: WBA and Chelsea (whose significant

debt to Abramovich is in their holding company). In fact, there were actually

four clubs with debt above £100 million, namely Manchester United £490 million,

Arsenal £233 million, Sunderland £141 million and Newcastle £129 million.

Given that Norwich’s debt is so low, it might be surprising

that their net interest payable went up last season to £1.2 million, but this

is because it includes exchange rate losses and finance charges on the

unwinding of discounts on player liabilities. The actual interest payable to

the bank was less than £300,000. This is a major advantage compared to some clubs,

e.g. Sunderland and West Ham both pay £6 million a year.

However, it should be noted that the club also owed £24.6

million in outstanding transfer fees, though this is largely offset by £22.1

million owed to Norwich by other clubs. In addition, there were contingent

liabilities of up to £17.5 million and additional signing on fees up to £5.9

million that will become payable if certain conditions in transfer and player

contracts are fulfilled.

Moreover, the club was committed to further net payments of

£12.6 million for player purchases subsequent to year-end plus a maximum further

amount of £9.0 million dependent on club and/or player performance.

Norwich’s cash flow statement highlights the improvement in

finances since promotion to the Premier League. In the five years since then,

the club has generated £91 million from operating activities, compared to less

than £1 million in the preceding five years.

This has very largely been invested in improving the playing

squad with a net £65 million (£93 million gross) spent on player registration

in that period. As McNally once said: “(We don’t have) the richest owners and

so our model is to try and raise as much cash as we can ourselves and re-invest

every spare penny in football.”

The club also repaid £20 million of debt with a further £6

million going on interest payments and £6 million on infrastructure investment.

What is a little worrying is that the club has had net cash

outflow in each of the last four seasons, leading to a tiny cash balance of

£83,000 in 2015/16. This is in stark contrast to other Premier League clubs,

where the trend has been for growing cash balances, e.g. Manchester United £299

million, Arsenal £226 million and Manchester City £56 million, and again gives

the lie to the belief that Norwich have not spent.

All clubs in the Championship are constrained by that

division’s version of Financial Fair Play (FFP), though the regulations have changed

in the 2016/17 season. Going forward the losses will be calculated over a rolling

three-year period up to a maximum of £39 million, i.e. an annual average of £13

million, assuming that the owners inject equity.

This brings them more in line with the Premier League, which

has an equivalent figure of £105 million. However, a club that moves between

the Premier League and Championship (like Norwich) will be assessed in

accordance with the permitted loss in the relevant divisions played in during

the three-year period in question. For example, a club that had played two

seasons in the Championship and one in the Premier League would have a maximum

permitted loss of £61m, consisting of one season at £35m and two at £13m.

"Hoo can stop the rain?"

These limits are much higher than the previous £6 million a

season, so are likely to encourage clubs to “go for it” even more, as

Bournemouth did in the past, which will make it more promotion more challenging

for a sustainable club like Norwich.

There has been a fair bit of movement in the board in the

last 12 months: Bowkett, Stephen Fry and McNally all resigned, being replaced

by Balls, Tom Smith and Jez Moxey, the former chief executive at Wolverhampton

Wanderers. The club was at pains to note that its ownership would be

“unaffected by these changes”.

This was re-affirmed by majority owners (53%) Delia Smith

and Michael Wynn-Jones, who recently said, “No way will we sell. We don’t even

listen to any enquiries.” Wynn-Jones added, “We are stewards of this club, not

owners. The club belongs to the supporters.” Delia agreed, “That’s really,

really what I am. A fan.”

"Thank you, world"

Very few football clubs have been as well run as Norwich

City, but their business model does have some limitations. As Ed Balls said,

“I’ve been a supporter here for 40 years and we’ve always been an up-and-down

club.”

They started this season on fire, but a recent run of poor

results has spread some doubts. As Alex Neil said, “Right now, there are going

to be question marks whether we can compete at the top end of the table.”

However, for a self-funded club like Norwich, it is

important to be in the top flight. The club has spent as much as it can to

“maximise the chances of returning to the Premier League at the earliest

opportunity”.

Their prospects are enhanced by substantial parachute payments, but the Championship is one of the most competitive leagues around, so it is very far from a done deal.

Their prospects are enhanced by substantial parachute payments, but the Championship is one of the most competitive leagues around, so it is very far from a done deal.

No comments:

Post a Comment