“Good

old Sussex by the sea, Good old Sussex by the sea, Oh we’re going up….”

Brighton and Hove Albion’s famous song goes on to refer to

winning the cup, but these days the Seagulls are firmly focused on going up to

the Premier League. The club has transformed itself from relegation candidates

in a “disappointing” 2014/15 to viable promotion contenders this season.

Indeed, the Albion currently sit proudly on top of the table

and after 19 games are the only remaining unbeaten side among the 92 Football

League clubs. As chairman Tony Bloom commented, this represents “a tremendous

improvement and progress in the past 12 months.”

Under the guidance of manager Chris Hughton, who replaced

Sami Hyypia on New Year’s Eve after the Finn had finally been “binned”,

Brighton are once again playing some effective football.

The proverbial “safe pair of hands”, the knowledgeable Hughton

first ensured that Brighton stayed up and has since “reshaped the squad into

one capable of competing at the top end of the Championship.” As Hughton said,

“We knew it was going to be a big recruitment summer. We lost nine players and

knew we had to bring in nine, which is really too many.”

"Marching orders"

Nevertheless, they have recruited well, signing a good blend

of experience and youth including Liam Rosenior, Jamie Murphy, Uwe Hünemeier,

Gaetan Bong, Tomer Hemed, Niki Mäenpää, Elvis Manu and Connor Goldson. They

also captured James Harper, the promising “kid from Madrid”, and delivered the

icing on the cake in the form of returning hero Bobby Zamora.

Last season was particularly frustrating after the club’s

development over the past few years. Following promotion from League One in

2011, Brighton had qualified for the Championship play-offs two years in

succession in 2013 and 2014.

The recent success tastes all the sweeter when the many

years of adversity are considered. In the early 90s the Goldstone Ground was

sold to property developers, ostensibly to pay off the club’s debts, though the

vast majority of fans considered this to be a blatant act of asset-stripping by

the reviled chairman, Bill Archer, and his partner-in-crime, chief executive

David Bellotti.

In 1997 Brighton avoided relegation out of the Football

League to the Conference by the skin of their teeth, as a 1-1 draw at Hereford

United condemned their opponents to the dreaded drop, but there then followed

years of struggle, exacerbated by the problems of finding a suitable ground.

"Let's get serious"

First came exile to Kent, where a ground share with

Gillingham meant a 140-mile round-trip for Albion fans to attend their “home”

games. After two long years the club made its weary way back to Brighton in

1999, but the destination was Withdean, an old council-owned athletics stadium

where the facilities were far from ideal. Largely open to the elements, the

“theatre of trees” was arguably the worst stadium in the whole of the Football

League with totally inadequate facilities, but at least chairman Dick Knight

had brought the club back home.

It took 12 years, but finally Brighton moved to the

magnificent new Amex stadium in Falmer. The major investment required to build

the stadium (and indeed a superb new training centre) was financed by Tony

Bloom, a lifelong fan who became chairman with Knight taking the role of life

president.

It is now a realistic aspiration for Brighton to seek

promotion. Although the club has never been in the Premier League, it did play

in the old First Division, which was then the top tier of English football, for

four seasons between 1979 and 1983, when they also came within a kick of

beating the mighty Manchester United in the 1983 FA Cup Final (“and Smith must

score”).

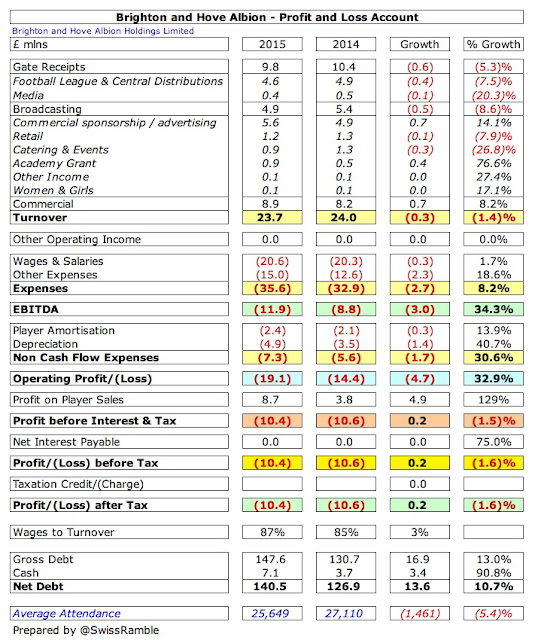

So the club has made great strides off the pitch in the past

few years, but the financial results for the 2014/15 season “reflected a

difficult season”, though the £10.4 million loss was a slight improvement on

the previous year’s £10.6 million.

There was a small decrease in turnover of £0.3 million (1%)

from £24.0 million to £23.7 million. Although there was solid growth of £0.7

million (8%) in commercial income to £8.9 million, as a result of the

sponsorship of the American Express Elite Football Performance Centre and the

Academy grant increasing from £0.5 million to £0.9 million for Category 1 status,

the other revenue streams fell.

Gate receipts were £0.6 million (5%) lower in line with the

fall in attendances, while broadcasting income dropped £0.5 million (9%), as

the club featured less on live TV.

On top of that, all cost lines were higher. Wages rose £0.3

million (2%) to £20.6 million, while other expenses surged £2.3 million (19%)

to £15.0 million. There were also increases in the non-cash expenses, as

depreciation was up £1.4 million (41%) and player amortisation rose £0.3

million (14%) to £2.4 million.

The deterioration in ongoing revenue and costs was

compensated by a significant £4.9 million increase in profits on player sales

from £3.8 million to £8.7 million, largely due to the sales of Leo Ulloa to

Leicester City and Will Buckley to Sunderland.

To be fair to Brighton, almost all clubs in the Championship

lose money and are reliant on owners’ funding. In 2013/14, the last season when

all clubs have published their accounts, losses were reported by 21 of the 24

clubs – in stark contrast to the Premier League where the new TV deal, allied

with wage controls, has led to a surge in profitability. The only clubs to make

money in the Championship were Blackpool (and their model is not one to be

recommended), Wigan Athletic and Yeovil Town.

As Bloom noted, “Any Championship club wishing to compete

for promotion will inevitably make significant losses, so it remains a delicate

balancing act for the board, recruitment team and manager as we strive to

achieve our ultimate aim.”

That said, Brighton’s loss of £11 million in 2013/14 was one

of the highest in the league, only surpassed by six clubs: Blackburn Rovers £42

million, Nottingham Forest £23 million, Leicester City £21 million,

Middlesbrough £20 million, Leeds United £20 million and Millwall £12 million.

This was despite Brighton making a fair amount from profits

on player sales with only three clubs generating more money from this activity

in 2013/14. Again, Championship clubs rarely sell players for big bucks, at

least compared to the Premier League, but this has become increasingly

important to Brighton, rising from £3.8 million to £8.7 million in 2014/15.

It is believed that Brighton have received additional

payments of around £2 million for Ulloa and Buckley helping their clubs stay

up. Although it is not completely clear whether these payments were included in

the 2014/15 accounts, the contingent receivables on transfers have fallen from

£4.3 million to £2.1 million, so it is a reasonable assumption that they have

been booked.

Of course, losses are nothing new for Brighton. The last

time that they made a profit was back in 2007/08 – and that was less than £1

million and only arose because of a £3.6 million exceptional credit, due to a

change in the accounting for the Falmer stadium expenses incurred to date.

Since then, the club has made cumulative losses of £62

million. In fact, their losses have increased as the stakes have got higher,

i.e. targeting promotion to England’s top flight, where the financial rewards

are enormous. This has produced £46 million of losses in the four years since

promotion to the Championship, averaging more than £11 million a season. As

Tony Bloom put it, “most Championship clubs are currently loss-making as a

means of supporting their own ambitions.”

As we have seen, the 2014/15 figures were flattered by hefty

profits on player sales. Traditionally Brighton have made very little from the

transfer market until 2013/14 when the club sold Liam Bridcutt to Sunderland

and Ashley Barnes to Burnley.

Next year’s accounts will be interesting, as no major sales

were made this summer. In fact, Brighton demonstrated their ambition by

resisting Fulham’s offer of £4-5 million for central defender Lewis Dunk, who

is not even guaranteed a starting place.

That said, Bloom admitted, “It would be ridiculous for me or

any owner to say that a player is never for sale. There’s always a price for

any player.” In particular, Brighton have a number of players that could

attract tempting bids from bigger clubs, e.g. Solly March, Dale Stephens, Beram

Kayal and that man Dunk.

Brighton’s strategy is more clearly seen by the club’s

alternative presentation of the profit and loss account, which highlights the

increase in the football budget last season, funded by making the

administrative and operational costs more efficient plus improvements in player

trading.

This has been driven by chief executive Paul Barber, who

explained the approach in this way, “I’m obsessive about reducing our

operational costs, cutting waste, getting better supplier deals, and making the

club more efficient, because it's the only way that we can maintain a

competitive playing budget without breaking Financial Fair Play (FFP)

regulations.”

Finance director David Jones added, “We have continued to

increase our investment in football, and in particular player wages, in order

to give ourselves the best possible chance of success on the pitch.” This

enabled Brighton to invest an additional £3 million in the club’s football

budget in 2014/15.

In fact, Brighton’s managers have benefited from a

significant increase in this football budget of around 80% since 2012, as it

has grown from £13.1 million to £23.7 million.

This was a notable achievement, especially in a season that

Barber described as “unexpectedly difficult”. He added, “Ticket sales fell,

merchandising sales fell and, on top of that, our Football League income fell

too. Against such a backdrop, keeping our turnover ticking over was the first

priority. Give or take, we managed to keep our overall income static, despite

reductions in key areas.”

To put this into perspective, Brighton’s revenue has grown

by almost 500% since 2009, surging from £4 million to £24 million, largely due

to what can de described as the "Amex effect", though the promotion

from League One to the Championship in 2011 has obviously also helped.

Following the move from Withdean, gate receipts are more than four time higher, increasing from £2.3

million to £9.8 million.

In addition, the new stadium has brought more commercial

opportunities, leading to income climbing from £3.1 million to £8.9 million.

The club could negotiate better deals with sponsors in the higher division (up

from £0.8 million to £5.6 million), increase retail sales, e.g. from the

stadium megastore (up from £0.5 million to £1.2 million) and make more from

catering, i.e. pies and the famous Harveys beer (up from £35k to £1.0 million).

In 2013/14 Brighton’s revenue of £24 million was the 8th

highest in the Championship, but the clubs with the three highest revenues

(QPR, Reading and Wigan Athletic) were more than 50% higher with £37-39

million.

Money often talks in football, so it is no surprise that two

of the four clubs with the highest revenue were promoted that season: QPR and

Leicester City. The exception to the rule was Burnley, who had the 11th largest

revenue, £4 million less than Brighton, so it is still possible to get out of

the Championship on a modest budget.

Of course, these revenue figures are distorted by the

parachute payments made to those clubs relegated from the Premier League, e.g.

in 2013/14 the first year of relegation was worth £24 million. If we were to

exclude this “disparity” (as Barber calls it), then Brighton’s revenue would

have been the 3rd highest in the Championship, only behind Leicester City and

Leeds United.

As Barber observed, “Championship clubs need to be spending

the sort of money we are spending to be competitive, but it is certainly easier

to do this if you have higher incomes supported by parachute payments.”

Following last season’s movements, the club’s revenue mix

has also changed, though the majority (41%) still comes from gate receipts

(down from 43%). Commercial income’s share has increased from 34% to 38%, while

broadcasting has reduced from 23% to 21%. This is a not untypical mix for

Championship clubs, as opposed to the Premier League where TV is by far the

largest source of income – up to 80% for some clubs.

Clearly, Brighton are more reliant on match day income than

most clubs. In fact, in 2013/14 only two clubs were more dependent on this

revenue stream: Charlton Athletic 50% and Nottingham Forest 44%.

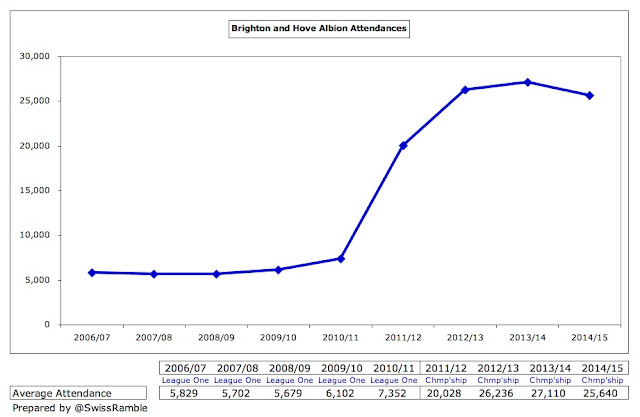

However, Brighton’s gate receipts fell 5% (£0.6 million)

from £10.4 million to £9.8 million in 2014/15, driven by a decrease in average

attendance from 27,110 to 25,649 and one less cup game being staged at the

Amex. Despite the reduction, this is still likely to be the highest match day

revenue in the Championship, as they were far ahead of the closest challengers

the previous season (Leeds United £8.6 million and Nottingham Forest £7.2

million), partly due to the transport levy paid to rail and bus companies.

After having the highest attendances in the Championship for

two seasons in a row, Brighton fell back to 3rd place in 2014/15, behind Derby

County 29,232 and Norwich City 26,343.

Since the move to the Amex, attendances had been steadily

rising from the 7,352 at Withdean, as the new stadium finally met latent local

demand for tickets. Capacity has been increased twice since the original move:

in July 2012 it grew from 22,500 to 27,444 after the Upper tier of the East

Stand was extended; and in March 2013 there was a further increase to 30,750

after all four corners were completed.

Although the reduction in attendances must be of concern,

Brighton’s potential was highlighted by a new record crowd of 30,278 being set

in the FA Cup 4th round tie against Arsenal in January 2015.

Ticket prices are among the highest in the Championship.

According to the BBC’s Price of Football survey, Brighton have the second

highest cheapest season ticket (only below Hull City) and the fifth highest

most expensive season ticket (behind Fulham, Ipswich, Sheffield Wednesday and

QPR).

However, Barber argued: “Once the cost of travel is

deducted, our average ticket price is very much in line with the Championship

and wider Football League average prices.” He also pointed to the magnificent

facilities that are second to none, including free wifi and VIP padded seats,

In 2014/15 Barber “kept season ticket prices as low as

possible”, which meant an average increase of 3%, though there was a price

freeze for juniors. The good news is that in 2015/16 the club froze season

ticket prices, extended the subsidised travel zone and introduced a new age

bracket for fans under 21.

Brighton’s broadcasting revenue fell from £5.4 million to

£4.9 million in 2014/15, which was attributed to the club being shown less on

live TV, but was also due to not appearing in the play-offs. In the

Championship most clubs receive the same annual sum for TV, regardless of where

they finish in the league, amounting to just £4 million of central

distributions: £1.7 million from the Football League pool and a £2.3 million

solidarity payment from the Premier League.

However, the clear importance of parachute payments is once

again highlighted in this revenue stream, greatly influencing the top eight

earners, though it should be noted that clubs receiving parachute payments do

not also receive solidarity payments.

Looking at the television distributions in the top flight,

the massive financial disparity between England’s top two leagues becomes

evident with Premier League clubs receiving between £65 million and £99

million, compared to the £4 million in the Championship. In other words, it

would take a Championship club more than 15 years to earn the same amount as

the bottom placed club in the Premier League.

As we have seen, parachute payments make a significant

difference to a club’s revenue and therefore its spending power in the

Championship. Up to now, these have been worth £65 million over four years:

year 1 £25 million, year 2 £20 million and £10 million in each of years 3 and

4.

However, the Premier League has recently announced changes

to this structure, whereby from 2016/17 clubs will only receive parachute

payments for three seasons after relegation, although the amounts will be

higher (my estimate is £75 million, based on the advised percentages of the

equal share paid to Premier League clubs: year 1 55%, year 2 45% and year 3

20%).

There are some arguments in favour of these payments, namely

that it encourages clubs promoted to the Premier League to invest to compete,

safe in the knowledge that if the worst happens and they do end up relegated at

the end of the season, then there is a safety net. However, they do undoubtedly

create a significant revenue advantage compared to clubs like Brighton.

If Brighton were to gain promotion, the financial prize for

returning to the Premier League would be immense, exacerbated by the recent

blockbuster Premier League deal that starts in 2016/17, which Barber described

as “astonishing”. I have estimated this be worth an additional £30-50 million

for Premier League clubs, depending on where they finish in the table, though

my assumption for overseas deals may prove to be a little conservative.

Even if a team were to finish last in their first season and

go straight back down, their TV revenue would increase by an amazing £87

million (£92 million less £5 million) and they would also receive a further £64

million in parachute payments (restricted for clubs only in the Premier League

for one season), giving additional funds of around £150 million. The size of

the prize helps explain the loss-making behaviour of many Championship clubs.

Of course, Brighton would also have to spend more to improve

their playing squad, but the net impact on the club’s finances would

undoubtedly be positive, as evidenced by the clubs promoted in the past few

seasons.

Commercial income was the most impressive revenue performer

in 2014/15, rising 8% (£0.7 million) from £8.2 million to £8.9 million,

comprising commercial sponsorship and advertising £5.6 million, retail £1.2

million, catering and events £0.9 million and academy grant £0.9 million.

In the new world of FFP, Bloom said that the club “had to

adapt and move quickly to establish a sharper commercial focus. We had to focus

on the inherent value of our brand.” The club’s success in this area is

reflected by Brighton having the 3rd highest commercial revenue in the

Championship, only behind Leicester City (boosted by a “friendly” marketing

deal with Trestellar Limited) and Leeds United, as befitting their fine

history.

This is despite the fact that Brighton now only report the

net catering commission in revenue, whereas in previous seasons all the gross

revenue was included in revenue with the expenses shown in costs.

"Tell me when my light turns green"

What has been particularly impressive is the increase in

sponsorship. American Express are not only shirt sponsors, but also naming

rights partner for the stadium and the training ground. This multi-year

agreement, signed in March 2013, was described by Barber as “the biggest in the

club’s history.”

Similarly, Barber said that the 2014/15 Nike deal, replacing

Errea after 15 years as the club’s kit supplier, represented “a significant

increase on our existing commercial arrangement.”

Interestingly, the club has applied for planning permission

for a 150 room hotel alongside the stadium through its subsidiary, The

Community Stadium Ltd, with a planned opening in summer 2017. This would enable

the club to host more events like the two rugby World Cup matches in September.

Brighton’s total wage bill rose by 2% (£0.3 million) from

£20.3 million to £20.6 million, though this was still lower then the 2013 peak

of £21.1 million. It is worth noting that since 2012, the first year back in

the Championship, the wage bill has grown by £6 million (41%), while revenue

has only increased by £1.5 million (7%).

Furthermore, given the significant reduction in

administrative and operational expenses, it is likely that the players wage

bill has increased by a healthy amount.

Despite this growth, Brighton’s wage bill is still only the

8th highest in the Championship, thus outside the top six, as noted by Hughton,

so promotion would indeed be a fine achievement. It was significantly lower

than the likes of Leicester City, Reading, Blackburn Rovers and Wigan Athletic,

whose wages were all above £30 million. QPR were even higher at £75 million,

but that was simply ridiculous in the second tier.

The remuneration for the highest paid director, who is not

named, but is surely Paul Barber, has decreased from £652k to £558k, almost

certainly due to the previous season including a large bonus for the chief

executive’s success in cutting operational expenses and renegotiating many of

the sponsorships.

Although Brighton’s wages to turnover ratio increased from

85% to 87%, which is not exactly great, it is by no means one of the highest in

the Championship. No fewer than 10 clubs “boasted” a wages to turnover ratio

above 100% in 2013/14 with the worst offenders being QPR 195%, Bournemouth 172%

and Nottingham Forest 165%.

The (relatively) prudent approach is evidently the one that

Brighton want to follow, especially in a FFP world, as noted by Bloom: “While

we do want to play at the highest level, we cannot simply open our cheque book

and start spending without care or attention.”

Other expenses rose by 19% (£2.3 million) from £12.6 million

to £15.0 million, which are the 2nd highest in the Championship, only behind

Leeds United. These represent the other side of the coin of moving to the Amex,

as the club noted: “The operational and administrative costs of running a state

of the art stadium are significant.”

Depreciation increased by 41% (£1.4 million) from £3.5

million to £4.9 million, which is by far the most in the Championship, the next

highest being Derby County £2.1 million. This represents the annual charge of

writing-off the cost of the stadium and (for the first time in 2014/15) the

training ground. These are depreciated over 50 years, i.e. 2% of cost per

annum.

Player amortisation was 14% (£0.3 million) higher at £2.4

million, but this is strictly mid-table in the Championship. To put this into

perspective, the highest player amortisation in 2013/14 was at QPR £16.6 million,

Blackburn Rovers £7.2 million, Wigan Athletic £6.8 million and Nottingham

Forest £5.7 million.

The way that football clubs account for player trading can

be confusing, but the fundamental point is that when a club purchases a player

the costs are spread over a few years, but any profit made from selling players

is immediately booked to the accounts.

So, when a club buys a player, it does not show the full

transfer fee in the accounts in that year, but writes-down the cost (evenly)

over the length of the player’s contract. Therefore, if Brighton were to spend

£10 million (if only) on a new player with a 5-year contract, the annual

expense would be only £2 million (£10 million divided by 5 years) in player

amortisation (on top of wages).

However, when that player is sold, the club reports the

profit on player sales straight away. This essentially equals sales proceeds

less any remaining value in the accounts. In our example, if the player were to

be sold 3 years later for £13 million, the cash profit would be £3 million (£13

million less £10 million), but the accounting profit would be higher at £9

million, as the club would have already booked £6 million of amortisation (3

years at £2 million).

Over the years, Brighton have not been a big player in the

transfer market, often registering net sales, though they have increased their

gross spend recently, averaging £4.4 million in the last two seasons, compared

to just £0.5 million over the previous eight seasons.

However, it is apparent that Brighton have not gone

overboard in terms of spending, especially compared to some of their principal

rivals who are really “going for it”. To illustrate this, in the last two

seasons Brighton had net sales of £2 million, while four clubs had net spend

above £10 million: Middlesbrough £15 million, Burnley £14 million, Derby County

£14 million and Hull City £12 million.

To be fair, this comparison has to be treated with some

caution, as the figures are distorted by clubs that were in the Premier League

the previous season, either because of high spend when they were in the top

flight or large sales following their relegation. Furthermore, many deals are

“undisclosed” in the Championship, so might have no reported value.

That said, it is clear that Brighton have been comfortably

outspent by many other clubs. As Hughton observed, “There are big spenders in

the Championship. We aimed to put ourselves in a challenge for the play-off

positions – no-one would have put us as favourites. But let's keep surprising

people.”

Therefore, Brighton have to box clever. They have made

extensive use of the loan system, although arguably too much, as at one stage

last season they had six loanees, one more than the maximum permitted in a

match day squad – and who could forget Leon Best, the most inappropriately

named player since Dennis Wise.

Fortunately, this season’s loan signings looks more

promising, especially the talented James Wilson from Manchester United, while

Barber has said money is available for permanent transfers: “we have some funds

to invest in January – but as ever we will do it in the right way, for the

right player, at the right price.”

Brighton’s net debt rose by £14 million from £127 million to

£141 million with the £17 million increase in gross debt to £147 million

slightly offset by cash also rising by £3 million to £7 million. Debt has been

rising over the past few years, but it is almost entirely owed to Bloom and can

be regarded as the friendliest of debt, being interest-free and repayable after

more than one year.

This means that Brighton have one of the largest debts in

the Championship, though it is still not as high as Bolton’s £195 million in

2013/14. The other difference is that Brighton’s borrowings can be considered

as “good” debt, having been largely used to fund the new stadium and training

ground, as opposed to other clubs, whose debt is more to fund over-spending on

players and agents.

Brighton also have £2.3 million of contingent liabilities in

regard of transfers, which could be payable if certain defined performance

criteria are met, e.g. number of appearances.

Although Brighton’s finances are pretty robust (for the

Championship), the support of Tony Bloom remains incredibly important, as

Barber acknowledged: “In football, people talk about spending – or losing –

millions of pounds almost flippantly. It's still very important to remember

that Tony Bloom is covering our annual losses of £10.4 million – and as a

result we are not under pressure to sell players. Tony has incredibly deep

pockets but we don’t ever take his incredible generosity towards our club for

granted.”

As well as the £17 million increase in his loans, Bloom also

invested a further £11 million in shares subsequent to the year-end. It is not

clear whether this is new capital or equity conversion, but it does not detract

from the fundamental point, which is that Bloom has put in a massive amount of

funding.

As at the 2014/15 accounts, I estimate that this amounts to

£217 million, split between the current £147 million of debt, £11 million

converted to equity and £58 million of share capital. That may not be the

precise figure, but, to paraphrase Oscar Wilde, we don’t need to know the price

of everything, as the value of the owner’s contribution is crystal clear.

Looking at how Brighton have used these funds since Bloom

took charge, the majority (£153 million, or 72%) has gone on investment into

infrastructure (including £103 million on the stadium and £32 million on the

training centre), while £45 million (21%) has been used to cover operating

losses. Any spending on new players has essentially been self-funded in this

period by player sales.

Being so dependent on one individual can be a concern, but

Bloom comes from a family of Brighton supporters: “I have absolutely no

intention of selling. I think I will be here for many years to come.”

He continued: “Our ambition remains for the club’s teams,

both men and women, to play at the highest level possible – and as chairman

(and a lifelong supporter of the club) I will do everything I possibly can to

achieve that and I remain fully committed to that goal.”

"Smooth operator"

Bloom is seriously wealthy from his property and investment

portfolio (plus money earned from poker and other forms of gambling), but he would

not be able to simply buy success, even if he wanted to, as Brighton will need

to continue to comply with the Financial Fair Play (FFP) regulations. Under the

previous rules, clubs were only allowed a maximum annual loss of £8 million

(assuming that any losses in excess of £3 million are covered by injecting

equity).

It should be noted that FFP losses are not the same as the

published accounts, as clubs are permitted to exclude some costs, such as youth

development, community schemes, promotion-related bonuses and depreciation on

fixed assets. In any case, Brighton have complied with FFP for the 2014/15

season.

"One better Dale"

The current rules will continue to apply for the 2014/15 and

2015/16 seasons (though the maximum allowed loss is increased to £13 million

from the second season), but will change from the 2016/17 season to be more

aligned with the Premier League’s regulations, e.g. the losses will be

calculated over a three-year period up to a maximum of £39 million.

Although Bloom said that the club was “not entirely happy”

with the increase, he did concede that the change “does provide us with greater

flexibility and the option to compete with those clubs benefiting from

parachute payments.”

FFP encourages clubs to invest in youth development, which

is an area of focus for Brighton. The splendid new training centre (“the best

I’ve ever worked in”, according to Hughton) has resulted in the awarding of the

important Category 1 academy status and will ultimately help develop players

that can push for the first team.

"Long may you run"

Brighton can only be applauded for their efforts off the

pitch, which have produced a remarkable transformation. As Hughton said, “There

is no doubt that in the ambition the club have shown in the infrastructure, the

stadium and the training ground, this can be a Premier League club.”

However, he pointed out that the Championship is “an

incredibly demanding division”, so it was good to see that the owner is also

acutely aware of this fact: “We have had a very good start to the current

season, but we all know how competitive and tough the Championship is year

after year, so it’s important we do not become complacent.”

Are Brighton Premier League ready? Absolutely, but they

still have to do it on the pitch and there’s a long way to go yet. Nobody on

the South coast is counting their chickens before they’ve hatched, but the

Albion have put themselves in a great position to realise Bloom’s dream.

Excellent summary and analysis, thank you!

ReplyDeleteAbsolutely fantastic read. Thanks a lot for your efforts. I'm grateful

ReplyDeleteReally interesting stuff.

ReplyDeleteToo bad now you're only writing about english clubs. Benfica and Oporto just signed two deals worth 857.5 million euros (for 10 years), and Sporting Lisbon should announce today a deal worth around 400 million.

ReplyDeleteIt's a bit confusing how dutch football is so far behind, given that the country is much richer and draws two times more seats per game.

It seems like the situation of great clubs like Ajax, Celtic, Rangers (etc. etc.) will only get worse in the coming years, which can't be good for european football as a whole. I find it a bit surprising no one has started talking about merging some leagues.