What to make of Arsenal? On the one hand, they are once

again adding to their trophy cabinet, winning the FA Cup for the past two

seasons, and continue to qualify for the Champions League, a feat that most

clubs can only dream about. On the other hand, the feeling remains that Arsenal

are not making the most of their (abundant) financial resources.

2015 was meant to be different, but the lack of signings

this summer has once again sent many fans into a tailspin, as the same old

failings continue to be exposed. This is particularly disappointing, as manager

Arsene Wenger himself believes that Arsenal should now genuinely be able to

compete for the Premier League title, as the club no longer has to sell its

best players.

Although Arsenal have not matched the fabulous success of

the early period of Wenger’s reign, they have performed in line with their

budget (slightly better some years), as the only clubs that have finished ahead

of them in the league have enjoyed significantly higher spending power.

"Stuck in the middle, Giroud"

However, Arsenal are now swimming in cash, as demonstrated

by director Lord Harris’ view that the club could buy any player it wanted with

the exception of Lionel Messi or Cristiano Ronaldo.

Arsenal could certainly do with some new players, if you

believe club legend Thierry Henry: “Arsenal need to buy four players, they need

that spine. They need a goalkeeper, they still need a centre-back, they still

need a holding midfielder and, I'm afraid, they need a top, top-quality striker

in order to win this league again.” Since those remarks the only arrival has

been goalkeeper Petr Cech from Chelsea, but, importantly, no outfield players

were recruited (apart from a couple of promising youngsters).

The limited recruitment is all the more puzzling, as

Arsenal’s activity in the transfer market had been on an upward trajectory. In

the last five years Arsenal had a gross spend of £253 million, compared to just

£85 million in the preceding five years. On a net basis, in the same periods

they moved from sales of £31 million to £97 million expenditure.

In particular, the club had “a record level of expenditure

on players” in the last two transfer windows making six major signings: Alexis

Sanchez, Danny Welbeck, Gabriel, Mathieu Debuchy, Calum Chambers and David

Ospina.

In fact, over the last two seasons Arsenal have the third

highest net spend in the Premier League of £74 million. This was only surpassed

by the two Manchester clubs (City £151 million and United £145 million), but to

place this into perspective they did spend almost twice as much as the Gunners.

Wenger explained this summer’s low spending as follows: “The

solutions we had were not convincing at all. In the end you do not buy to give

one hope, you want to buy because the players who come in can help your squad

to be stronger. Buying and selling is one way to strengthen your team, but

that’s not the only way.”

He also pointed out that the prices quoted to Arsenal and

other leading English clubs tend to be higher than those for continental clubs,

as sellers are clearly aware of the wealth coming from the Premier League TV

deals. However, that’s the reality of the football market today, so clubs like

Arsenal need to blow the other clubs out of the water – or there’s simply no

point having more money.

In fairness, another aspect of the market is supply and

demand and Wenger was keen to stress that the issue was more about the

availability of players rather than lack of funds: “It is not a shortage of

money, just a shortage of players.” Leaving aside the observation that there

must surely be one or two available players in world football that could

improve the squad, he is spot on about the financial situation at Arsenal.

Specifically, Arsenal’s huge cash balance is still the talk

of the town and has gone up yet again, rising another £20 million in the last

12 months from £208 million to £228 million. Let’s pause to absorb that number:

that’s nearly a quarter of a billion.

To place that into context, the next highest cash balances

in the Premier League in the 2013/14 season were Manchester United £66 million,

Tottenham Hotspur £39 million and Newcastle United £34 million. In fact,

Arsenal held 40% of the total cash in the Premier League that season: £208

million against £311 million for all 19 other clubs combined. Manchester

United’s 2014/15 balance has increased to £156 million, but this is still £72

million less than Arsenal.

Lord Harris was quick to boast about the club’s financial

capacity: “Money was tight when we moved to the Emirates, but it’s a lot freer

now. In the accounts, there’s over £200 million in the bank.”

"Speed your love to me"

However, he had obviously not received the memo from chief

executive Ivan Gazidis, who had previously explained why not all of this cash

balance is available to spend on transfers: “It is quite untrue that we are

sitting on a huge cash pile for some unspecified reason. The vast majority of

that cash is accounted for in various ways.”

In fact, the club is so sensitive on this point that the

accounts note that “proper consideration” of the cash balance should make

deductions for the £35 million debt service reserve and the net £66 million

owed on previous player purchases, which would leave “only” £128 million.

The annoying debt service reserve has been required since

the 2006 bond agreements, though it does raise the question of whether these

arrangements could be renegotiated given Arsenal’s significantly better

financial position today, thus freeing up this £35 million.

It is also true

that most season ticket renewals are paid in April and May, so Arsenal’s

cash balance will always be at its highest when its annual accounts are

prepared, namely 31st May. The club has to pay a good proportion of its annual

running expenses out of this cash, though it is equally true that other money

will flow into the club during the course of the season, such as TV

distributions and merchandise sales.

Despite all of these factors, the truth is that year after

year Arsenal’s cash balance has steadily risen: May 2007 £74 million, May 2008

£93 million, May 2009 £100 million, May 2010 £128 million, May 2011 £160

million, May 2012 £154 million, May 2013 £153 million, May 2014 £208 million

and May 2015 £228 million.

In other words, there is substantial money available to

spend. It’s clearly not as much as the £228 million in the books, but we can

say with some conviction that there would be enough available in the January

transfer window to safely cover some of the glaring weaknesses in the squad: let’s say

£70-80 million (with the usual caveats).

Looking at Arsenal’s cash flow statement, we can see signs

of a change in approach: in the six seasons between 2007 and 2012 Arsenal spent

just a net £4 million on player purchases, while they have spent a net £83

million in the last three seasons. That said, more than half of the money still

goes elsewhere.

In 2014/15 Arsenal generated an impressive £102 million from

operating activities, spending a net £46 million on transfers and £56 million on

other things: £19 million on

financing the Emirates Stadium (£12 million interest plus £7 million on debt

repayments), £14 million on capital expenditure (e.g. refurbishment of Hale End

Academy and some initial work on London Colney) and £2 million on tax. What

happened to the remaining £20 million? Nothing really, as it just went towards

increasing the cash balance.

This is nothing new. Since 2007 Arsenal have produced a very

healthy £628 million operating cash flow, though £231 million has had to be

used on the stadium financing (£147 million on loan interest and £85 million on

debt repayments) with a further £103 million on infrastructure investments

(“this may not attract headlines in the same way as player transfers, but will

provide benefit over a longer term” per Sir Chips Keswick) and £14 million on

tax.

Only 14% (£87 million) of the available cash flow has been

spent in the transfer market, though almost all of that has been in the last

three seasons. The other notable “use” of cash in that period is to increase

the cash balance, which has risen by a cool £193 million.

Major shareholder Alisher Usmanov noted that Wenger had been

put in a very difficult position, as the shareholders did not put money in to

finance the new stadium, which meant that the near quarter of a billion

incurred to date on stadium was not available to improve the squad. That’s

evidently correct, but it is equally true that Arsenal have left a lot of

available money in the bank to attract one of the lowest interest rates in

history, while transfer inflation is running amok.

Although Sir Chips stated, “we remain committed to spending

only the money we earn”, the reality is that the club comes nowhere near doing

that. They have “a pocket full of pretty green” (to quote The Jam), but they don’t

seem to know what to do with it.

Arsenal’s 2014/15 financial results underlined how well run

the club is from a business perspective with the chairman commenting, “The club

has had a successful year both on an off the pitch. We are in a robust position

across all the key areas of our activities.” Indeed they are, with profit before

tax rising by £20 million from £4.7 million to £24.7 million. The increase was

smaller after tax, as the previous year’s figures were boosted by a tax credit,

but this still rose by £12.8 million to £20.0 million.

Revenue surged by £31 million to £329 million (excluding £15

million from property development that brought total revenue to £344 million),

mainly due to an increase in commercial income from the PUMA kit deal, while

profit on player sales was £22 million higher at £29 million and a once-off

profit-share bonus from a previous sale meant that property was up £13 million.

Against that, the increased investment in the squad resulted

in the wage bill climbing £26 million to £192 million and player amortisation

rising by £14 million to £54 million. Depreciation and other expenses were also

£4 million higher.

Traditionally Arsenal have been one of the few football

clubs able to make a profit, but the impact of the last TV deal has helped change this with only five Premier

League clubs reporting a loss in the 2013/14 season. In fact, Arsenal’s £4.7

million profit was only the 12th highest that season, far behind clubs like

Tottenham Hotspur £80 million, Manchester United £41 million, Southampton £29

million and Everton £28 million.

The importance of player sales to these figures is clear. While

Arsenal had “a quiet year in terms of outbound player transfers” in 2013/14,

making only £7 million from selling Gervinho and Vito Mannone, other clubs

generated sizeable profits from this activity: Tottenham £104 million (largely

Gareth Bale to Real Madrid), Chelsea £65 million (David Luiz to PSG),

Southampton £32 million (Adam Lallana to Liverpool) and Everton £28 million

(Marouane Fellaini to Manchester United).

As we have seen, Arsenal’s 2014/15 accounts included much

higher profits on player sales of £29 million, including the transfer of Thomas

Vermaelen to Barcelona and the proceeds of an agreement with Real Sociedad to

cancel the club’s option to reacquire the registration of former player Carlos

Vela.

Despite the improving profits at other clubs, Arsenal are

still very much the financial poster child of the Premier League. You have to

go back as far as 2002 to find the last time that they made a loss. In fact,

they have made total combined profits of £226 million in the eight years since

2008.

This is an astonishing achievement in the cutthroat world of

football where success is very largely bought. In the last four years up to

2013/14 (the last season where every club has published its accounts), only

Tottenham had higher total profits than Arsenal and that was entirely due to

the Bale sale. In contrast, Arsenal have been very consistent and are one of

only three clubs that made money in each of the four years, along with

Newcastle United and WBA.

However, it is worth noting that Arsenal only managed to

post a profit in 2014/15 thanks to £29 million of player sales and £13 million

from property development. Over the years, much of the club’s excellent

financial performance has been down to profits from player sales (e.g. £65

million in 2011/12, £47 million in 2012/13) and property development (e.g. £13

million in 2010/11, £11 million in 2009/10).

These should be lower in future, as Arsenal no longer have

to make “forced” player sales, while the property development is largely coming

to an end, which means that Arsenal will be more reliant on their core

business.

Arsenal’s property development segment generated revenue of

£15 million and operating profit of £13 million in 2014/15, almost entirely due

to a once-off bonus in relation to the revenue achieved for the sale of

residential units on a previously sold site. Apart from this, there was

“minimal activity” on the property side, but there should be money coming from

the sale of the Holloway Road and Hornsey Road sites once planning consents are

resolved, though this is proving to be more complex than anticipated.

The other side of player trading accounting is player

purchases, where the recent increase in spending has been reflected in

Arsenal’s profit and loss account via player amortisation, which leapt from £40 million

to £54 million in 2014/15. In fact, this expense has increased by £32 million

from £22 million four years ago. For the same reason, player asset values on the balance sheet have risen to £172 million.

However, Arsenal's player amortisation is still by no means the largest in the

Premier League. Those clubs that are regarded as big spenders logically have

the highest amortisation charges, e.g. Manchester City £76 million and Chelsea

£72 million in 2013/14, while Manchester United’s cheque-book strategy since

Sir Alex left has driven their annual amortisation up to an incredible £100

million in 2014/15.

Although this is fairly technical, it is important to

understand that transfer fees are not fully expensed in the year a player is

purchased, but the cost is spread evenly over the length of the player’s

contract – even if the entire fee is paid upfront. As an example, Mesut Ozil

was reportedly bought for £42 million on a five-year deal, so the annual

amortisation in the accounts for him is £8.4 million.

The fundamental point is that when a club purchases a player

the costs are spread over a few years, but any profit made from selling players

is immediately booked to the accounts, which helps explain why clubs like

Manchester City can spend so much and still meet UEFA’s Financial Fair Play

targets.

As a result of these accounting complications, clubs often

look at EBITDA (Earnings Before Interest, Depreciation and Amortisation) for a

better idea of underlying profitability. On this basis, Arsenal’s profitability

has improved considerably in the last two seasons after many years of decline,

with EBITDA rising from £25 million in 2013 to £64 million in 2015.

That’s very good, but is still only around half of Manchester

United’s £120 million (down from £130 million the previous year), which goes to

show what an amazing cash machine they are.

Football revenue increased by 10% (£31 million) from £299

million to £329 million in 2014/15, largely thanks to commercial income, which

was up 34% (£26 million) from £77 million to £103 million. Broadcasting revenue

was 3% (£4 million) higher at £125 million, while match day revenue was flat at

£100 million.

Arsenal’s revenue hardly moved at all between 2009 and 2011,

but since then has grown by 46% (£104 million) from £225 million to £329

million. Most of the growth (£57 million) has come from the previously

under-performing commercial division, while improved TV deals have driven a £40

million increase in broadcasting revenue. Match day income has also risen by £7

million in that period. The advances made in the last two years alone are quite

striking, amounting to £87 million.

Arsenal’s £329 million is still some £66 million below

Manchester United, even though their revenue dropped from £433 million to £395

million in 2014/15 following their failure to qualify for the Champions League.

Moreover the Red Devils are projecting revenue of £500-510 million in 2015/16.

Arsenal are now quite close to the 2013/14 figures of Manchester City (£347

million) and Chelsea (£320 million), though they may well increase in 2014/15.

This is important, as budget is closely correlated with

success in the pitch. As Wenger put it, “The clubs who have better financial

resources have the better teams.” Arsenal already have the 8th highest revenue

in the world (per the Deloitte 2014 Money League), but the problem is that

three of the clubs above them are English. In fact, 14 Premier League clubs are

now in the top 30 (with all 20 in the top 40).

Gazidis has been quoted as saying, “Our revenues will grow

to put us into the top five revenue clubs in the world”, but that is far from a

fait accompli

given the continuing progress made by the leading clubs. For example, both

Spanish giants have announced good revenue growth in 2014/15: Real Madrid up 5%

to €578 million, Barcelona up 16% to €561 million. Against that, their revenue

in Sterling terms will be impacted by the weakness of the Euro.

If we compare the revenue of the other nine clubs in the

Money League top ten, we can immediately see where Arsenal’s largest problem lies,

namely commercial income. OK, the £197 million shortfall against PSG is largely

due to the French club’s “friendly” agreement with the Qatar Tourist Authority,

but there are still major gaps to other clubs in commercial terms: Bayern

Munich £167 million, Real Madrid £116 million, Manchester United £112 million,

Manchester City £89 million and Barcelona £78 million.

On the plus side, Arsenal are well ahead of most of their

rivals on match day income, while they are competitive on broadcasting revenue,

only really losing out compared to the individual deals negotiated by Real

Madrid and Barcelona.

Arsenal’s revenue mix is remarkably even with broadcasting

the most important at 38%, followed by commercial and match day at 31% apiece.

Gazidis noted, “Whilst our match day revenue is now ranked behind both

broadcasting and commercial as a source of income, it remains vitally important

to the club and is a key differentiator to competitor clubs with smaller, less

modern venues.”

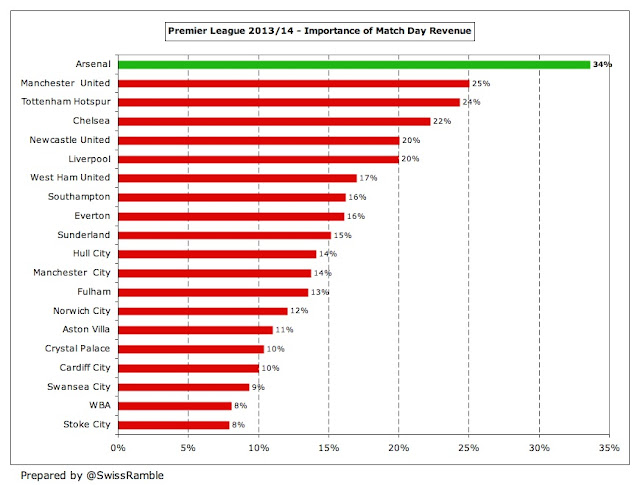

This can be seen by looking at the importance of match day

revenue to Premier League clubs in the 2013/14 season, where Arsenal were the

only one above 30%.

Arsenal’s share of the Premier League television money was

£97 million in 2014/15, up £4 million from £93 million the previous season,

primarily due to finishing one place higher in the league.

Gazidis made a good point, when he observed: “Most of this

new revenue is shared very, very equally around the league. We are going to

have teams who will to be able to sign top class players. There will be teams

that do it very, very well and they are going to be challenging for those top

four places.” That may well lead to a rise of the “middle class” clubs and make

the Premier league more competitive.

This is even before the increases from the blockbuster

Premier League TV deal in 2016/17. My estimates suggest that Arsenal’s third place would be worth an

additional £47 million under the new contract, increasing the total received to

£144 million. This is based on the contracted 70% increase in the domestic deal

and an assumed 30% increase in the overseas deals.

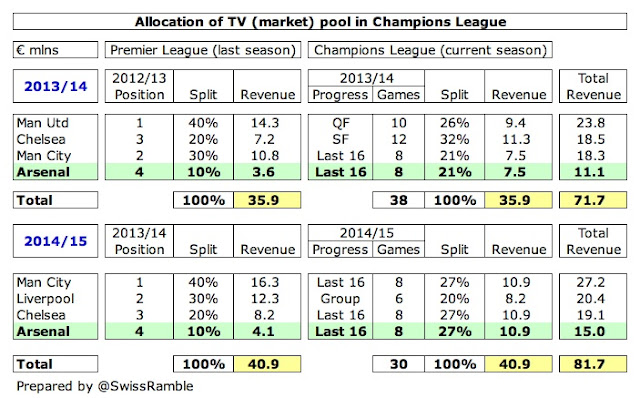

Arsenal did not announce how much they received from the

Champions League, but I have estimated €32 million, up from the €27 million in

2013/14, largely due to more money from the UK market pool, as this did not

have to be shared with a Scottish club in 2014/15 (as was the case in 2013/14

with Celtic). However, this would have been adversely affected in Sterling

terms by the weaker Euro.

Nevertheless, the value of Champions League qualification is

clear, especially if it is compared to the Europa League, where the most earned

by an English club in 2013/14 was Tottenham’s €6 million. This underlines the value

of Arsenal qualifying for the Champions league 18 times in a row, described by

Sir Chips Keswick as “a remarkable record of consistency unmatched by anyone

else in England.”

The financial significance of a top four placing is even

more pronounced from the 2015/16 season with the new Champions League TV deal

worth an additional 40-50% for participation bonuses and prize money and

further significant growth in the TV (market) pool thanks to BT Sports paying

more than Sky/ITV for live games.

Arsenal’s 2015/16 payment will partly depend on how far they

progress in this season’s Champions League, but is also dependent on where they

finished in the previous season’s Premier League (3rd in 2014/15, compared to

4th the year before). If they reach the same stage in the Champions League in

the 2015/16 season, this could be worth an additional €20 million under the new

BT deal.

Match day revenue was flat at £100 million, despite two

fewer home games (in the FA Cup), as this was compensated by the 3% ticket

price rise. Manchester United’s income dropped by £17 million to £91 million

following their lack of European games, so Arsenal will earn most from this

revenue stream in 2014/15.

This is partly due to having the second highest attendances

in the Premier League, up from 59,790 to 59,930 in 2014/15, but also very high

ticket prices. The club is keen to emphasise that ticket prices have only been

raised three times in the last ten seasons (frozen for 2015/16) and that the

increases are significantly below inflation, but there is no doubt that Arsenal

fans are not happy contributing so much money to effectively grow the club’s

bank balance.

Gazidis said that the board wished to “strike a balance

between the expense of coming to games for our supporters and the club’s

ever-increasing costs and expenditure as it develops on and off the pitch”, but

he slightly ruined the effect by adding, “demand for tickets continues to far

exceed supply”, reducing it to an issue of basic economics.

Commercial revenue passed £100 million for the first time,

as it shot up £26 million (34%) from £77 million to £103 million, comprising

£78 million from commercial deals and £25 million from retail and licensing.

This was largely due to the new PUMA kit deal, which started in July 2014.

The club stated that this contract “signals the end of a

period where our commercial revenues lagged behind a number of our competitors

as a consequence of the long-term deals that were in place as part of the

funding of the Emirates move”, which is right, but the reality is that Arsenal

are still a fair way below the Manchester clubs: United’s 2014/15 revenue was

up to £197 million (nearly twice as much), while City’s 2013/14 revenue was

£166 million (and is expected to rise).

Similarly, Arsenal are still behind Chelsea (£109 million)

and Liverpool (£104 million) before any 2015 growth, though they are miles

above other Premier League clubs, e.g. Tottenham £42 million, Aston Villa £26

million.

Despite an increase in the number of partnerships, the

concern is that Arsenal’s commercial performance will continue to place them at

a competitive disadvantage relative to other leading clubs. Indeed, in the

interim accounts the chairman warned, “Inevitably, this growth rate will now

slow as we have our key partnerships with Emirates and PUMA in place for the

medium term.” Further substantial increases are only likely to come as a result

of success on the pitch, which again makes you wonder why the available cash

has not been spent on strengthening the squad.

The PUMA agreement is worth £150 million over 5 years, so

£30 million a year, which represents a £22 million increase over the former

Nike deal. This is one of the best kit deals around, but is still dwarfed by

Manchester United’s extraordinary £750 million 10-year deal with Adidas that

starts from the 2015/16 season.

Similarly, Arsenal’s Emirates deal is also among the highest

in the world. The £150 million contract covers a 5-year extension in shirt

sponsorship from 2014 to 2019 plus a 7-year extension in stadium naming rights

from 2021 to 2028. The club has not divulged how much of the deal is for naming

rights, so I have used the straightforward £30 million annual figure, though my

own estimate would put the pure shirt sponsorship at around £26 million, which

would still be pretty good.

That said, it has since been overtaken by new sponsorship

deals at Manchester United with Chevrolet (around £43 million a year) and

Chelsea with Yokohama Rubber (£40 million).

There’s an old saying that “it’s an ill wind that blows no

good” which applies to Arsenal’s relatively poor commercial performance to

date. The new Premier League Financial Fair Play regulations restrict the

amount of money clubs can spend from the new TV deal on wages, but this

restriction only applies to the income from TV money, so Arsenal’s additional

money from the new sponsorship deals can still be spent on wages.

Arsenal’s wage bill actually increased by 16% (£26 million)

from £166 million to £192 million, primarily as a consequence of player

purchases/upgrades and contract extensions for several players. Even with the

revenue growth, the wages to turnover ratio has risen from 56% to 58%.

This is higher than the 46-50% achieved between 2008 and

2010, but is still very reasonable and is in line with most clubs in the

Premier League.

However, it is striking how close Arsenal’s wage bill is to

other leading clubs now. For example, Manchester United’s 2014/15 wage bill

fell to £203 million, just £11 million more than Arsenal, compared to a £48

million differential the previous season. It is also within striking distance

of Manchester City (£205 million) and Chelsea £193 million, though those are

the 2013/14 figures.

Of course, Arsenal’s wages are way ahead of most other

Premier League clubs with the nearest challengers (in 2013/14) being Liverpool

£144 million, Tottenham £100 million and Newcastle £78 million.

One other point worth noting is that Arsenal’s wage bill was

inflated by bonus payments for Champions League qualification, which, depending

on your view, is either a sensible performance plan or demonstrates a palpable

lack of ambition.

Although there is a natural focus on wages, other expenses

also account for a sizeable part of the budget at leading clubs with Arsenal’s

increasing by £2 million to £72 million in 2014/15, which is exactly the same

as Manchester United. These cover the costs of running the stadium, staging

home games, supporting the commercial partnerships, travel, medical expenses,

insurance, retail costs, etc.

Last year they also included a £3 million fee paid to

majority owner Stan Kroenke’s holding company for “advisory services”, but we

will have to wait until the full accounts are published to see if a similar fee

has been paid this year. If so, it would be helpful if the club provided a

meaningful explanation for this apparently ridiculous payment – even if they

were to say that it was effectively a dividend in all but name.

There have been a few misguided reports in the media that

Arsenal have paid off their stadium debt, but the reality is that the debt

incurred for the Emirates development continues to have an influence over

Arsenal’s strategy. Although this has come down significantly from the £411

million peak in 2008 to £234 million, it is still a heavy burden, requiring an

annual payment of around £19 million, covering interest and repayment of the

principal.

The interest payable of £13 million is a lot more than any

other Premier League club (£5 million at Manchester City, Everton, West Ham and

Liverpool) with the exception of Manchester United, who leapt to £35 million in

2014/15.

Although the net debt stands at only £6 million, thanks to

those large cash balances, the gross debt of £234 million remains the second

highest in the Premier League, only behind Manchester United, who still have

£411 million of debt even after all the Glazers’ various re-financings.

Arsenal’s debt comprises long-term bonds that represent the “mortgage” on the

stadium (£206 million) and the debentures held by supporters (£28 million).

Apart from financial debt, it is worth noting that the money

owed to other football clubs for transfers, including stage payments, has gone

up from £38 million to £81 million in 2014/15.

For the past few years Arsenal’s business plan has seemingly

been based on the belief that Financial Fair Play (FFP) would level the

financial playing field, but a series of legal challenges, allied with other

clubs’ ability to meet the targets, has severely compromised this strategy.

Even Wenger acknowledged this: “It has gone. I have seen the signs coming from

UEFA for a while now. I thought for a while FFP would happen, but now it is not

possible.”

"Young at heart"

Although the basic FFP rules remain in place, the subtle

difference is that new owners will now be allowed to make larger losses, as

long as they can produce a business plan that will show how they will reach

break-even. Hence, clubs like Milan and Inter will be allowed to spend more

after being bought by new owners.

Essentially, UEFA are now arguing that the modified stance

is a move from “austerity to sustainable growth” in an effort to encourage

investment into European football, though Wenger pointed to the revenue growth

in the Premier League as another factor: “I believe the television contract in

England has pushed some other clubs in Europe to want this to be a bit more

flexible for them, so they can compete better with investors investing in their

clubs.”

"Red Hot Chile Pepper"

Even if some other clubs are still well ahead financially,

Arsenal are still better placed than most. If they continue to qualify for the

Champions League, their revenue should be up to £400 million in two years, but

the question is how much of this will be seen on the pitch.

The board should surely follow its own virtuous circle,

which describes how “funds generated by the business are available for further

investment into the club with the aim of achieving an increased level of

on-field success, which ultimately translates into the winning of trophies.”

Arsenal have a fine squad that is eminently capable of

gaining silverware, but the latest financial figures clearly demonstrate that

the club has not used all of its resources to give itself the best chance of

success – which is all that most fans are asking for. They will hope that this

summer does not come to be regarded as another missed opportunity.

Wonderful article as always. I think Arsenal's player wages would significantly decrease once Rosicky, Arteta and Flamini run out their contracts. Debuchy looks outbound too.

ReplyDeleteThanks again for the insights!

ReplyDeleteI'm still puzzled by the weak commercial revenue excluding shirts/kits compared to other clubs with smaller or equivalent worldwide appeal. Extrapolating it from the other clubs figures Arsenal's commercial revenue could/should be 20-30M higher. I wonder what's holding them back.

Lack of success on the pitch, if we were to win the PL and more so the CL then we could instantly command better 'secondary' commercial deals, even so we are somewhat behind, we should be at £120m at least if we had negotiated harder I believe, the Emirates and Puma deals were decent enough but nothing special, despite all the patting themselves on the back the board gave, a bit like on the pitch our ambitions are 'safe' and not 'daring'. If the football world was in financial crisis we would be perfectly placed but as it is with the spiraliing TV money we are placed to finish 3rd/4th as usual. Boring. Stan needs to go and take Arsene along with him before this strategy changes.

DeleteNaming rights to the Stadium is the largest, Kit deals second.

DeleteHi, a very enjoyable read as ever! Well done! Got a scenario for you, what if the issue is not the cash balance but the board wanting to not report a loss which is preventing the signing of a super player? For example, if the player costs 50mn and wants 150k per week, the annual cost plus amortization (over 4 years) would be nearly 20mn which is close to the stated net profit. So effectively we aren't able to afford more than that 50mn/150k level which rules out quite a few top, top strikers.

ReplyDeleteExactly my analysis. Player purchases at Arsenal are indeed limited by the net profitability mandate of the board, huge cash balances aside. Increasing TV revenues from 2016 will partially offset this profitability limitation, but in my view, Arsenal will probably need to earn a net profit of 30m or more in order to both afford a world-class striker and still report a net profit (an increase in commercial revenues by an additional 20-25m this year would have delivered that), especially as Arsene is not interested in adding only marginally better players.

Deleteyup, 30m net profit will get us a 60m/200k per week player

DeleteThat's a wrong view, in my opinion, because if Arsenal were to buy a top striker - Griezmann or Jackson were signed for less than £30M - (Arsenal should sign better players), they would be able to sell Giroud for at least £20M, which means that the net spend would be lesser than the £50M (for me an exagerated value). Similarly you can make the same argument regarding the salary and you'd come to the conclusion, that the needed investmet shouldn't be so high. Arsenal needs top center-backs, a defensive midfielder and a more effective striker and there are several great options around Europe if they look outside England or France. For instance Garay is a top center-back, far better than the actual players and it would cost less than £15M, but instead of an experienced defender Arsene opted by Gabriel (this makes me laugh)...

DeleteAnother issue i that Arsenal, like most english teams have a lot of overrated players with a high payroll but the most important issue is that Arsene is no longer a cutting-edge manager as he's tactically outdated. In CL in the last 10 seasons english teams won 2 times, In the same CL in the last 5 years just 1 victory, 1 semi-final and 1 quarter-final. This means that although the budgets have sky-rocketed due to tv agreements, the performance on the pitch has been decreasing regarding contin.ental teams. Think about it

Good article but in pointing out Arsenal's cash reserves compared to other clubs why not also ask the question whether other clubs hold enough reserves consistent with best business practice? It has been apparent for some time that football has suffered from what Lord Sugar described as the 'prune juice' effect which hindered the proper growth of club. Maybe other clubs should increase their reserves consistent with the risks. A £60m player on a 4 year contract means the club has to account for the extra liability of £15m a year for the next 4 years. That's a big chunk of revenue for most self sustaining clubs. To what extent should cash reserves accommodate a risk of failing to qualify for CL football? With £81m still owed for players already bought, the provision for debt servicing, and the front loading of season ticket income in mind what is an appropriate amount of cash for Arsenal to hold? Do other clubs hold sufficient cash to manage the risk to their businesses?

ReplyDeleteGreat article as ever, well done (even if I didn't teach you at BPP).

ReplyDeleteStrange reticence to buy though they will need another DM next summer with Arteta and/or Flamini going. There needs to be a mindset change on recruitment, there are less Wenger bargains (and he has found some fantastic ones over the years) than before. A shame that he didn't get someone to add to the competition in the squad this summer.

Great read yet again. Comparing the commercial revenues to other clubs and how they've failed to develop adequately over years shows that the people in that department have been failing badly. The same goes for the transfer team. FFP was always going to be undermined considering the amounts of money involved in world football, but Arsenal has the cash to deal with that situation. Yes the transfer market is inflated, especially for English clubs, but there is no excuse for not buying much needed players in the transfer window.

ReplyDeleteThough as the article states, the lack of a serious uptick in commercial revenues can be attributed to a lack of success on the pitch more than the commercial folks failing badly.

DeleteI see that creditor payments due within one year went up from £203m to £278m while creditor payments due after one year remain static at £264m (£266m). Shouldn't this be considered in the context of Arsenal's cash 'mountain'?

ReplyDeleteI am a Spurs fan but I found this post very informative and interesting.

ReplyDeleteAs well as commercial revenue, the one unmentioned delinquent income stream is prize money. Is there any way of determining the value of FA Cup wins and any other trophies as compared to other clubs in England and Europe over the last decade?

ReplyDeleteThe prize money for the FA Cup was 1.8m last year. If you add in the gate receipts, Arsenal earned around 4m from it in total. So more than enough to pay Kroenke the annual 3m for his advice (plus the expenses he presumably charges the club when he attends a board meeting and/or a game), but it's not a significant trophy from the financial point of view.

DeleteThe commercial revenue of Manchester City should not be used as a comparison. It is obviously just a gift from relatives of the owners in order to try and comply with regulations, which seem to have disappeared. Although ruled above board by UEFA, its hard to see how. They sell less shirts, have less fans worldwide, but have more commercial revenue, by the grace of Qatari oil. However Chelsea's commerical revenue is more realistic and Arsenal have been lagging a little there, and should be level with a club like Chelsea.

ReplyDelete...." its hard to see how. " That's because you don't want to believe it, and by the way, Qatar deals with Barca, we are Abu Dhabi, do try and be better informed ;-)

Delete...and further to my last ... may I refer you to the excellent recent SR article on City's finances :

Deletehttp://swissramble.blogspot.ch/search/label/Manchester%20City .... a brief extract :

Critics will argue that this is built on friendly deals with Arab partners, but the fact is that City are now signing up many other deals not linked to their owners.

In any case, the groundbreaking 10-year £400 million deal with Etihad Airways, covering shirt sponsorship, stadium naming rights and the campus development, now looks to be behind the market, as other clubs have since raised the bar. It is estimated that the shirt sponsorship element of City’s deal is worth £20 million a season, which would put City’s deal way below their competitors: Manchester United – Chevrolet £47 million ($70 million); Chelsea – Yokohama Rubber £40 million; and Arsenal – Emirates £30 million.

Great read, very informative and great clarity. Arsenal as a club are "penny wise and pound foolish "

ReplyDeleteA great read, much better than doing actual work.

ReplyDeleteAssuming our restrictions over holding 35m for debt repayment in cash hasn't changed in a number of years it appears to me that the vast majority of the rest should be available should we wish to spend it. PL money comes in throughout the year as does gate receipts for non ST holders (as well as extra for cup games and if we get out of the CL group). Don't buy the clubs line about it being used for day to day expenditure..surely there's a structure in place where puma, Emirates and other commercial sponsers pay over the season as opposed to all at once. The PL money comes in installments too and gate receipts are regular enough even if a large chunk is already pocketed come may 31st.

The real shame is that the 150m or so we could potentially spend now isn't worth anything like the 60-70 we probably could/should have spent 4-5 years ago.

If Cash balances only increased by £20m and some £15m of that was based around one-off property development receipts, how can you justify saying that the club can sustainably spend £70-80m?

ReplyDeleteSurely the only sustainable spend is on increases? Eg, you only spend by the amount you have increased?

Also, given the issues witnessed at ManU in the wake of Ferguson's departure and the inevitable spending that any new manager would want to make, surely a healthy cash balance to cover future expenditure is the smarter option? Do you spend £50m now (that you won't have later) on a squad that's already winning silverware and one of the best in the league, or do you save that £50m for when you really need it down the track because you have a new manager who needs to buy new players or regenerate the squad.

This is thoughtful and thorough, as always. It raises two questions for me, one at the strategy level and another (minor one) at the technical accounting level.

ReplyDelete1. Might you be underplaying the wage growth and as a result misrepresenting the strategy? Perhaps the club has made the decision to give better terms to current players deemed worthy and are withholding cash to meet those enhanced commitments. That could be a legitimate choice over committing the funds to transfers and amortization. It's admittedly more prosaic than landing a shiny new player every summer, but it's not necessarily a sign of miserliness.

2. Can you explain the reason the operating profit figures differ in the cash flow statement (£7.8MM) and the P&L (-£5.2)?

Thanks very much for your great work.

Thanks.

Delete1. Possibly, but I think that could be funded by future revenue growth.

2. Operating profit in cash flow statement is the sum of football operating loss £(5.2)m plus property profit £13.0m, which gives £7.8m.

I think your 30% increase in International rights is low. Sports television is increasingly valuable due to it's inherent ability to resist pirating. Also the number of international viewers is increasing rapidly through better distribution of legal internet streams. The last 2 times the deals were negotiated saw increases in the international payments of close to 70% on average. The US deal with NBC is set to double at $1 Billion over 6 years. (I think this was a great deal for NBC and the EPL could have done much better but preferred NBC over a better paying FOX).

ReplyDeleteGreat work, very informative as usual (and as expected).

ReplyDeleteI believe yhat Arsenal has a strategic problem which derives from the contentment with the actual and past sporting performance. Somewhere along the line, I feel that the board and Arsene lost the sight from hat's really important - winning.

From what I've read here, clearly the fans have the management that they deserve. The silverware Arsenal is winning hasn't got any value outside England - FA Cup, The League Cup and the Charity Shield are minors trophies without relevance outside England. If that silverware fulfills the fans' ambitions, than they get what they deserve.

Naturally, the commercial deals will never grow alongside with Man U, Man City or Chelsea because these teams sign great players or win BPL and/or European silverware. And this is the key-issue to commercial growth.

Liverpool is an exception due to it's immense fan-base both in England and outside due to it's glorious past, but it's sporting mismanagement will pay its toll in the future, because the new generation doesn't associate Liverpool with success.

The Wenger-Out lobby has a lot to explain when you compare Cash flow since 2007 with CFC. The difference is 750 mil - pause for a sec - and consider what would have happended if AW had spent 100 mil more each year since 2007.....

ReplyDeleteThe difference to MU and MC are even bigger. Thus, Arsenal is and will remain the fourth club in England. Demanding titles under such circumstances is not reasonable. Not finish worse than 4th is the only logical way to run this football club.

Sorry lads

I'm not english, I couldn't care less about Arsenal success... As I've said before, if the fans like being 4th on a regular basis then they deserve what they have.

DeleteThe problem is thinking money will bring titles, it's not all about the money, but more about management. With the values that Arsenal pays from salaries and their money capability to move in the transfer market - seen in signings like, Podolsky, Giroud, Ozil, etc. it's money squandered, that what Arsenal lacks is sporting management, both in the transfer market and on the pitch. That's my opinion.

Why does the graph of commercial income broadcasting income and match income go from side to side as if there is negative income ?

ReplyDeleteAs the title of the graph says, it's Arsenal's revenue compared to the other clubs in the Deloitte Money League, not absolute revenue.

DeleteTo take an example, Arsenal's commercial revenue was £77m in 2013/14 (see Money League graph above), which was £197m below PSG's commercial revenue of £274m. This is portrayed as the big, negative pink bar in the graph.

you've made a mistake (Man united fan with keen interest in Arsenal as brother supports Arsenal) as you've stated man uniteds interest repayments have increased (which wouldnt make sense if you are refinancing to a higher total debt.)

ReplyDeleteAs mentioned by the club (and Andersblog) the senior secured notes interest decreased from 8.375% to 3.79% and theres a secured term loan facility at 1.79%.

Basically interest is down to £13.2mil.

Anyways, my take on Arsenal is that considering in 2008 that arsenal and man united were somewhat similar with finances (us making about £40mil extra in revenue) and up to 2010 we somehow reached £753mil of debt, Arsenals money team should have surely preformed better in getting wenger available cash. As maybe being able to spend on a keeper during Alumina era or get a backup dm/cb when the inevitable injury crisis happened 09-13 would have surely won arsenal a trophy here and there.

When you consider the rate of growth for Man united in terms of money (and the success included) from both 2005 and 2010 (both times looked as if United was finished apparently) then you have to blame the commercial side of Arsenal for them being 'steady'...well from an outside view.

Actually we're both right. Although United's latest refinancing will indeed result in a reduction in the interest payable, this only took place in June 2015, so will be reflected in future accounts. In fact, the 2014/15 accounts included a hefty premium payment for this refinancing, which took the net finance costs up from £27.4m to £35.2m.

DeleteThanks again for this new article (a long time reader). Crystal clear.

ReplyDeleteAs an AFC fan (from Switzerland also... but in the Geneva area), I share the thoughts of several other readers that the commercial team could do better. Now, to force them to do better, more success on the pitch is required. In the meantime I hope that they have specific clause linked to success that would exist in the current deals. So that it boosts the commercial revenues, waiting for even better new deals, leveraging successes.

Being a fan of Olympique de Lyon on another hand, I made for a long time a parallel about both clubs' situation. Let's hope that the new Stade des Lumières will help Lyon to effectively build a sustainable model like AFC's one.

I would be an happy fan, seeing my two clubs behaving ok for a foreseeable future.

Have a great day et à bientôt

François

Greetings from San Francisco --

ReplyDeleteEven with the shocking (by most accounts) 2-0 result against Bayern earlier today, there remains a strong likelihood that Arsenal will finish 3rd in their CL group.

Curious if there is a way to model what a CL exit in the round of 16 or 8 would be compared to an Europa League semi-final loss, final loss, or final victory for the Gunners.

You document quite well how much the Emirates gate revenue contributes to the club's top and botttom lines. Being stateside and not knowing much about the Europa League (except when Fulham made it to the final a few years back under a previous tournament name) makes me wonder what the true financial impact would be...and you have a team like Athletico that parlayed success in this tournament and took it to the next level the following season.

Thanks, Matt

This year Arsenal can be first everywere.

ReplyDelete