The 2013/14 season was a mixed bag for Norwich City, as

another good year from a financial perspective was completely overshadowed by

the results on the pitch. As the annual report stated, it was “a disappointing

season for the club, culminating in relegation to the Championship following

three successive years in the Premier League.”

Although Norwich had arguably outperformed the previous

season by finishing in a comfortable 11th position in the Premier League, it

must have been strange to supporters to see the club record a £9 million profit

before tax (up more than 700%) and

further reduce debt instead of spending more in an attempt to avoid relegation.

A prudent approach would have been understandable in some

ways, given Norwich’s experience of financial problems in the not-too-distant

past, such as when they struggled to meet payments against their debt following

relegation to League One in 2009, but that was not really the case here.

Chairman Alan Bowkett explained, “We had planned to roughly

break even, and we have made this profit because we did not have to pay the

players the bonus for staying in the Premier League.” He added, “I find myself

in the uncomfortable position of being disappointed that the club has reported

an above forecast profit for last year.”

"Brad New Cadillac"

At the risk of stating the obvious, it was a key part of the

club’s strategy to retain their place in the Premier League, not least due to

the financial awards available in England’s top tier. Chief executive David

McNally had claimed that he would “prefer death to relegation”, which may have

been a little over the top, but there is no doubt about his determination to

gain promotion back to the Premier League at the earliest opportunity.

That has been evidenced by a number of managerial changes

with Neil Adams being promoted after his Youth Cup success to replace Chris

Hughton in a (forlorn) attempt to prevent relegation. This move did not pay off

in the Championship either, so in January McNally recruited Alex Neil from

Hamilton Academical in the Scottish Premiership. The team has

put together a run of wins since then, taking them up into the play-off

positions, and providing much encouragement to the Canaries' fans.

The club’s financial strength is an integral part of

improving the chances of promotion. Bowkett again, “The good news is that this

surplus has enabled us to construct one of the strongest squads in the

Championship. Due to our strong balance sheet we are able to totally focus on

planning our return to the Premier League.”

That surplus has arisen from the 2013/14 profit before tax

of £9.3 million (£6.7 million after deducting a tax charge of £2.5 million),

which was £8.1 million higher than the previous season. The main reason for the

growth was the new Premier League television contract, which increased

broadcasting income by £19 million. This was partially offset by increases in

player costs: player amortisation was up £6 million following significant

investment in the squad, while there was a £4.5 million charge relating to the

contracts of certain players whose registration value is impaired and whose

contracts have been classified as onerous contracts.

Operating income fell by £2.8 million following a reduction

in loan player income from £2.4 million to £1.1 million and a compensation fee

of £1.5 million paid in 2012/13, presumably for former manager Paul Lambert’s

move to Aston Villa. The reduction in the club’s external debt has also cut the

net interest payable by £1 million to just £245,000.

Note that the previous financial year actually covered 13

months, as the club decided to change the year-end date from 31 May to 30 June.

There was nothing sinister in this, merely the desire to bring this into line

with player contracts and the majority of other football clubs.

After their previous financial trials and tribulations

Norwich had stated that one of their objectives was “to reduce the annual

losses” and they succeeded in doing so in the three years they spent in the

Premier League with an aggregate profit before tax of £27 million in that

period. In fact, the club made its highest ever pre-tax profit of £16 million

in the first season back in 2011/12, following four consecutive years of

losses. Since then the profit has been reduced due to investment in the playing

squad.

Revenue rose 26% (or £19.6 million) from £74.7 million to a

record £94.3 million, very largely due to broadcasting income, which increased

by 39% (£19.0 million) from £49.4 million to £68.4 million. There was also

solid growth in commercial income, which was up 7% (£0.9 million) from £13.7

million to £14.6 million, while gate receipts dropped 3% (£0.3 million) from

£11.6 million to £11.3 million.

Of course, the most significant revenue growth in the past

few years took place following promotion to the Premier League in 2011. Norwich

generated revenue of £23 million in their last season in the Championship in

2010/11, so they have increased their revenue by £71 million since their

elevation. The majority of this (£63 million) is due to the vast disparity in

the TV deals, but there was also good growth in commercial income of £5 million

(60%) and gate receipts of £3 million (39%).

Despite Norwich’s impressive growth to £94 million in

2013/14, their revenue was still among the lowest in the Premier League. In the

previous season, Norwich’s revenue of £75 million was the 12th highest, but

they were overtaken by a number of clubs in 2013/14, such as Southampton (£106

million), Swansea City (£99 million) and Stoke City (£98 million), partly

because their share of the TV deal increase was more than the Canaries. Of

course, Norwich’s revenue was still miles behind the leading clubs, e.g.

Manchester United’s £433 million was almost five times as much.

The growth in broadcasting income meant that 72% of Norwich’s

revenue in 2013/14 came from this revenue stream, compared to 66% the previous

season. So, just over a quarter of their revenue came from other sources:

commercial 16% (down from 18%) and gate receipts 12% (down from 16%). The

revenue mix will dramatically change in the Championship, due to the lower TV

money (despite the parachute payment from the Premier League).

Norwich received £64.6 million in distributions from the

Premier League TV money in 2013/14, which represented an £18.5 million (40%)

increase over the previous season, as this was the first year of the current

three-year cycle. The increase would have been even higher if Norwich had not

finished seven places lower than 2012/13, which reduced their merit payment

from £7.6 million to £3.7 million.

Most of the Premier League money is distributed as equal

shares to the 20 clubs: 50% of the UK deal, 100% of the overseas deals and the

central commercial income. The only other variable is the facility fees, which

is based on the number of times that each club is shown live on television.

Obviously Norwich will receive a lot less money in the

Championship, even though they are protected to some extent by a parachute

payment of £24 million. This will be added to the £1.9 million given to all

Championship clubs from the Football League’s own TV deal, but Norwich will

still have to contend with a £38 million cut in TV money. In fairness, while

they are cushioned by the parachute payment, they will still earn a lot more

(around £22 million) than most Championship clubs, who receive a solidarity

payment from the Premier League of £2.3 million.

If it were not already abundantly clear that a rapid return

to the Premier League is imperative for Norwich, the recent announcement of a

70% increase in the TV rights for the cycle starting in 2016/17 further

emphasised this. In another article, I estimated that the bottom club in

the Premier League would earn around £92 million a season, while a Championship

club (without a parachute payment) would receive £9 million. That might be a

tidy increase on the current £4.5 million, but the gap to the Premier League

will actually widen from £60 million to £84 million – not so much a gap, more a

chasm.

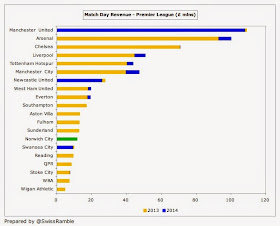

Match day revenue fell slightly from £11.6 million to £11.3

million, despite the average attendance rising by 0.5% from 26,672 to 26,805.

This was mainly due to Norwich’s run to the quarter-finals the previous season,

which included four home ties. Only six clubs generated less money than Norwich

in the Premier League from match day income (though the Canaries do include

catering revenue in commercial income, so there might be a mismatch with other

clubs).

In fairness, attendances have been very good at Norwich and

have held up well in the Championship with the current average of 26,142 (as at

27 February 2015) being the second highest in the division, only behind Derby

County. In fact, season ticket sales for the 2015/16 season are actually up on

the same point from 2014 after the board decided to freeze prices for the

second consecutive year “as a thank-you to our loyal supporters”.

This level of support has induced the club to investigate

the possibility of expanding Carrow Road to increase the stadium capacity from

27,000 to 32,000. However, that plan has been shelved for the time being, as it

would cost circa £30 million and require a substantial loan to finance the

development.

Commercial revenue increased by 6.6% (£0.9 million) from

£13.7 million to £14.6 million. This comprises commercial income £9.1 million,

catering £4.2 million, UEFA solidarity payments £0.8 million and other income

£0.5 million. The amount of catering income is quite striking, but you would

perhaps expect this to be a good source of revenue from a club that includes

the famous cook Delia Smith among its owners.

Norwich have managed to drive commercial growth pretty well,

but this is still far below the leading English clubs, e.g. four generate more

than £100 million commercial income a season: Manchester United £189 million,

Manchester City £166 million, Chelsea £109 million and Liverpool £104 million.

The disparity is most evident when comparing the shirt

sponsorship deals. Norwich have been with insurance company Aviva since 2008.

They extended their deal by four years in 2012 to the end of the 2015/16

season, paying around £1 million a season. This looks quite low compared to the

major clubs, who continue to increase their deals, e.g. Manchester United and

Chelsea have both announced huge new deals recently, United for £47 million

with Chevrolet and Chelsea for a reported £38-40 million with Yokohama Rubber.

It’s a similar story with the kit supplier, Errea, who have been with Norwich

since the 2011/12 season.

In fairness, most clubs outside of the absolute elite have

struggled to secure such massive deals, so Norwich will hope that they are back

in the Premier League before negotiating for a new deal.

The wage bill was reported as £54 million in the accounts,

but this included £4.5 million for onerous contracts, which should really be

treated as an exceptional item. If this is excluded, the underlying wage bill

would reduce to £49.5 million, a reduction of £1.3 million compared to the

previous year’s £50.8 million, thanks to the non-payment of around £6 million

of performance bonuses linked to Premier League survival.

That reduced the wages to turnover ratio from 68% to a very

respectable 52%. This has come down from 80% in the Championship, but we should

expect a deterioration in this ratio this season following the relegation.

Previous years’ staff costs have been inflated by promotion

bonuses: £3.8 million for the Premier League promotion in 2011 and £0.9 million

for the League One promotion in 2010. This year’s wage bill will fall, as the

club has confirmed that there are relegation clauses in all player contracts

with a rumoured 40% cut in wages in the Championship.

Some fans have drawn attention to the high remuneration

package for the chief executive, David McNally. Although this was cut by

£500,000 in 2013/14, it still amounted to a hefty £1.2 million, including a

£367,000 bonus “for achieving non-football-related targets and objectives”. Not

bad, considering that the main football-related target, i.e. Premier League

survival, was clearly not achieved.

That said, it was always going to be a struggle for Norwich,

given how low their wage bill is compared to other Premier League clubs. In

2012/13 only four clubs had a lower wage bill than Norwich and two of those

(Reading and Wigan Athletic) were relegated that season. In 2013/14 other clubs

have been making use of their additional TV money to increase their wage bill.

Granted, Norwich’s wage bill would have been higher if those Premier League

survival bonus payments had been made, but it would still have been on the low

side relative to the club’s rivals.

The club would point to the major investment it has made in

the transfer market after it was promoted to the Premier League. This amounted

to net spend of £41 million in just three years with Norwich laying out big

money on the likes of Ricky van Wolfswinkel, Gary Hooper, Leroy Fer, Sebastian

Bassong and Nathan Redmond. In contrast, in the previous nine seasons Norwich

had net sales of £4 million. Since relegation Norwich have once again been net

sellers, transferring Robert Snodgrass to Hull City and Fer to QPR.

As well increasing player investment in the Premier League

era, Norwich have also managed to resolve their debt issues. A key element of

the club’s business plan was “to address the level of debt on the balance

sheet.” Five years ago gross debt peaked at £24 million and in 2010 the club

was actually in breach of certain covenants with its principal lenders, AXA

Investment and the Bank of Scotland, necessitating a long-term financial restructuring plan that rescheduled

payments. In particular, the club owed its bondholder AXA a significant amount,

taking out two loans of £7.5 million, one at 7.67% and one at 7.24%, which were

securitized on future revenue streams.

Since those dark days, the club has actually swung into a

net funds position of £3.4 million, i.e. cash balances of £6.9 million are

higher than gross debt of £3.5 million. Not only that, but there is no external

debt remaining, as the gross debt comprises directors loans of £2.1 million and

preference shares of £1.4 million. The directors loans are interest free and

have been provided by the joint majority shareholders Delia Smith and her

husband Michael Wynn-Jones (£1.529 million) and the deputy chairman Michael

Foulger (£540,000).

However, it should be noted that the club was committed to

net payments of £13.6 million for player purchases subsequent to year-end

(Lafferty, O’Neill, Cueller, Jerome, etc) plus a maximum further amount of £3.5

million dependent on club and/or player performance. This was on top of existing

contingent liabilities of up to £8.3 million and additional signing on fees up

to £9.7 million that will become payable if certain conditions in transfer and

player contracts are fulfilled.

McNally has praised the club’s shareholders, though he

noted: “They are not the richest owners and so our model is to try and raise as

much cash as we can ourselves and re-invest every spare penny in football.”

That approach can be clearly seen by looking at the club’s cash flow statement,

where the cash flow generated from operating activities shot up in the Premier

League, amounting to £82 million over the last three years.

This was largely invested in improving the playing squad

with £51 million spent on net player registration since 2011/12, compared to

less than £1 million in the previous eight years. There were also net loan

repayments of £17 million in the last three years in stark contrast to £10

million of net new loans required before the return to the Premier League when

external financing was required. Interestingly, promotion to the Premier League

also led to an acceleration of repayments to AXA Investment as previously

agreed in the restructure plan.

In 2011 the club actually had to sell land near Carrow Road

to a housing association to fund loan repayments, which only emphasises the

desperate predicament the club had found itself in and indeed the magnitude of

the recovery in its financial status since then.

There is little doubt that Norwich City have been a well-run

football club over the last few years. Relegation has been a major blow, but

chairman Alan Bowkett took a realistic view of the club’s future prospects: “The

future isn’t rosy but it is manageable. Our income has collapsed, but we can

survive. We have the financial resources (for our manager) to produce automatic

promotion and going forward, we won’t be entering into the financial

difficulties of a few years ago.”

That’s very sensible, but the club need to maintain their

recent good form to get out of the incredibly competitive Championship and back

to the Premier League, which McNally rightly described as “integral to our

future plans”.

Interesting article. As a NCFC fan I take some solace that we will take on a manageable loss this season, if that 40% wage reduction estimate is true. That does seem to be a great deal (for the club) and an informal chat with David McNally prior to the Man Utd game last season suggests that, anecdotally at least, that it might be correct. With such a wage reduction then it's amazing that we didn't lose players other than Snodgrass and Fer (and RvW on loan). However it's clear (as with all relegated PL clubs) that we have 2/3 years to get back up or face major financial issues. The signs are good but if it doesn't happen this year then it's worth investing more to get back to the new riches of the PL.

ReplyDeleteThen all we need is a sustained run in the PL so that the stadium can be extended (with a record crowd yesterday it seems there is a clearly scope for that to happen….although granted it was for a derby game).

Easy :)!!

Geraint Parry @liverpoolplants