It was so close. Although Liverpool supporters would

naturally have been disappointed that Brendan Rodgers' team narrowly missed out on

securing title winning glory in the 2013/14 season, objectively speaking their

surge to second place in the Premier League represented great progress. Not

only did they improve significantly from the previous season’s seventh, but

they also qualified for the Champions League, a competition that has played an

important part in the Reds’ famous history.

It was a similarly positive story off the pitch, as

Liverpool reported their first profit in seven years after revenue surged by

24% to a record £256 million, despite receiving no benefit from European

football. These figures were testament to the financial progress the club has

made since it was purchased in October 2010 by Fenway Sports Group (FSG), the

American investment company run by John W. Henry. The good news did not end

there, as it came hot on the heels of UEFA clearing the club of any breaches of

their Financial Fair Play (FFP) regulations.

This represented a significant turnaround in the club’s

finances, as the massive losses of recent seasons were converted to a £0.9

million profit before tax (£0.4 million after tax). As chief executive Ian Ayre

said, “The profit of just under a million pounds from a loss last time of

almost £50 million is a huge swing for us.” He rightly pointed out that the key

component of this £51 million improvement was “media revenue increase” of £37

million, driven by the new Premier League television deal, as 2013/14 was the

first season of a three-year cycle.

In addition to the increase in TV money, the other revenue

streams also grew steadily with commercial and match day income each up around

£6 million. The loss from player sales was also slashed by £12 million to just

under a million, while the player amortisation and impairment charges fell by

£6 million, as last season’s figures included the impact of correcting previous

errors in the transfer market. These improvements were partially offset by £17

million higher expenses, largely due to a £13 million increase in the wage

bill.

It is worth noting that the net interest payable of £4.6

million has come down significantly since the bad old days of the Tom Hicks and

George Gillett regime, when it peaked at £17.6 million in 2010. That said, it

is one of the higher interest payable figures in the Premier League, albeit

nowhere near as much as Manchester United £27 million and Arsenal £13 million.

The last time that Liverpool reported a profit was back in

2007/08 with £10 million. Since then, the club has registered substantial

losses, amounting to £176 million over the five years leading up to 2013/14,

including an average of £47 million for the last three seasons. In fairness,

many of these losses have been due to FSG having to spend substantial sums on

player recruitment in order to repair the damage caused by the previous owners’

lack of investment in the squad.

The other factor that has had a strong influence on

Liverpool’s losses is the amount booked for so-called exceptional items, which

adds up to nearly £100 million over the last eight years, mainly due to

writing-off £61 million spent on unsuccessful stadium developments and £31

million paid-out as a result of changes in coaching staff (e.g. the departures

of Roy Hodgson and Kenny Dalglish). In fact, Liverpool would have made a profit

of £10 million in 2011 without such exceptionals. These have been steadily

reducing and were down to just £1.4 million in 2013/14 for costs related to the

new stadium development in Stanley Park.

Profits and losses have also been influenced by player

trading. In the six seasons up to 2011 Liverpool made a total of £106 million

profit on player sales, including £43 million in 2011 and £23 million in 2010

with profitable sales including Fernando Torres to Chelsea and Javier

Mascherano to Barcelona. However, in the last three seasons the club has

registered total losses of £15 million from this activity, including the sale

of Andy Carroll to West Ham.

Basically, player sales have gone from boosting profits (or

at least reducing losses) to being a drag on the financials. This will, of

course, change in the 2014/15 figures, as this season will include the

lucrative sale of Luis Suarez to Barcelona, reported in various media outlets

as being between £65 million and £75 million.

The potential importance of this activity can be seen by

looking at Chelsea, who would have made a £46 million loss last season instead

of a £19 million profit without their £65 million profit from player sales.

Also, it will not have escaped the attention of Liverpool’s board that Everton

made £28 million profit from player sales.

So what, you might say, given that Liverpool still produced

a profit. That’s true, but their £0.9 million profit is still at the lower end

of the spectrum. To date 14 of the 20 clubs in the Premier League have

published their 2013/14 accounts and 11 of those have reported profits – with

Liverpool’s figure being the lowest. Five clubs have announced profits before

tax of more than £10 million: Manchester United £41 million, Everton £28

million, Chelsea £19 million, WBA £13 million and West Ham £10 million.

In fact, the only clubs to have so far announced a loss are

Manchester City £23 million, Cardiff City £13 million and Aston Villa £4

million, and all three of those clubs have their own particular issues.

Revenue grew by an impressive £50 million (24%) from £206

million to £256 million in 2013/14, largely driven by media revenue, which was

up £37 million (58%) from £64 million to £101 million. There was also good

growth from match day of £6 million (14%) from £45 million to £51 million and

commercial income of £6 million (6%) from £98 million to £104 million.

Ayre noted, “Revenue has been consistently increasing from

around £170 million in 2009 to over £250 million today”, which is largely true,

though the growth is actually £78 million (44%) from £177 million in 2009. It’s

also worth noting that the majority of this growth (£67 million) has come in

the last two seasons, as revenue was relatively flat over the previous seasons,

partly due to the disappearance of Champions League revenue, which offset

commercial growth (including bringing catering revenue back in-house in

2010/11.

The absence of Champions League money has restricted the

growth in broadcasting revenue since 2009 to “only” 35% (£26 million), largely

due to the new Premier League TV deals, though also partly because of the

inclusion of Liverpoolfc.TV Limited in the club’s figures. Commercial income

has, in fact, been the main growth driver, increasing by 72% (£44 million) over

the same period, while match day income has risen by a more modest 20% (£8

million).

So Liverpool remain in 5th place in the English revenue

league with £256 million, as all other clubs have grown their revenue in

2013/14, thanks primarily to the new Premier League TV deal. As Warren Buffett

once said, “A rising tide lifts all boats.” Liverpool are still a fair way

behind their rivals for Champions League qualification with Manchester United’s

revenue of £433 million being an amazing £177 million (or almost 70%) higher.

Similarly, Liverpool are below Manchester City £347 million, Chelsea £320

million and Arsenal £299 million. That said, Liverpool are in turn much higher

than Tottenham’s £181 million.

Liverpool’s challenge can be seen more clearly by comparing

the 2013/14 revenue growth for the top six English clubs. Although their growth

of £50 million is seriously impressive, it’s still lower than the growth reported

by Manchester City £76 million, Manchester United £70 million, Chelsea £60

million and Arsenal £55 million. In other words, the gap was large and will get

larger – unless Liverpool do something about it. This is why they are

developing Anfield and are so focused on qualifying for the Champions League

(which they did last season, but need to do consistently to narrow the

financial gap).

The increase in Premier League TV money has resulted in

English clubs moving up the Deloitte Money League with Liverpool rising three

places from 12th to 9th place, ahead of Juventus, Borussia Dortmund and AC

Milan, despite not competing in European competitions. The magnitude of

Liverpool’s task in their Champions League group this season is emphasised by

the disparity with Real Madrid, whose revenue of £460 million is around £200

million more than Liverpool’s £256 million.

Despite the new Premier League TV deal, commercial income

remains the most important revenue stream at Liverpool, contributing 41% of

total revenue, though it is now only just ahead of broadcasting 39%. With the

addition of Champions League revenue in 2014/15, broadcasting is likely to

become the highest revenue stream. Match day income is down to 20%, which

should be addressed with the planned stadium expansion.

Broadcasting revenue increased by £37 million (58%) to £101

million, very largely driven by the new Premier League TV deal, though this was

partly offset by no Europa League revenue in 2013/14. In fact, even though they

finished 2nd in the Premier League, Liverpool actually received the largest

central distribution with £97.5 million, up £43 million (or 78%), as they were

shown live more often than champions Manchester City, which resulted in higher

facility fees (25% of the domestic deal).

The only other variable element in the Premier League

distribution is the merit payment (also 25% of the domestic deal), which

depends on where you finish in the league. All other elements are equally

distributed among the 20 Premier League clubs: the remaining 50% of the

domestic deal, 100% of the overseas deals and central commercial revenue.

Of course, this is just the first year of the current

Premier League TV deal and there will be even more money available when the

next three-year cycle starts in 2016/17 with the recently signed extraordinary

UK deals with Sky and BT producing a further 70% uplift. My estimates are that

a club finishing near the top of the table will receive around £150 million a

season, which would represent an additional £50 million. If anybody had any

doubts as to why so many overseas owners have been investing in English

football, it’s staring you in the face right here.

Liverpool’s broadcasting revenue for 2014/15 will

be boosted by their participation in the Champions League (and Europa League).

Given the equitable nature of the Premier League TV deal, the real

differentiator for the leading English clubs is in fact the Champions League.

In 2013/14 Liverpool earned most from the Premier League, but their total

broadcasting income of £101 million was surpassed by Chelsea £140 million,

Manchester United £136 million, Manchester City £133 million and Arsenal £123

million.

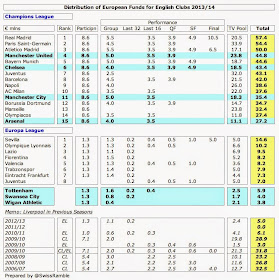

In that season, the English clubs earned an average of €38

million, ranging from Manchester United’s €45 million to Arsenal’s €27 million.

In the past Liverpool have earned similar sums from Europe’s premier

competition, averaging around €29 million between 2007 and 2010.

The importance of qualifying for the Champions League has

been further emphasised with the new deal from the 2015/16 season that will

further increase the prize money. UEFA recently advised the European Club

Association that clubs could expect a 30% increase in revenue, but the uplift

is likely to be even higher for English clubs, as BT’s exclusive acquisition of

UK rights is double the current arrangement.

Although Liverpool’s failure to qualify from their Champions

League group will reduce the amount of money they receive, this blow will be

partly mitigated by some revenue from dropping down into the Europa League

(like 2009/10), but also the way that the TV (market) pool is allocated. A

club’s share of the UK market pool is dependent on both how far they progress

(compared to other English clubs) and their finishing place in the previous

season’s Premier League. In this way, Liverpool will benefit from finishing 2nd

in last season’s Premier League, which will give them 30% of half of the market

pool.

Commercial revenue rose £6 million (6%) from £98 million to

£104 million, mainly due to additional sponsorship and merchandising sales. New

sponsor deals were announced with Subway, Dunkin’ Donuts, Vauxhall and Garuda,

which is an example of Liverpool’s strategy of “leveraging the club’s global

following to deliver revenue growth.”

Only seven clubs generated more commercial income than

Liverpool, which is an excellent performance, given the lack of Champions

League qualification in recent seasons and demonstrates the strength of

Liverpool’s “brand”. That said, other leading clubs do earn prodigious amounts

of money from commercial activity. In particular, Bayern Munich have managed to

increase commercial income from £203 million to £233 million, more than double

Liverpool. PSG’s numbers are inflated by their €200 million deal with the Qatar

Tourist Authority.

To reinforce this point, in England Manchester United have

increased commercial income by 171% (£119 million) to £189 million in the last

five years, which is far superior to Liverpool’s 72% (£44 million) over the

same period – and that’s before United receive the full benefit of their

massive new Chevrolet and Adidas deals. In fact, the gap between Liverpool and

United has grown from £10 million in 2009 to £85 million in 2014. Similarly,

Manchester City is now up to £166 million, driven by their Etihad sponsorship.

Liverpool are still way above Arsenal, though the Gunners’ PUMA deal only

starts from the 2014/15 season.

Liverpool’s shirt sponsorship of £20 million, signed in July

2010, is one of the highest in England, though has been overtaken by Manchester

United’s £47 million Chevrolet deal and Arsenal’s £30 million Emirates deal.

Recently, Chelsea announced a new deal with Yokohama Rubber for a reported

£38-40 million. Therefore, Liverpool will be looking for a significant

improvement when their current deal expires at the end of the 2015/16 season

with figures of at least £30 million being discussed.

Last month Liverpool announced a “record” New Balance kit

deal, switching from Warrior to their current supplier’s parent company. No figures

were divulged, but I suspect that the basic deal is worth the same amount as

the six-year deal signed with Warrior in 2012, namely £25 million a season,

with the increase coming from the other part of the deal, i.e. earnings from

merchandising sales, due to New Balance’s better distribution network. Whatever

the exact details, it will have to go some to match Manchester United’s

“largest kit manufacture sponsorship deal in sport” with Adidas, which is worth

£750 million over 10 years or an average of £75 million a year from the 2015/16

season.

Match day income grew by £6 million (14%) from £45 million

to £51 million, mainly due to additional pre-season matches, ticketing and

hospitality revenue, though this was partially offset by not having any European

matches. The pre-season tour attracted huge crowds including 95,000 in

Melbourne and 82,000 in Jakarta. Great stuff, but Liverpool’s match day income

is still miles behind Manchester United and Arsenal, who both generate over

£100 million – or more than twice as much.

In order to address this difference, FSG plan to expand

Anfield in much the same way they successfully redeveloped the Fenway Park

Stadium for one of their other clubs, US baseball team the Boston Red Sox. The

plan is to expand the Main Stand capacity by 8,300 seats taking the overall

Anfield capacity to around 54,000, which should be complete for the 2016/17

season. Potentially, there would also be a further increase of 4,800 seats in

the Anfield Road stand at a later date.

It is estimated that this would increase revenue by £25

million: £20 million from the extra seats and (an ambitious) £5 million for

naming rights for the stand (though importantly the club would keep the famous

Anfield name for the stadium as a whole). The additional seat income is largely

driven by 4,500 corporate seats, which Ayre says is vital for the plan’s

viability: “Corporate hospitality revenues are essential. This means we will

pay the debt back quickly… while increasing revenues into the playing squad.”

"Sterling service"

Including the cost of acquiring the land, this project will

cost well over £100 million, but it is likely to be funded by an interest-free

loan from the owners, thus eliminating the need to make steep interest

payments, as Arsenal are still doing for their Emirates Stadium.

This all sounds very promising, as relatively low match day

income has long been Liverpool’s Achilles’ heel, but every silver lining has a

cloud and there has been much concern among supporters’ groups about ticket

prices. Season tickets have risen by around 10% over the last few years, which

is more than other leading clubs. Liverpool chairman Tom Werner is clearly

aware of the fans’ discontent: “We are committed to working towards a tiered

solution at Anfield, so there are affordable tickets as well as tickets that

are higher priced.” We shall see. Certainly the new TV deal should give clubs

the opportunity to address ticket prices.

Wages increased by £13 million (10%) from £131 million to

£144 million, largely due to higher bonus payments “as a result of the impact

of the 2nd place Premier League finish.” Interestingly, Ian Ayre has spoken of

making player contracts more performance-related, which seems very sensible.

Despite this wages growth, the wages to turnover ratio was cut from 63% to a

very respectable 56%, the lowest for five years.

The highest paid director, presumably Ayre, earned £1.032

million, which is almost exactly the same amount as he was paid the previous

season.

Note: these wage figures have been adjusted from the staff

costs in the club’s accounts to exclude once-off exceptional items (for

pay-offs to departing coaching staff), as most clubs show these separately.

Liverpool’s £144 million is the 5th highest wage bill in

England, exactly in line with revenue, behind Manchester United £215 million,

Manchester City £205 million, Chelsea £193 million and Arsenal £166 million.

United’s wage bill is almost 50% (£71 million) more than Liverpool.

The different investment policies of the last two sets of

owners can be clearly seen by looking at the net transfer spend: in the three

years leading up to 2010/11 the club had net sales proceeds of £8 million, but

there has been net spend of £135 million in the four years since then, even

after a number of big money sales including Torres and Suarez. It was

imperative that Fenway splashed the cash after Hicks and Gillett kept their

hands in their pockets and they have done so. This season alone, they have

bought Lallana, Markovic, Lovren, Balotelli, Moreno, Can, Origi and Lambert with

the proceeds of the Suarez sale.

That said, Liverpool have still been outspent by other clubs

in that four-year period, especially by Manchester United £260 million, but

also Manchester City £212 million and Chelsea £196 million. They have however

spent more than Arsenal, even though the Gunners bought Mesut Ozil and Alexis

Sanchez, and Tottenham, whose figures are impacted by the sale of Gareth Bale

to Real Madrid.

Net debt has increased by £12 million from £114 million to

£126 million. As there are only modest cash balances of less than £500,000,

gross debt is £127 million, made up of interest-free loans of £69 million from

the owners (unchanged from last year) and bank loans of £58 million (up £10

million). Note that the reported net debt excludes £20 million owed to the

subsidiary Liverpoolfc.TV Limited.

Although debt has been steadily increasing since 2011, it is

still nowhere near the shocking levels reported under the previous hated

regime. While there was “only” £123 million net debt in the football club, the

full picture was revealed in the holding company where borrowings had grown to

nearly £400 million. Fortunately, this debt was largely eliminated following

the change in ownership.

In addition to this debt, Liverpool have contingent

liabilities of £12.8 million, which represent fees that may be payable

depending on contractual clauses such as number of appearances, Champions

League qualification, etc. Similarly, Liverpool will potentially receive £3.3

million from other clubs. Debt will surely increase for the stadium

development, though this should be provided by the owners.

Since FSG bought the club, they have actually had lower cash

flow available from operating activities: £81 million in four years, compared

to £123 million in the previous four years. Despite this, they have spent more

on players (£152 million vs. £110 million), though less on capital expenditure

(£16 million vs. £52 million). This has been funded by higher bank loans,

making use of a revolving credit facility.

There has actually been relatively little funding from FSG,

though they did of course write-off the previous debt and injected £47 million

into the club in 2012, which was used to fully repay the outstanding stadium

loan. All these external loans have meant relatively high interest payments:

net £29 million over the last eight years.

Liverpool have managed to avoid any FFP issues, even though

their cumulative pre-tax loss of £89 million for the last three seasons is

clearly higher than UEFA’s €45 million limit (assuming the owners cover the

deficit by making equity contributions). This is because UEFA permits some

“good” costs to be excluded from its break-even calculation, such as stadium

development, youth and community development and goodwill amortisation.

However, the clause that has probably most helped Liverpool

is the possibility to exclude the wages for players signed before June 2010

(when the FFP rules were introduced). Theoretically, this would only be allowed

if Liverpool’s losses had reduced from 2011/12 to 2012/13, which was not the

case, but as the 2011/12 accounts only covered 10 months, the argument must

have been that it would have been higher on an annualised basis.

Despite the potential problems for Liverpool, John W. Henry

has actually been one of FFP’s staunchest advocates: “Financial Fair Play is a

much bigger solution to the problems Liverpool and other clubs are trying to

compete against.”

"Little Red Corvette"

Going forward, Liverpool should not experience any more FFP

issues, as their revenue will continue to grow. The 2014/15 accounts will be further improved by

Champions League money plus the Suarez transfer (and the accounts state that the net effect of player sales will be a £52 million profit), while the figures in 2016/17

will be enhanced by the Anfield expansion and the blockbuster new Premier League

TV deal, especially as Premier League rules prevent much of this money being

used on player wages.

If Liverpool can also improve their record in the transfer

market by successfully investing in young players, that will not only help the

squad, but potentially lead to the club once again making money on player

sales.

Returning to profit after so many years is only one step in

the club’s journey, but, as those sons of Liverpool, Echo and the Bunnymen,

once said, “A show of strength is all you want.” Although there is still much

to do, it is difficult to argue with Ian Ayre, who said, “With a hugely

supportive ownership we have brought financial stability back to this football

club and we now have the right structure, platform and ambition to continue

growing on and off the pitch.”

Vauxhall. Garuda, Dunkin Donuts and Subway are not included in these set of accounts. They will be seen from next set

ReplyDeleteI'm not sure if the others are included partly or not, but the Garuda training kit deal definitely started this season. It is supposed to be worth £32m over two years, so our commercial revenues should have gone up quite a bit this season.

DeleteYes, I should have made it clearer that many new deals will only be included in the 2014/15 figures.

DeleteThis comment has been removed by the author.

ReplyDeleteThe daily mail reported that the New Balance merchandise deal works out at £300 million . I'm not sure of the time frame.

ReplyDeleteLiverpool signed a six-year deal with Warrior in 2012 which was worth £25m a season, with the club estimating they could make as much again in additional merchandising – making the whole package worth a potential £300million. New Balance basically took over that deal.

DeleteGood stuff. Although I feel some of your conclusions are very naive.

ReplyDeleteTicket prices will increase. The decision to stay at Anfield means that the stadium will be like a visit to the museum(it's meant as a compliment!) in the future. a lot of those seats will probably be sold to tourist visiting from abroad. They'll probabaly lower prices for dead rubber games to show their goodwill towards the supporters.

Funnily enough, the main reason the club is doing well in my opinion is that the current owners are competent. There isn't anything groundbreaking in their way of running the club. It's just that they are sensible. They have brought good business practices in the club. It's incredible to think how badly some clubs are run by people who are considered to be good businessmen. It seems they lose their head when they get their toy. Credit to them.

The next few years leading up to the opening of the renovated stadium will be crucial for the club imho.

Should the owners and the manager invest intelligently in the playing squad with on-field success(consistent top4 and cup success), the potential to move up the Deloitte money list and increase revenues is within grasp. Without on-field success though, it's going to be difficult increasingly to market the club abroad imho.

Whatever be the case if FSG manoeuvre the stadium debt correctly, it's going to be their legacy.

Here's what I actually wrote about ticket prices:

Delete"This all sounds very promising, as relatively low match day income has long been Liverpool’s Achilles’ heel, but every silver lining has a cloud and there has been much concern among supporters’ groups about ticket prices. Season tickets have risen by around 10% over the last few years, which is more than other leading clubs. Liverpool chairman Tom Werner is clearly aware of the fans’ discontent: “We are committed to working towards a tiered solution at Anfield, so there are affordable tickets as well as tickets that are higher priced.” We shall see. Certainly the new TV deal should give clubs the opportunity to address ticket prices."

I'm not really sure how you can describe that as "very naive".

Fair enough.

Delete"Liverpool chairman Tom Werner is clearly aware of the fans’ discontent

Certainly the new TV deal should give clubs the opportunity to address ticket prices"

He won't do anything about it irrespective of how much money TV companies throw at the club. It doesn't make any business sense. Why would he renovate the stadium to get more seats only to reduce ticket prices, limiting matchday revenue? That was the naivety point.

Anyway it's a minor point. I mostly agree with what you write.

Thanks for the write up, Swiss Rambler. My concern is that, despite our increases in revenue we are still falling short, in percentage terms, of the teams that are ahead of us financially, Manchester United in particular. Is there a possible future where we can bridge that gap? I don't know, but I do know that without it we will always get outbid on wages for players that we are in for.

ReplyDeleteAny thoughts?

Great writing as ever SR. Depressing looking at how the other big clubs are increasing their revenues with monstrous sized deals from the likes of Gazprom, Qatar Tourist Board etc but big money attracts big owners and what happens becomes less intelligible to the mere mortal.

DeleteHas to be said though that TV and the competition structures are keeping the product on people's screens.

I think the owners have already made the strategy clear. They have tried to buy 24 year old excellent players and been continually knocked back. Their greatest successes have come from buying young players for both the first team and the academy.

DeleteThere's simply no point trying to go up against oil money but those clubs will also lose out on some players who don't believe they will get playing time.

Mourinho selling Schurrle and buying Cuadrado is what you do when you dine at the top table rather than look to the future.

He won't be worth much when they're done with him but they have spent £100m each year for the last 3 years and need to complete for the top prizes now.

For us our players are increasing in value so the ones who choose to leave are going to generate big fees for reinvestment. Some will leave for whatever reason, but we are building a decent supply chain and playing style and look like we can be valid competitors for the title going forwards.

We will attract some players if we can stay in the CL that's for sure. Not all but enough.

I don't have a problem not being Real Madrid for example.

Excellent writing as ever. I'd be interested to see what your recommendations would be for a club like Liverpool. The player acquisition strategy whilst sensible financially doesn't look like delivering on the pitch, at least in the Premier League. Is the answer to continue to develop the stadium further? If they could add another 5,000 to the Anfield Road and then if they could develop the Kop to the same height as the new main stand (big if given the proximity of Walton Breck Road behind it, but the North Stand at OT bridges the road behind it, so not impossible, but would also involve buying up the businesses and houses located there, again not impossible as the redevelopment of both the Main Stand and the then Kemlyn Road have shown), then you could be looking at a similar capacity to OT. From there the top line difference would only be commercial (where admittedly Man U are currently stronger) and performance related revenue. With Man U no longer guaranteed CL qualification and with their commercial revenue being increasingly linked to CL qualification its possible the gap could be bridged in the foreseeable future...

ReplyDelete