So Manchester City are once again spending big, with this

summer’s transfer window seeing the arrivals of Kevin De Bruyne, Raheem

Sterling, Nicolas Otamendi, Fabian Delph and Patrick Roberts. This should have

come as no surprise given comments from chairman Khaldoon al Mubarak earlier

this year, “We want to go to the next level and a squad that has the capability

and quality to win the Premier League and compete in and win the Champions

League and go all the way in tow cup competitions in England.”

However, the question on everyone’s lips was how could they

do this without falling foul of UEFA’s Financial Fair Play (FFP) regulations?

There have been a few articles attempting to provide an answer, but they have

tended to focus on the generic issues with FFP, while this piece will attempt

to look at the specifics for City.

After an initial period of major investment following the

club’s purchase by Sheikh Mansour, which peaked with £155 million of gross spend

in 2010/11, City had been reducing their activity in the transfer market

(relatively speaking) until this summer’s £142 million outlay.

Interestingly, City’s gross spend in the last five years of

£462 million (averaging £92 million a season) is almost exactly the same as the

£456 million spent in the previous five years – though most of this (£407

million) was incurred in the three years after the new regime arrived in

September 2008.

Of course, there are two sides of a market and City managed

to recoup £51 million through player sales, giving a net spend of £91 million.

Obviously this is still on the high side and most clubs can only dream of such

a level of expenditure, but it’s not quite so dramatic as the gross spend

figure widely reported. It is also worth noting that this is the highest annual

player sales figure achieved to date by City.

To an extent City have been playing catch up this summer, as

UEFA had imposed restrictions on their transfer spending last year.

Nevertheless, City still have the highest net spend over the last two season of

£151 million, though Manchester United are pretty much at the same level with

£145 million, as Moyes and Van Gaal have both endeavoured to reinvigorate their

squad following the departure of Sir Alex Ferguson.

Both Manchester clubs are a long way ahead of the other

Premier League clubs in terms of net spend with the closest challengers being

Arsenal £74 million (around half as much), Newcastle United £62 million and

Liverpool £57 million.

At this stage we have to get a little technical in order to

understand how football clubs accounts for player trading, as this is important

for FFP. The fundamental point is that when a club purchases a player the costs are spread over a few years, but any profit made from selling players is immediately booked to the accounts.

Basically, football clubs consider players to be assets, so do not fully expense transfer fees in the year a player is purchased, but instead write-off the cost evenly over the length of the player’s contract via player amortisation – even if the entire fee is paid upfront.

Basically, football clubs consider players to be assets, so do not fully expense transfer fees in the year a player is purchased, but instead write-off the cost evenly over the length of the player’s contract via player amortisation – even if the entire fee is paid upfront.

So if a player is purchased for £25 million on a five-year

contract, the annual amortisation in the accounts for him would be £5 million, i.e.

£25 million divided by five years. This means that the player’s book value

reduces by £5 million a year, so after three years his value in the accounts

would be £10 million, i.e. the original transfer fee of £25 million less £15

million cumulative player amortisation (three years at £5 million a year).

If the player were to be sold at this point for £32 million,

the profit on player sales from an accounting perspective would be £22 million

(sales proceeds of £32 million less remaining book value of £10 million).

Another way of looking at this is that the cash profit is £7 million (sales

proceeds of £32 million less £25 million purchase price), but we then add back

the £15 million of player amortisation already booked to the accounts.

This is all fairly tedious stuff, but it does have a major

influence on a football club’s bottom line and will help explain why City’s

transfer activity this summer is still in line with FFP.

In this way, although City had gross spend of £141.5 million

(De Bruyne from Wolfsburg £54 million, Sterling from Liverpool £44 million,

Otamendi from Valencia £28.5 million, Delph from Aston Villa £8 million,

Roberts from Fulham £5 million and Enes Unal from Bursaspor £2 million), the

annual player amortisation shown in the books is “only” £26.5 million. As an

example, De Bruyne’s £54 million is equivalent to £9 million amortisation,

because he is on a six-year contract.

Caveat: these figures should only be considered as indicative,

because various different numbers have been reported in the media for transfer fees (partly due to exchange rates used),

but they should be sufficiently accurate to illustrate the argument. I have

also excluded any transfer add-ons from the calculation, as these are dependent on future

achievements, so are not immediately included in the accounts (except in the

notes as contingent liabilities).

City’s wage bill will also increase by £31.7 million a year

for these purchases (again based on widely reported weekly wages), leading to a total

increase in annual costs of £58.2 million.

This works out to a total commitment over the length of the player contracts of a cool £310.5 million (plus £14.5 million of potential add-ons).

This works out to a total commitment over the length of the player contracts of a cool £310.5 million (plus £14.5 million of potential add-ons).

However, we now need to look at the impact of players

leaving City, which has generated sales proceeds of £50.5 million (Alvaro

Negredo to Valencia £24 million, Matija Nastasic to Schalke £10 million, Rony

Lopes to Monaco £9 million, Karim Rekik to Marseille £3.5 million, Scott

Sinclair to Aston Villa £2.5 million and Dedrick Boyata to Celtic £1.5

million).

In addition, City have received £5.2 million in loan fees

(Edin Dzeko to Roma £2.9 million, Stevan Jovetic to Inter £2 million and Jason

Denayer to Galatasaray £0.3 million), giving total receipts of £55.7 million.

On top of that, there would be a further £18 million due for Dzeko and Jovetic if

those deals were made permanent at the end of the loan periods.

After deducting the accumulated player amortisation, the

once-off profit on player sales works out to £40.2 million. In addition, £8.3

million will be taken off the annual amortisation charge.

City have also removed a number of high earners from their

wage bill via free transfers (that obviously did not generate a transfer fee),

notably Frank Lampard, James Milner and Micah Richards, and player loans. On

the assumption that the wages of the loanees will be covered by the other clubs

this season, the annual wage bill will have been cut by £41.2 million, leading

to a total cost reduction of £49.5 million.

So the net result of all of City’s transfer and loan

activity this summer in the accounts is a relatively small increase of £8.7

million, with player purchases growing the cost base by £58.2 million, largely

offset by the £49.5 million reduction arising from sales and loans. This will

be more than offset by the £40.2 million profit on player sales.

As the late, great Sid Waddell once memorably said: “There’s

only one word for that: magic darts!”

City’s initial spending spree was reflected by player

amortisation shooting up from just £6 million in 2007 to a peak of £84 million

in 2011, before tailing off in the last three years to £76 million in line with

less frenetic transfer activity.

That said, this was still the highest in the Premier League

in 2014, followed by Chelsea £72 million, Manchester United £55 million,

Liverpool £41 million, Arsenal £40 million and Tottenham £40 million. As we

have seen, this summer’s renewed spending will likely increase this once again.

Now that people have a basic understanding of how player

amortisation works, you might think that next year’s accounts should also

benefit from the player amortisation on the major purchases in 2011 coming to

an end (assuming five-year contracts). Normally this would indeed be the case,

but there is a further complication at City, as they have frequently extended

player contracts.

In such cases, any remaining written-down value in the accounts

is amortised over the term of the new contract, which means that the annual

amortisation reduces, but the amortisation life is longer.

As an example, Yaya Toure was bought for £24 million in July

2010 on a five-year contract, so the annual amortisation was initially £4.8

million, and should have finished in June 2015. However, after two years, his

contract was extended in June 2012 by a further two years to June 2017, meaning

that he then had five years left on his new contract. At this point, his remaining

value was £14.4 million (£24 million cost less two years amortisation at £4.8

million). The new amortisation charge was thus £2.9 million a year, i.e. the

remaining £14.4 million divided by the five years now left on the contract.

City have extended the contracts for virtually all the big

players signed in 2010/11 at some point (either 2012, 2013 or 2014), which has

had the advantage of reducing the annual amortisation charge in recent years,

but has the disadvantage of extending the period for which these players’

transfer fees are amortised.

The good news is that (by my calculations) the 2014/15

accounts would have benefited from a £14.4 million reduction in amortisation,

but the amortisation on these players will not fully disappear until the 2019/20

accounts.

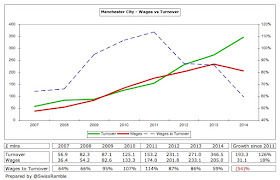

City will continue to focus on their wage bill, which

already fell by 12% (£28 million) in 2014 from £233 million to £205 million.

This meant that the wages to turnover ratio had been lowered (improved) from

114% in 2011 to an impressive 59%.

The magnitude of the 2014 wages reduction has raised a few

eyebrows, especially as the number of football staff was slashed from 222 to

112. This is essentially due to a group restructure, where some staff are now

paid by group companies, which then charge the club for services provided. This

accounting treatment has attracted the attention of UEFA, as some have accused

City of using this as a device to get round FFP.

UEFA have still to rule on whether this is a reasonable

approach, but it should be noted that many of these costs have simply been

booked elsewhere in City’s accounts, i.e. external charges rose £17 million

from £42 million to £59 million in 2014.

In addition, there are a couple of underlying reasons to

explain the year-on-year reduction: (a) the 2012/13 figures included

compensation paid to Roberto Mancini and his coaching staff following their

termination – which other clubs usually report under exceptional items; (b)

chief executive Ferran Soriano has renegotiated a number of contracts with a

lower basic salary, but higher bonus payments.

Whatever the rights and wrongs of City’s reported wages,

they have been overtaken by United, whose wage bill rose to £215 million in

2013/14. However, City’s £205 million is still £12 million higher than Chelsea

£193 million and £39 million higher than Arsenal £166 million. It should be

noted that one of the clauses in UEFA’s FFP settlement with City stated that

they could not increase their wage bill during the next two financial periods

(2015 and 2016) – though performance bonuses are not included.

What is often overlooked when discussing FFP is that it is

just as important for football clubs to grow their revenue, as well as

restraining costs. City have done very well here, increasing their revenue by

around 300% since 2009 – and there is more to come in every revenue stream: TV - through higher Premier League and Champions League deals; commercial - from renegotiating the shirt and kit sponsorship; and match day - after expanding the stadium.

City’s 2013/14 revenue of £347 million was the second

highest in England, only behind Manchester United £433 million, and ahead of

Chelsea £320 million, Arsenal £299 million and Liverpool £256 million.

This placed them 6th highest in world football, though Real

Madrid continued to lead the way with £460 million, followed by United £433

million, Bayern Munich £408 million, Barcelona £405 million and Paris

Saint-Germain £397 million.

The currency effect should be noted here, as last year’s

Deloitte Money League used a Euro:Sterling exchange rate of 1.20. If recent

rates of 1.40 were to be applied, that would have a significant effect on the

overseas clubs in Sterling terms, e.g. Real Madrid’s revenue would fall to £393

million. This Euro weakness partly explains the high level of purchases made by

English clubs this summer.

However, the main driver of the big spending in England is

clearly the money expected from the blockbuster Premier League TV deal in

2016/17. City already received £98.5 million from the central distribution in

2014/15, but my estimates suggest that their second place would be worth an

additional £51.5 million under the new deal, increasing the total received to

£150 million. This is based on the contracted 70% increase in the domestic deal and an

assumed 30% increase in the overseas deals.

Similarly, Champions League TV money has increased from the

2015/16 season with the new deal worth an additional 40-50% for participation

bonuses and prize money and further significant growth in the TV (market) pool

thanks to BT Sports paying more than Sky/ITV for live games.

In 2013/14 City received €35 million from the Champions

League, while I estimate that they will earn around €7 million more (€42 million) for the 2014/15 season, even though they reached the same stage (last

16) in both years.

This is because

City’s share of the UK market pool will be higher, partly as this did

not have to be shared with a Scottish club in 2014/15 (as was the case in

2013/14 with Celtic), but also how this is calculated. It party depends on

how far they progress in the Champions League, but is also dependent on where

they finished in the previous season’s Premier League (which they won in 2013/14,

compared to finishing runners-up the year before).

If City reach the same stage in the Champions League in the

2015/16 season, this could be worth an additional €20 million under the new BT

deal, though this will be adversely impacted in Sterling terms, due to the

weaker Euro.

City also have the potential to further increase their

commercial income – even after impressive growth over the past five years to

£166 million, which in England has left them only behind Manchester United’s

commercial juggernaut that produced £189 million. Critics will argue that this

is built on friendly deals with Arab partners, but the fact is that City are now

signing up many other deals not linked to their owners.

In any case, the groundbreaking 10-year £400 million deal

with Etihad Airways, covering shirt sponsorship, stadium naming rights and the

campus development, now looks to be behind the market, as other clubs have

since raised the bar. It is estimated that the shirt sponsorship element of

City’s deal is worth £20 million a season, which would put City’s deal way

below their competitors: Manchester United – Chevrolet £47 million ($70

million); Chelsea – Yokohama Rubber £40 million; and Arsenal – Emirates £30

million.

In fact, there has been talk of City renegotiating the

Etihad deal upwards to reflect their higher commercial value after two Premier

League titles and regular Champions League participation. Some reports have

speculated that the value could even double to £80 million a season.

There are also rumours that City are trying to negotiate

upwards their £12 million kit supplier deal with Nike, even though their

current six-year contract only started in 2013. There is certainly room for

improvement, as this is now well behind other clubs’ latest deals: United £75

million (Adidas), Arsenal £30 million (PUMA) and Liverpool £25 million

(Warrior).

Finally, City have wised up to the fact that it is better

for FFP to have numerous smaller deals (around the £3-5 million range) flying

under UEFA’s radar, so have been racking these up, thus emulating a key element

of United’s successful commercial strategy.

For the 2015/16 season City have increased the capacity of

the Etihad Stadium by 7,000 seats to 55,000 after adding a third tier to the

South Stand, which should result in higher match day income following record

season ticket sales of 40,000. They have also received planning permission for

potential further expansion up to 62,000 by doing the same for the North Stand.

Although this revenue stream has been on a rising trend,

City’s £47 million is till less than half the money generated by United and

Arsenal (both over £100 million), partly due to City season tickets being among

the cheapest in the Premier League.

After years of heavy spending in order to build a squad and

the facilities required to compete at the highest level, City’s losses have

been steadily reducing since the £197 million peak posted in 2011, effectively

halving each year (2012 £99 million, 2013 £52 million and 2014 £23 million). In

fact, the club has said that it should already be profitable in 2014/15, partly because the

2013/14 loss included the £16

million settlement with UEFA over (disputed) breaches of its FFP regulations

Financial Fair Play has obviously been one of the most

important challenges for Manchester City. According to UEFA’s interpretation of

the regulations, particularly the exclusion of costs of players purchased

before 2010, City failed to meet the break-even targets and as a consequence

were fined €60m (£49 million) of which €40m (£33 million) was suspended.

Other measures included “significantly” limiting spending in

the transfer market for seasons 2014/15 and 2015/16, not increasing the wage

bill in 2015 and 2016 and a limitation on the number of players City could

register for UEFA competitions.

"De Bruyne - X marks the spot"

City were also given specific targets for FFP losses of €20

million in 2013/14 and €10 million in 2014/15, as opposed to the cumulative

allowance of €30 million over those two seasons for all other clubs. In

reality, this should not have been a major issue, as City were allowed to

exclude infrastructure costs and the £16 million FFP settlement for the 2013/14

FFP loss, while they had always planned to be profitable from 2014/15 onwards.

Indeed, the FFP restrictions were duly lifted in July,

though UEFA did note that this was “subject to ongoing additional controls and

audits”, adding: “the club remains under strict monitoring and has still to

meet break-even targets and is therefore subject to some limitations in 2016.”

Some have suggested that the FFP rules are being relaxed in

light of the various legal challenges, but the truth is a little more

complicated than that. Although new owners will now be allowed to make larger

losses, as long as they can produce a business plan that will show how they

will reach break-even, the rules remain in place for clubs like City.

Essentially, UEFA are now arguing that the modified stance is a move from

“austerity to sustainable growth” in an effort to encourage investment into

European football.

"Silva and Gold"

The irony here is surely not lost on City fans, as they have

effectively been punished for embracing exactly this strategy, while others

(like Milan and Inter) will now be able to benefit from the more flexible

approach.

Maybe UEFA had been listening to City captain Vincent

Kompany, who had previously commented on the flaws in FFP: “If you go into the

business world, you can’t say to anyone they cannot invest. I understand the

fans have to be protected, the clubs have to be protected, but plans need to be

accepted. You win things, you get more fans. You get more fans, you create more

revenue. That’s not a stupid way of thinking, of investing in a business.”

One argument against FFP has been that it sometimes seemed

more of an attempt to prevent upstarts like City (and Paris Saint-Germain) from

taking on the established order of elite clubs, rather than tackling the game’s

financial issues. Either way, the regulations have undoubtedly caused City some

headaches.

"Train of thought"

Manager Manuel Pellegrini complained last year that transfer

restrictions meant that his club was not competing on a level playing field,

which supporters at other less wealthy clubs might have found a bit rich, given

previous expenditure but in a way he had a point. In any case, that excuse is

no longer valid after this summer’s spending spree.

Leaving aside the financial issues for a moment, City have

undoubtedly made some great purchases, including the exciting De Bruyne and

Sterling, which will add significant depth to their squad. Whether this will be

enough to help City meet the owners’ demanding objectives remains to be seen. The early signs are promising, as they have started the season like the proverbial house on fire, but older City fans in particular will know that there's an awful long way to go yet.

Premier League football is a farce.

ReplyDeleteCity are the Justin Gatlin of football. Use drugs ( ie money) to bulk up so they can win and then get an enduring effect even when they calm down on the expenditure. Same with Chelsea.

DeleteWill we ever see Notts Forest or their like again, getting promoted and standing a chance? No.

Will we have to put up with a very clubs ever winning? Yes. Will we have to put up with players demanding transfer requests to get higher salaries, also acting like very rich tossers divorced from the fans? Yes. One-club men (unless they started at a big club)? V unlikely.

The magic of football? Declining, will be gone in time as we just see which club has the highest wage bill and expect them to win. It's 20 years since a club other than the usual suspects won the league.

And Tottenham never will, 54 years and counting.

Great piece by the way, as always.

DeleteSpot on, CB. The Premier League is more competitive when you don't factor in the very top of the table, but when you do, there is an iron grip on the top four every year. The only time that Chelsea, Arsenal, and both Manchester clubs all didn't make the Champions League was during United's disaster two seasons ago. That's what it takes for someone else to have a chance- a complete collapse of one of the old guard. The upcoming TV deal may level the playing field, but I doubt it. Big money always finds a way to compete.

DeleteI can make a parallel to baseball, where there are no limits to what a team can spend on players besides a luxury tax for going over a certain amount (even then, only two teams have ever "suffered" this penalty), but it's such an unpredictable sport with not nearly as much talent as soccer that I really can't- not to mention an entire movie was created based on a book about one smaller club's consistent success in spite of not having as much money to spend.

The doping analogy used by the supporters of top clubs of yesteryear amuses me greatly. In what way are manchester City different to Arsenal after the 1st world war, Liverpool in the 70s, United in the 50s and again in the late 80s? Invest more than your competitors do and see the rewards in later years.

DeleteI should remind you that City hold the record for the highest English attendance outside Wembley.

I forgot about that Arab sheikh who bought Manchester United in the late 1980s and gave Ferguson all that money to spend- thanks for reminding me about that, Mr-Ed. I had thought Utd had spent their own money from attendances and merchandising. I was obviously completely wrong!

DeleteUnited didn't generate a pre-tax profit greater than £3.5 Million until 1993 (The year they won the inaugural Premier League)... The investment under Ferguson was upwards of £25 Million (not even getting into Ron Atkinson's spending), now unless I'm mistaken, I don't think the FA Cup Prize money was quite that high in 1990?

DeleteI'm sorry David, since when? Since the 09-10 season when Spurs were in there? Since Liverpool in the 13-14 season? So Chelsea, Arsenal and both Manchester clubs have now locked out the rest of the league for...one year in a row?

DeleteWay way way more disconcerting was before City(and slightly after) were taken over by the ADU group. From 03-04 to 08-09, of the 24 places available only 1 was taken by a team other than Arsenal, Chelsea, Liverpool or United. That was Everton and in that year Liverpool won the CL so they got to compete as defending champions(even though at the time there was no rule that stated the champions were automatic qualifiers, but it's Candlepool and they'll whine and whine and whine until you just give in and let them get their way.) So six consecutive years the same four teams appeared in the CL, did Spurs or Forest do anything in that time to indicate that an oil rich City would take away from them?

Excellent piece. It is good to have this complicated subject explained so succinctly. It does seem that City have a right to feel agreived; their business model has been adopted by UEFA after punishing City. Surely there is a case for reclaiming the fine money and receiving compensation for having to operate within ( falsely ) imposed restrictions?

ReplyDeleteAs a City supporter it is great to see such a balanced and well researched article on our finances which covers all the bases. Thank you for this, great pub ammo!

ReplyDeleteGreat piece as always. But I don't understand the structure of City's commercial income. Ethiad and Nike deals are worth a combined 52 million. However, total commercial income amounts to 166 million which suggests that City receives more than 110 million per year from secondary sponsors. That doesn't seem realistic considering that Arsenal only gets 15 million, Chelsea approx. 30 million and even United (including their training kit deal) only 70 million from their secondary sponsors. Do you have any information on where those extra 110 million are coming from?

ReplyDeleteThat additional income is covered in the Swiss Rambler's article. £3m here, £5m there lots and lots of small sponsors from all over the world. it will only increase as the City Group Model of "Local interest for a Global brand" increases revenue generated from across the world.

DeleteI'm still suspicious about FFP because of last season's sanctions on both City and PSG. If one or the other were slapped with them, then I wouldn't feel paranoid. But when both new-money clubs are penalized, you can make a case that UEFA is trying to enforce the status quo of the usual suspects on the European stage.

ReplyDeleteWell written as always

ReplyDeleteAn excellent article, as usual, by the Swiss rambler but a few points need to be raised that have been missed that are pretty important:

ReplyDeletePoint 1.

Manchester City were released from the constraints of FFP by UEFA in June. To have been released from FFP means that City MUST BE in profit in terms of FFP calculation for season 2014/15. There are no ifs and buts here to have been released from ALL FFP settlement constraints (as they were) City have to show an FFP profit in season 2014/15 or transfer spending would have been limited as per last season. The last sentence in Point 15 in the current FFP FAQ (point 17 in the original FFP FAQ version) confirms this by stating:

"If a club becomes breakeven compliant during the course of the settlement, all sanctions shall cease to apply for the following season, with the exception of the non-conditional element of the financial measure." In City's case the unconditional element was the £16m fine. UEFA's comments on releasing City from all FFP restrictions indicate that the provisional figures that led to City's release must be confirmed by City's audited accounts.

Point 2.

A minor point but around £2m in wage savings and £3.5m in sales have been missed. Milner and Richards were both earning an extra £1m a year (£19.2k a week) in wages than stated in the wage table and the sell-on sales of £700k earned on Trippier (sell on from Burnley to Spurs) and a minimum of £2.8m for Denis Suárez (sell on from Barca to Villarreal) are missing. Basically the whole transfer fee from Villarreal came to City with Barca only making money if he is sold on again.

Point 3.

The figures stated for players salary levels are those that will be paid if City JUST qualify for the Champions League - finishing 2nd or 1st in the Premier League, progressing further in the Champions League and winning Cups will boost every players salary levels considerably further. If City finish 2nd and get to the Champions League QF this year then this will bump up Sterling's salary to around £210k (base £160K), De Bruyne's to around £240k (base around £185k) and the rest of the team by similar amounts. The bonus structure is based on team success and is probably paid yearly in arrears for tax purposes - not in a lump sum).

For all forms of FFP (UEFA & Premier League)these bonus payments will still be considered as wage costs even though they are deferred. Indeed I can see City's total wage bill remaining static rather than decreasing. This means City would have to find an additional £18.2m in revenue a year rather than £8m a year to break even. Point 1 would suggest that this has occurred a year before the additional revenue is required to back up expenditure and City will be able to spend a considerable amount next year as well.

Agree with an earlier commenter that understanding the magnitude of City's commercial revenue, particularly when you subtract out Etihad and Nike, is a bit puzzling. In particular, related party payments (including, of course, the Etihad payments) seem to be somewhat unclear. The various sponsorships are supposed to be applied toward the entire City Football Group (CFG) -- how are these sponsorship funds allocated? What is the magnitude of payments that Man City receives from CFG? Does Man City receive direct payments from CFG and its subsidiary clubs (NYCFC, etc.) related to marketing/brand value, etc.?

ReplyDeleteThe numbers do make sense, in a way, but what is behind the numbers is more murky. The details are intentionally vague, but suspect that the CFG structure essentially allows Man City to both pay itself (with what looks on the surface to be revenue) and defray costs (by allocating them to CFG).

Fantastic analysis as always Mr. Rambler. If only every football fan out there read and understood your work.

ReplyDelete" The doping analogy used by the supporters of top clubs of yesteryear amuses me greatly. In what way are manchester City different to Arsenal after the 1st world war, Liverpool in the 70s, United in the 50s and again in the late 80s? Invest more than your competitors do and see the rewards in later years. "

ReplyDeleteQuite so, Mr. Ed. Indeed, United, for the first six years of Ferguson's time posted what were bad losses for the time. And then they won the league.

What's sauce for the goose, no?

As with Mr-Ed, you do not understand the difference between a club spending its own income on transfer fees and wages, and spending someone else's money (a sugar daddy's). All clubs spend money on transfers, picking out the teams that have been successful in the last few decades does not validate Chelsea or City. Their initial success helped them sustain success but they did it on quite different terms. Look at City before and after colossal cash injection, look at the immense investment in the stadium and infrastructure in the space of just a few years, which has overtaken what Utd have done in development over 25 years! Look at where Man Utd have been throughout their history with the normal peaks and troughs. Utd are currently attempting to compete with City on the basis of their income through attendance,merchandising, sponsorship- City are getting about the same TV money so no advantage there. The rest of City's money is a gift. And because of that, City can still blow Utd out of the water. Chelsea can buy a 28 year old in Pedro for 30 million euros, without even blinking. It's covered by Daddy. You understand the difference now, goosie?

DeleteDid Arsenal spend there own money after WW1? Did Utd Spend there own money in the 50's and late 80's? The answer is NO! Money was invested to gain initial success. Yes, the sums were a lot less but the same principle applies. Your argument is simply one for allowing a monopoly and creating a cartel of the so-called entitled elite.

DeleteIt's not City's problem that the Glazers bought Utd and saddled them with a whole heap of debt from a leveraged buy-out. Blame Utd fan shareholders who sold out.

Anyway it makes no difference anymore, it is clear from Swiss Rambles article that City are actually spending their own money - especially as he points out, the Etihad deal is way below market value these days.

Ergo - you borrowed to get success, we were given money to get success. Pray, what is the difference? We are near as damn it self-sustaining now. Speculating to accumulate is what businesses do. You did it. We, it seems, are condemned for doing it. Again, how does that work?

DeleteCity's money is no longer a "gift" though is it? Swiss Ramble's blogs shows they have grown to become a self-sustaining football cub that is no longer reliant on cash injections from it's owner, with potential to grow even further based on available improvements to revenue streams. To break the dominance of the football cartel - those who had the established fan base/success/revenue tied to winning things a self perpetuating ground hog day occurring all over the football world. - it was always going to take someone with a sizeable investment to come along in order to compete. That's exactly what City's owner's have done. It's a handy drum to bang constantly claiming that the money United spend is their own yadda yadda, but really what difference does it make? We're talking about businesses at the end of the day, in what world do you live in where you subscribe to the view that someone can't invest in their business to compete? In your Ideal world United would be able to negotiate their own TV rights, be able to spend more than the rest and continue to dominate in a way that would eventually kill the game of football dead. That another team has come along and shattered your utopian vision for your clubs future is what upsets you the most, exacerbated by the fact that the identity of that team happens to be your cross-city rivals, a team which you were happy enough to mock and lampoon at every opportunity during your golden era.

DeleteQuite. And after all, it's the likes of United who turned football into big business. And then say "not fair. City want to join in". Cake and eat it? United were one of the clubs who drove through stopping the sharing of home game receipts, and as David Conn's excellent "The Football Business", one of the clubs who hijacked what was to be the FA Premiership, as they saw money coming down the line. So why the problem with other clubs wanting a slice of the cake? Yes, I know we are now a far better run club than United, but hey, **** happens.

DeleteThe commercial income is still largely a gift given by relations. I wouldnt understand what Nike would gain by increasing their payment to Man City as shirt sales for City lag way behind other clubs the last time I looked, but maybe there are new fans in Africa and Asia.

DeleteAnother point of confusion- that a 'rich' club is the same as a 'well-run' club. The 'clever' signings are not Sterling for £49m and De Bruyne for £55m- they're Liverpool getting Sterling from QPR for a few hundred grand and Wolfsburg getting De Bruyne for £14m for Chelsea in the first place. Manchester City are not a definition of a 'well-run' club, a club like Swansea City or West Bromwich Albion are. City have just had immense investment. Strange how for a club enjoying such success at the moment, many of you City fans get terribly defensive about your finances!

Delete" As with Mr-Ed, you do not understand the difference between a club spending its own income on transfer fees and wages, and spending someone else's money (a sugar daddy's). All clubs spend money on transfers, picking out the teams that have been successful in the last few decades does not validate Chelsea or City. Their initial success helped them sustain success but they did it on quite different terms. Look at City before and after colossal cash injection, look at the immense investment in the stadium and infrastructure in the space of just a few years, which has overtaken what Utd have done in development over 25 years! Look at where Man Utd have been throughout their history with the normal peaks and troughs. Utd are currently attempting to compete with City on the basis of their income through attendance,merchandising, sponsorship- City are getting about the same TV money so no advantage there. The rest of City's money is a gift. And because of that, City can still blow Utd out of the water. Chelsea can buy a 28 year old in Pedro for 30 million euros, without even blinking. It's covered by Daddy. You understand the difference now, goosie? "

ReplyDeleteOh dear. All money is the same, and to claim some sort of moral high ground because your money is better than ours is just pathetic. As I noted earlier, United ran up big losses for six years to enable Ferguson to win the league. Nor will we mention bailing you out after the war. Pathetic. Still, whatever gets you through the night.

Thanks for the wonderfully explained business model followed by Manchester city football club. I dont think it will be long before city overtakes united , considering united have underperfmed last 2 seasons and their perceived lack of negotiating skills in transfer market to buy elite players

ReplyDeleteJust a minor point regarding amortisation savings in that I think you might have missed Milner was a £26m signing and hence £5.2m saved with his transfer to Liverpool. Demichelis' contract had expired but then renewed with a further saving of £2.2m.

ReplyDeleteYes, Milner was a £26m signing, but fully amortised in summer 2015 after his 5-year contract expired, so I excluded him from the calculation.

DeleteYou're probably right about Demichelis, but I only focused on the movements in and out of the club for that schedule.

So next year might be a bit more of an issues as i would think there will be lower sales however thats when champions league money increase kicks in and revenue elsewhere will carry on growing. and we have lower costs ?

DeleteYour the least bias and most informed writer on FFP and city but yet you still question the legitimacy of cities sponsorship and wages when nothing has been found wrong and sharing costs is common practice in the case of wages and in terms of sponsorship not related party and now under valued not that they can be over valued if not related

ReplyDeletei predict next season guardiola will arrive and we will go for messi and pogba

ReplyDeleteI predict that neither will come to City next season, and the fact that you are so willing to discard Pellegrini, who is a decent man doing an excellent job, for the glamour/status of Pep shows the mentality of the modern football fan and the state of the City fanbase. Prawn sandwich anyone?

DeleteSo willing to discard Pelle that we just extended his contract. Do keep up.

DeleteGood article on City, and how they stack up against the rest of the Premier League. I do wonder how the club will hold as time passes, as eventually society is forced to not depend on resources that the middle east provides. We sometimes tend to think of football as if it was in vacuum, but the world is much more complicated than that.

ReplyDeleteMr. Swiss Ramble. Like other comments above, I would like more clarification on Man City's commemercial revenue. City are getting more than 110 million pounds a year from 3-5 million small deals? Sounds highly improbable as even an established brand like Man Utd is not getting so much revenue from such deals.

ReplyDeleteIt would be great if you elaborate on this and give us a better idea about the commercial operational structure behind Man city.

Thank you.