Having tried so hard to reach the Premier League, it must

have been a bitter pill to swallow for Cardiff City, as the Bluebirds only

managed to stay in the top flight for one brief season before dropping back to

the Championship. They had been knocking on the door for so long, being

eliminated in the play-offs for three consecutive seasons, before finally

securing automatic promotion after comfortably winning the division in 2013.

The club had been guided to success in that memorable season

by Malky Mackay, but a disappointing start to Cardiff’s first ever Premier

League campaign, allied with a breakdown in trust over transfers between the

manager and owner, Vincent Tan, resulted in the Scot’s departure in December.

He was replaced by the former Manchester United star, Ole Gunnar Solskjaer, who

could not prevent relegation. His torrid time in charge ended in September

2014, when Russell Slade took his place.

The former Leyton Orient manager is renowned for operating

within a tight budget, which is a quality that will be all too necessary for

Cardiff, whose recent history features numerous financial problems. That said,

supporters will have been disappointed with the performances of Slade’s team on

the pitch so far, as Cardiff ended the 2014/15 season in an inadequate 11th

place in the Championship, the worst finish since the 2008.

"Bruno, Bruno"

Big spending under the previous owners, including the

controversial figures of Sam Hammam and Peter Ridsdale, who had plenty of

previous at other clubs, had brought Cardiff to the brink of administration, as

they endured a winding-up order over unpaid taxes and a transfer embargo

imposed by the Football League.

New investment in May 2010 from a group of Malaysian

businessmen, including that man Tan, stabilised the club’s finances. Not only

that, but Tan proceeded to spend heavily to finance the club’s promotion

attempts and gave strong backing to both Mackay and Solskjaer in the transfer

market.

However, this came at a price with Cardiff reporting a

string of heavy losses and building up substantial debt. Despite record revenue

of £83 million in the Premier League, Cardiff still somehow contrived to make a

£12 million loss, which was surely not part of the grand plan.

In fairness, Cardiff’s loss had improved by £18 million from

a staggering £30 million in the Championship, but it still meant that the club

lost £1 million every month and the accounts were just as much in the red as

the shirts worn in the top flight.

Revenue shot up by £66 million from £17 million to £83

million, largely on the back of the Premier League television deal, but Cardiff

also reported increases in all cost categories, even though the previous year

had included £5.2 million of once-off payments triggered by promotion.

The wage bill rose £20 million (62%) from £33 million to £53

million, while player amortisation nearly doubled from £7.4 million to £14.5

million as a result of “significant enhancements to the first team squad.”

There were also a number of not inconsiderable once-off

items, some of which were linked to poor work in the transfer market: (a)

impairment of player values increased by £3 million from £4 million to £7

million; (b) there was a loss on player disposals of £5 million, including the

sale of hapless Danish striker Andreas Cornelius back to FC Copenhagen for a

fraction of his purchase price.

There was also a £5.5 million write-down of the value of the

new East Stand, as this was not to be used in the first season back in the

Championship. Exceptional items of £2 million covered termination payments

following Mackay’s departure, though these were at a similar level to 2013

exceptionals, which were mainly due to the discount on loan note liabilities.

The club benefited from another interest credit of £1.6

million, but this was lower than the previous year’s £5.3 million accrual

release, which represented interest waived on Tan’s loans.

All of this meant that Cardiff were one of just five clubs

in the Premier League to make a loss in the 2013/14 season with only Fulham

(£33 million), Manchester City (£23 million) and Sunderland (£17 million)

registering larger deficits. Most clubs managed to move into the black

following the increase in TV money that season.

Promoted clubs normally have to splash out in their first

season in the Premier League in order to build a squad that can hope to compete

at the higher level, but Cardiff were the only one of the three to fail to make

a profit. Hull City moved from a £26 million loss in the Championship to a £9

million profit in the Premier League, while Crystal Palace’s profits increased

from £2 million to £23 million. In particular, it is striking how much higher

Cardiff’s expenses were than the other two clubs.

Clearly Cardiff’s financial results were greatly influenced

by the £12 million of impairment charges they booked (players £6.6 million,

stadium £5.5 million). To better understand the reasons for the player

impairment, we need to explore how football clubs account for player purchases.

Importantly, transfer fees are not fully expensed in the year a player is

purchased. Instead, the cost is written-off evenly over the length of the

player’s contract via player amortisation – even if the entire fee is paid

upfront.

As an example, if a player was bought from for £10 million

on a four-year deal, the annual amortisation in the accounts for him would be

£2.5 million. After two years, the cumulative amortisation would be £5 million,

leaving a value of £5 million in the accounts. However, if the directors were

to assess the player’s achievable sales value as £3 million, then they would

book an impairment charge of £2 million. Impairment could thus be considered as

accelerated player amortisation.

From Cardiff’s perspective, the 2013/14 impairment charge

has definite advantages in terms of Financial Fair Play (FFP). As clubs are

permitted to make far higher losses under the Premier League regulations (£105

million over three years) compared to the Championship (currently £8 million a

year), it makes perfect sense to book impairment charges in the Premier League

accounts. This approach has the added benefit of reducing annual amortisation

charges in future years (from £2.5 million to £1.5 million in our example).

Cardiff are by no means the only club to employ this fancy

footwork in their accounts, though their £12 million impairment charge was only

surpassed in 2013/14 by Chelsea £19 million and Fulham (also relegated) £17

million.

Without these impairment charges, Cardiff would have broke

even, which would have obviously been a much better result, though it would

still have been the fourth worst financial performance in the Premier League.

Of course, losses are nothing new for Cardiff, as they have

consistently lost money over the years. This is not entirely unexpected in what

the club described as “the challenging financial environment presented by the

Championship”, as very few clubs in this league are profitable.

Interestingly, although Cardiff’s current ownership made

reference to the “imprudent and careless management” of the previous hierarchy,

losses have grown since their arrival: £67 million in the past four seasons

compared to “only” £17 million in the preceding four seasons. The difference,

of course, is that the new owners have at least been able to fund these

shortfalls.

The smallest loss in this period was £0.9 million in 2010,

but even this was due to special factors, mainly the profit from the disposal

of fixed assets of £7.2 million. This largely referred to the sale of the

Ninian Park stadium, which produced proceeds of £7.4 million, plus the sale of

plots or land adjacent to the new stadium to companies associated with Cardiff

City directors: the hotel site to (former director) Paul Guy for £1.8 million

and the House of Sport site to Steve Borley for £450,000.

The 2010 figures also included a £4.2 million profit from

player sales, mainly arising from Roger Johnson’s transfer to Birmingham City.

That was the last time Cardiff made reasonable money from selling players. In

fact, in the four years up to 2010 the club made £17 million profits from this

activity, but slumped to a loss of £5 million in the next four years.

Cardiff’s £5 million loss on player sales was the worst

performance in this area of any Premier League club in 2013/14. This was in

stark contrast to the £104 million profit made by Tottenham, which was

ironically due to the sale of Cardiff-born Gareth Bale to Real Madrid.

Cardiff’s chief executive Ken Choo said that they “took the

hard decision to incur these losses for the good of the club”, referring to the

cost of extricating themselves from the Cornelius purchase (among others). In

total the club said that this one transaction cost the club just under £10

million in transfer fees, salaries and agents’ fees.

On the bright side, the 2014/15 accounts should include a

positive contribution from player sales after the departures of Gary Medel to

Inter and Steven Caulker and Jordan Mutch to Queens Park Rangers.

However, there will also be additional costs incurred with

severance payments to Ole Gunnar Solskjaer and his team. This is becoming a

recurring theme at Cardiff: as well as the £2.1 million paid out in 2014 to

Mackay and his staff, the club also had to pay £1.7 million in 2012 as a result

of Dave Jones’ departure.

So Cardiff’s player trading has been disappointing, while

the accounts have been impacted by a series of exceptional items, but the

underlying business has not been that great either. A good way of checking this

is to look at the club’s EBITDA (Earnings Before Interest, Taxation,

Depreciation and Amortisation), which has been consistently negative, before

rising to £22 million in the Premier League season.

In particular, the 2013 EBITDA of minus £20 million was

markedly worse than other years. While much of this was attributed to

“significant bonus payments in relation to promotion to the Premier League”,

this does not fully explain the deterioration. There is a mysterious non-cash

movement of £13.8 million mentioned in the cash flow statement, but this is not

detailed.

Although Cardiff’s EBITDA improved by £42 million in 2014,

their £22 million was still among the lowest in the Premier League, only ahead

of Aston Villa £19 million, Sunderland £13 million, WBA £9 million and Fulham

£2 million. In fairness, few people would expect them to compete with the likes

of Manchester United £130 million and Manchester City £75 million, and Cardiff

is around the same as their Welsh rivals Swansea City, who are often portrayed

as a model club.

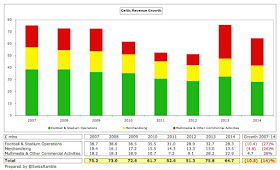

Cardiff’s revenue growth is obviously dominated by the

impact of promotion to the Premier League with revenue of £83 million almost

four times higher than the £17 million earned in the Championship. Most of the

£66 million increase was down to the much higher TV money, which rose £59

million from £5 million to £64 million, but there was also solid growth in

commercial income, up £4.7 million from £6.2 million to £10.9 million, and

match day, £2.1 million higher at £8.3 million.

Revenue in the Championship years was largely influenced by

success on the pitch, either through domestic cup runs or progress to the

play-offs. In this way, the increase in 2012 from £15.9 million to £20.2

million was driven by reaching the Carling Cup final against Liverpool, which

was worth £2.3 million, while the 2008 growth was similarly enhanced by

reaching the FA Cup final against Portsmouth.

Despite the steep revenue growth in 2013/14, Cardiff’s £83

million was actually the lowest in the Premier League in 2013/14, just behind

Hull City £84 million and WBA £87 million. It is worth noting that the three

relegated clubs (Cardiff, Fulham and Norwich City) were all in the bottom six

in revenue terms, though this is admittedly a somewhat of a “chicken and egg”

point, as the Premier League TV distributions partly depend on where a team

finishes in the league.

Like every other Premier League club, Cardiff were in the

top 40 revenue earners worldwide, according to the Deloitte Money League, which

sounds very impressive, if it were not for the fact that this does not help at

all domestically. For example, five English clubs earn more than £250 million a

season with Manchester United leading the way at £433 million – or more than

five times as much as Cardiff. This really highlights the magnitude of the

challenge for the smaller clubs in the Premier League.

Over three-quarters (77%) of Cardiff’s revenue in the

Premier League came from television with just 13% from commercial income and

10% from gate receipts. This was very different to the more balanced revenue

mix in the Championship: commercial 36%, match day 36% and broadcasting 28%.

The club notes in the accounts that its principal risk is

“substantially lower” broadcasting revenue in the lower leagues, but amazingly

five Premier League clubs had an even higher reliance on TV money than Cardiff

with Crystal Palace and Swansea City both earning around 82% of their revenue

from broadcasting.

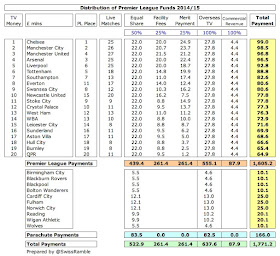

Cardiff’s share of the Premier League television money was

£62 million in 2013/14, based on the fairly equitable distribution methodology.

Most of the money is allocated equally, which means each club receives 50% of

the domestic rights (£21.6 million in 2013/14), 100% of the overseas rights

(£26.3 million) and 100% of the commercial revenue (£4.3 million). However,

merit payments (25% of domestic rights) are worth £1.2 million per place in the

league and facility fees (25% of domestic rights) depend on how many times each

club is broadcast live.

As a result, Cardiff’s merit payment for finishing last was

only worth £1.2 million, compared to the £11.1 million received by 12th placed

Swansea City. The Bluebirds’ distributions were also restricted by being

broadcast live just 8 times, though they were actually paid on the basis of 10

times, which is the contractual minimum. This meant that they only got £8.6

million, compared to, say, Aston Villa’s £13.1 million for being shown live 16

times.

Of course, in 2014/15 in the Championship Cardiff will

receive a lot less TV money, amounting to around £28 million. This will

comprise a parachute payment of £25 million and a Football League distribution

of £1.7 million plus some money for cup runs, live matches, etc. That will mean

a painful reduction in TV money of £36 million year-on-year.

That might sound horrific, but most clubs in the second tier

receive just £4 million from television, regardless of where they finish in the

league, comprising the £1.7 million from the Football League pool and a £2.3

million solidarity payment from the Premier League. Note: clubs receiving

parachute payments do not also receive solidarity payments.

Parachute payments are currently worth £65 million over four

seasons (£25 million in year 1; £20 million in year 2; and £10 million in each

of years 3 and 4) and have a big influence on a club’s finances in the

Championship.

However, the Premier League has recently announced changes

to this structure, whereby from 2016/17 clubs will only receive parachute

payments for three seasons after relegation, although the amounts will be

higher (my estimate is £75 million, based on the advised percentages of the

equal share paid to Premier League clubs: year 1 - 55%, year 2 - 45% and year 3

- 20%).

Clearly, being in the Championship will have a major adverse

impact on Cardiff’s revenue. On top of the estimated £36 million fall in broadcasting,

there will also be reductions in match day and commercial. I would expect gate

receipts to fall back by £2 million to around 2012/13 levels of £6 million, as

lower average attendances are slightly offset by more home games in the cup

competitions; while commercial income is likely to drop by at least a third (£4

million) from £11 million to £7 million, depending on whether sponsorship deals

have relegation clauses.

That would produce a total reduction in revenue of £42

million from £83 million to £41 million, though this is still likely to have

been one of the highest in the Championship last season (along with fellow

relegated clubs, Norwich City and Fulham), which makes Cardiff’s mediocre performance in the second tier

all the more disappointing. To place this into context, in the Championship in

2013/14 QPR boasted the highest revenue with £39 million, followed by Reading

£38 million and Wigan Athletic £37 million.

Match day income rose by 33% (£2.1 million) from £6.2

million to £8.3 million in 2013/14, but this was still the third lowest in the

Premier League, only ahead of Stoke City £7.7 million and WBA £7.0 million.

Cardiff’s revenue was actually around £1 million less than Swansea’s £9.2

million, even though their average attendance of 27,430 was considerably better

than their Welsh competitors’ 20,407.

In fact Cardiff’s attendance was a very respectable 13th

highest in their season in the top flight, though gate receipts were influenced

by a five-year freeze on season ticket prices.

Cardiff’s attendances had been on a rising trend since the

13,800 low point in 2007/08, boosted by the move to the Cardiff City Stadium in

2009, with more than 5,000 additional people attending in the Premier League.

However, they have lost more than 6,000 (23%) following the return to the

Championship and registered their lowest ever crowd of 4,194 at the new stadium

for a FA Cup 3rd round match against Colchester United in January.

These are worrying signs, especially as the season ticket

sales for the 2015/16 season have only just passed the 10,000 mark, compared to

16,500 last season and 22,500 in the Premier League. This is a sign that many

fans have become disenchanted with the club, not least the team’s insipid

displays on the pitch.

The club’s net contribution to the new stadium on completion

of the core build was £26 million with other funding being provided by the

local council, who granted Cardiff a 150-year lease for an annual rent of

£180,000. In addition, the club paid the council £720,000 on promotion to the

Premier League.

The stadium originally had a capacity of nearly 27,000 when

it was completed in 2009, but this has been expanded following a further £12

million investment by the club to 33,280. However, this has effectively been reduced

to around 28,000, as the new stand has been mothballed for the forthcoming season due to poor ticket

sales.

Commercial income surged 75% (£4.7 million) from £6.2

million to £10.9 million in 2013/14. Although this the fifth lowest in the

Premier League, that’s a pretty good performance, only just behind Premier

League stalwarts Everton £12.7 million and Fulham £12.3 million. As might be

expected, clubs like Manchester United £189 million and Manchester City £166

million are out of sight, but that’s not really a valid comparison. A better

comparative for Cardiff would be Swansea City, who only generated £8.3 million

from commercial operations.

The club has focused on “improved commercial partnerships”,

which is fair enough, but few were supportive of the “strategic decision” to

change the colour of the home strip from blue to red, even if the “rebranding

was seen by the club as a positive step in securing future commercial

opportunities.” Fortunately the club decided to revert back to its traditional

blue in January 2015, after many supporter protests and diminishing

attendances, which may or may not have persuaded Adidas to commit to a

long-term kit supplier deal this month.

The shirts are emblazoned with the “Visit Malaysia” slogan,

but it is not totally clear how much Cardiff are being paid for the privilege.

An analysis by the respected Sporting Intelligence website put the annual value

at just £500,000, while the club accounts list various figures: £1 million in

2012, £750,000 in 2013 and nothing in 2014.

A response in the Malaysian parliament suggested that the

deal was worth £7.35 million in total, but the Tourism Ministry was only

contributing less than half that amount. Again it was not clear whether this

referred to an annual figure or the total cost of the deal over a number of

years.

The wage bill was up a hefty 62% (£20 million) from £33

million to £53 million, though the underlying increase was probably even

higher, as the 2013 figures were inflated by “significant” bonus payments.

However, following the massive revenue growth, the wages to turnover ratio

improved from a barely credible 189% to a respectable 64%.

Even so, that ratio was still one of the highest in the

Premier League, only “beaten” by four clubs. Interestingly, Swansea’s ratio was

almost identical to Cardiff.

However, Cardiff’s £53 million was one of the lowest wage

bills in the division, only ahead of three clubs: Norwich City £50 million,

Crystal Palace £46 million and Hull City £43 million. Money usually talks in

the football world, so it is perhaps unsurprising that Cardiff were relegated,

though it is worth noting that Palace comfortably outperformed them.

There is one mysterious note in the accounts that mentions

an additional £1.7 million paid to “key management personnel” on top of the

staff costs. The recipient of this money is not explained, but my guess is that

it is linked to a consultancy agreement for someone senior.

In 2014/15 the wages should have been cut considerably in

the Championship, as player contracts should include relegation clauses. In

addition, Russell Slade has been tasked with slashing the wage bill by

offloading a number of players to reduce a squad that had become too bloated.

The new austerity was typified by Matt Connolly and Kenwyne Jones being allowed

to go on loan to other Championship clubs in the second half of the season for

“business reasons”.

It is to be hoped that the club has also managed to cut its

Administration Expenses, which have exploded in the last two years, rising from

£7 million in 2012 to £16 million in 2013 and then £40 million in 2014. Some of

the exceptional items discussed earlier will have had an impact, but that does

not fully explain this puzzling increase in non-footballing costs.

For many years Cardiff were essentially a selling club, not

least because the Football League imposed a transfer embargo for a while, but

Tan has financed a bit of a spending spree (relatively speaking) in the drive

to reach the Premier League. Following a series of disappointments in the

play-offs, the club recognised that the playing squad had “insufficient

strength in depth to sustain a strong promotion challenge”, so this spending

was to a certain extent vindicated when they finally achieved their target.

However, this approach did not work so well in the Premier

League with Tan furious about what he perceived to be over-spending on players

who failed to deliver on the pitch, so much so that Mackay and head of

recruitment Iain Moody paid the price with their jobs.

Over the course of the last three seasons, no Championship

club has spent more than Cardiff, even after the net sales in 2014/15. In that

period, Cardiff’s net spend was £28 million, more than Norwich City £24

million, Fulham £16 million and Nottingham Forest £12 million. Granted, this

comparison has to be treated with some caution, as the figures are distorted by

clubs that played in the Premier League the previous season, but Cardiff

supporters would surely be entitled to expect a better return on this amount of

expenditure.

The question is whether Tan will maintain his investment at

these levels. The accounts stated, “Following relegation from the Premiership,

the owners are aware that they need to again invest to strengthen the playing

squad, but that they need to spend wisely.” That’s hardly definitive, nor is it

particularly encouraging, given that they made a very similar statement about

spending wisely the previous season and that did not work out too well.

Moreover, Russell Slade’s assessment was slightly different,

“We are having to shop in a different area. We are not shopping at Harrods

now.” Despite the cutbacks, Slade somewhat defiantly claimed that “the ambition

is still to try and get into the top six”, but Cardiff’s transformed approach

cannot make this any easier.

Cardiff’s total liabilities of £157 million are now £66

million more than the club’s assets and include £135 million of debt. The vast

majority of this, £130.3 million, is owed to the club’s overseas shareholders.

As £7.5 million has been provided by Torman Finance Inc, a company believed to

belong to chairman Mehmet Dalman, the remaining £122.8 million is from Vincent

Tan. Interest accrues on these loans at an annual rate of 7%, though the total

due to May 2014 was waived in September 2013.

These shareholder loans have been rising at an alarming

rate: from £15 million in 2011 to £130 million just three years later. The

increase in 2014 alone was £65 million, which just about doubled this debt. To

put it simply, Tan basically lent his way to promotion, but is now back to

where he started – except he is now significantly out of pocket.

More positively almost all of the other external debt has

been paid off with only £4.6 million loan stock remaining. This agreement had

been renegotiated down from £24 million to £15 million in 2006 in exchange for

future income from stadium naming rights plus a one-off payment of £5 million

if the club achieved Premier League status.

"The Iceman Comes"

During 2014 the outstanding debts to PMG Estates Limited

(that helped fund the new stadium build) and the Sport Asset Capital player

finance fund were finally repaid. In 2009 these had been as high as £9.8

million and £3.8 million respectively. The other stadium loan of £7.1 million

was paid off earlier with the proceeds of the Ninian Park sale.

Even though nearly all Cardiff’s debt is owed to the club’s

shareholders, it is still a concern, as Tan could demand repayment at any time.

It is particularly worrying, given that the owner has frequently promised to

convert his loans into equity, which he can do at any time at a fixed

conversion price of 15.61 pence per share. Back in August 2013, he stated, “We

are in the process of turning loans into equity. It will take the club to

almost debt-free, probably in the next couple of months, God willing.”

This may have been derailed by the disagreement with Mackay,

but that argument does not really wash. It just seems like he is no longer so

keen on the idea following comments made in May 2014: “I will convert some of

my debt to equity, but not all, because the amount is very big. Maybe I will

convert £50 million and leave £100 million debt.” Actions speak louder than

words and he only actually converted £2.5 million in 2014, which hardly seems

worth the effort.

As a result, Cardiff had the third highest gross debt in the

Premier League with their £135 million only behind Manchester United (following

the Glazers’ leveraged buy-out) and Arsenal (to finance the Emirates Stadium

construction). Of course, both those clubs also had substantial cash balances

(Arsenal £208 million, United £66 million), while Cardiff only held cash of

around £1 million.

In fairness to Tan, he and his colleagues have put a

colossal amount of money into Cardiff City, around £142 million by my

calculations, split between £130 million of loans and £12 million of new share

capital. This has covered large operating losses, while funding player

purchases and investment in infrastructure, so that the books are balanced from

a cash perspective. As Slade said, “The figures are staggering – the amount of

money and support he has given this football club.”

The club’s annual report said that the Malaysian investors

“will continue to support the company in the foreseeable future”, but added two

important provisos, namely that “the business develops as planned” and

“long-term funding is not guaranteed.” That’s not exactly an unequivocal

commitment.

An additional worry might be Tan’s expanding portfolio of

football clubs, as he recently added KV Kortrijk in Belgium to FK Sarajevo in

Bosnia and (a minority share in) MLS franchise Los Angeles FC), though these

could just as easily be used to provide talent to Cardiff in the future.

In any case, the advent of FFP should at least apply a brake

to Tan’s spending in the Championship, even if he did want to again bankroll

the club. Dalman recently emphasised the need for Cardiff to operate “in a

viable and financially sustainable manner.”

"Complete Control"

Tan himself has observed, “Cardiff is very important to me.

I have put in a lot of money there. I hope to be able to take Cardiff to the

Premier League again, but we will not do it in a silly way. We will do it in a

more commercially clever manner.” Some have taken this as an indication that

the club might be willing to sell some of its better players over the summer

with bids reportedly having been received for David Marshall, Peter Whittingham

and Joe Mason.

However, it is also worth remembering that this is the last

season that Cardiff will receive big money from parachute payments (£20 million), as these

drop to £10 million from the next year. It might therefore be tempting to once

again “speculate to accumulate”, especially as Tan does not seem like the kind

of man to patiently bide his time in the Championship. Whichever strategy

Cardiff opts for, the harsh reality is that there are no guarantees in football

– no matter how much you spend.