The 2014/15 season was not one of the best for Everton, as

they slumped to 11th in the Premier League. Not just my assessment, but also that of the club’s hierarchy, as chairman Bill Kenwright drily

observed that “last season was not the one Evertonians had hoped for.” Even the

normally irrepressible manager Roberto Martinez noted, “2014/15 was a very

tough and demanding season at times.”

This was particularly disappointing, as the previous season

(Martinez’ first in charge) had seen Everton achieve a club record points haul

in the Premier League era, finishing 5th and thus qualifying for the Europa

League.

Despite a glut of injuries, Everton have returned to form

this season and currently sit 7th in the league, while there is a decent chance

of silverware in the Capital One Cup, where they have progressed to the

quarter-finals.

"Spanish Steps"

In contrast to the travails on the pitch, chief executive

Robert Elstone claimed, “We made great strides off the pitch in 2014/15”, though

in truth Everton’s financial figures were a bit of a mixed bag. Yes, the club

achieved record turnover of £126 million, but they also made a loss of £4

million, while net debt rose to £31 million.

In fact, the bottom line was £32 million worse than the previous

year, as Everton moved from a £28 million profit to a £4 million loss. This was

largely due to profit from player sales falling by £25 million to just £3

million, as the 2013/14 figures included the sale of Marouane Fellaini to

Manchester United.

Revenue rose £5 million (4%), despite broadcasting income

falling £3 million (4%) to £82 million, as a result of increases in both

commercial income, up £7 million (37%) to £26 million, and gate receipts, £1

million (8%) higher at £18 million. On the other hand, there were substantial

increases in the cost base: wages climbed £8 million (12%) to £78 million;

other operating costs rose £4 million (16%) to £30 million; and player

amortisation was up £1 million (5%) to £20 million.

This was slightly offset by net interest payable,

principally from the servicing of securitised debt and bank overdraft,

decreasing by £1.3 million (26%) to £3.8 million, due to a reduction in

interest rates.

It should be noted that Everton have changed the way that

they have classified revenue this year, including a restatement of the 2014

results. This has no net impact, but means that the figures reported for gate

receipts and broadcasting income have reduced, while commercial income has

increased (by £6.3 million in 2014). The club stated that this now represents a

“more accurate presentation of turnover”, though maybe the board just got fed

up with all the criticism received about the relatively low level of commercial

income.

In fairness to Everton, it is no great surprise that profits

have fallen, as this is the second year of the current three-year Premier

League deal, so there are limited opportunities for significant revenue growth,

while wage bills continue to grow. This can be seen by the fact that four of

the seven Premier League clubs that have reported 2014/15 figures to date have

announced lower profits.

That said, Everton are one of only two clubs that have

actually lost money, the other one being Manchester United, whose £4 million

loss is almost entirely due to their failure to qualify for Europe in 2014/15.

Given the amount of TV money on offer, the expectation would be that most clubs

in the top flight would manage to be in the black. Indeed, 15 of the 20 Premier

League clubs were profitable in 2013/14.

Everton had the 4th highest profit in the Premier League

that season with £28 million, only behind Tottenham £80 million, Manchester

United £41 million and Southampton £29 million.

This shows how much a football club’s profitability can be

influenced by profits on player sales. As an example, in 2014/15 Southampton

made £44 million from this activity, manly due to the sales of Adam Lallana and

Dejan Lovren to Liverpool plus Calum Chambers to Arsenal, while the previous

season saw Tottenham Hotspur make an amazing £104 million (largely due to the

mega sale of Gareth Bale to Real Madrid) and Chelsea £65 million (David Luiz to

Paris Saint-Germain).

Everton themselves made £28 million from player sales in

2013/14, largely due to Fellaini’s transfer, but just £3 million in 2014/15. In

terms of keeping their squad together, this is clearly a good thing, but

obviously had a big adverse effect on their financial results.

To an extent, Everton’s small loss in 2015 is a return to

their customary performance, as they had been consistently loss-making between

2006 and 2012 (with a cumulative £45 million loss in those seven years) before

the improvement seen in 2013 and 2014

However, it is fair to say that in many years Everton have

effectively subsidised their underlying deficit with the sale of a major

player. Indeed, in the 11 years from 2005 Everton basically broke-even (making

total profits of £5 million), but £128 million of this came from player sales.

This has been a regular theme going back to 2005 when the £24 million profit

was almost entirely because of Wayne Rooney’s big money transfer to Manchester

United.

Not only that, but Everton have also been selling off the

family silver with a number of sale and leaseback deals plus the sale of their

Bellefield training ground in 2011, which generated an £8 million profit.

Given the impact that player sales have on the finances of a

club like Everton, it is worth exploring how football clubs account for

transfers, as it has a major impact on reported profits. The fundamental point

is that when a club purchases a player the costs are spread over a few years,

but any profit made from selling players is immediately booked to the accounts.

So, when a club buys a player, it does not show the full

transfer fee in the accounts in that year, but writes-down the cost (evenly)

over the length of the player’s contract. Therefore, if Everton spent £25

million on a new player with a 5-year contract, the annual expense would be

only £5 million (£25 million divided by 5 years) in player amortisation (on top

of wages).

However, when that player is sold, the club reports straight

away the profit on player sales, which essentially equals sales proceeds less

any remaining value in the accounts. In our example, if the player were to be

sold 3 years later for £32 million, the cash profit would be £7 million (£32

million less £25 million), but the accounting profit would be higher at £22

million, as the club would have already booked £15 million of amortisation (3

years at £5 million).

This is all horribly technical, but it does help explain how

clubs can spend big in the transfer market with relatively little immediate

impact on their reported profits. Even though the annual cost of purchasing

players is therefore somewhat reduced in the profit and loss account, it is

worth noting that the impact of Everton’s increasing spend in the transfer

market over the last two years has pushed up player amortisation, which has

just about doubled from £11 million in 2013 to £20 million in 2015.

Obviously this is nowhere near as much as the really big

spenders like Manchester United (£100 million), Chelsea (£72 million) and

Manchester City (£70 million), but it is something that Everton will have to

keep an eye on in future years.

The other side of the coin here is that all these signings

have helped strengthen the balance sheet with player values (reported as

intangible assets) climbing to £53 million, compared to only £24 million just

three years ago. So what, you might say, but it is obviously good for any club

to have better quality “assets” on the pitch.

In point of fact, the accounting treatment understates the

value of Everton’s squad, as it does not fully reflect the market value of

internationals like John Stones, Seamus Coleman, Phil Jagielka, James McCarthy

and Leighton Baines, while attributing no value to homegrown players like Ross

Barkley.

Given all the accounting complexities arising from player

trading, clubs often looks at EBITDA (Earnings Before Interest, Taxation,

Depreciation and Amortisation) for a better understanding of how profitable

they are from their core business. In Everton’s case, EBITDA was only slightly

above zero for many years before shooting up to £25 million in 2014, though it

did fall back to £18 million last season.

This highlights the impact of the new TV deal in 2014, as

the combined £43 million of EBITDA in the last two seasons is nearly twice as

much as the club generated in the previous seven seasons.

This is pretty good, but at the same time helps to outline

the challenge for clubs like Everton, as the EBITDA at the leading clubs is

significantly higher, despite their larger wage bills: Manchester United £120

million, Manchester City £83 million, Arsenal £64 million, Liverpool £53

million and Chelsea £51 million.

Since 2009 Everton’s revenue has grown by 58% (£46 million)

from £80 million to £126 million. Not bad at all, but much of this is down to

the increasing TV deal (£33 million), which is thanks to the central Premier

League negotiating team, as opposed to the club’s board. Commercial revenue has

apparently risen by £17 million in the same period, while gate receipts have

fallen £4 million, though this is misleading, as it does not take into

consideration the club’s restatement of the revenue categories in 2014.

In any case, the growing TV money has allowed Everton to

change their traditional business model, so they no longer need to sell to buy,

which in the past led to the departures of players like Jack Rodwell, Mikel

Arteta, Joleon Lescott and Andy Johnson.

Despite significant growth over the last two years,

Everton’s revenue of £126 million is still a lot lower than the Champions

League elite, e.g. the top four clubs all earn well above £300 million:

Manchester United £395 million, Manchester City £352 million, Arsenal £329

million and Chelsea £320 million.

Little wonder that Kenwright once asked, “How does Everton

do it? How do we consistently perform so well in these days of cheque book

fuelled football?” This is a reference to Everton consistently outperforming

their revenue level.

That said, Everton are not doing too badly in revenue terms,

as they are the 8th highest in the Premier League, just behind Newcastle

United, but ahead of Aston Villa, West Ham and Southampton.

In fact, if the gross revenue from the outsourced catering

and kit deals were to be added back, then Everton’s revenue would be around £8

million higher at £134 million.

What’s more, Everton’s revenue is now the 20th highest in

the world according to the Deloitte Money League, ahead of famous clubs such as

Marseille £109 million, AS Roma £107 million and Benfica £105 million.

However, this does not help them much domestically, as there

are no fewer than 14 Premier League clubs in the world’s top 30 clubs by

revenue (and all of them are in the top 40). As Roberto Martinez emphasised,

“The Premier League is the most competitive league in Europe week in week out.”

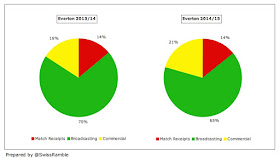

Everton’s revenue mix shows their reliance on Premier League

TV money: broadcasting 65% (though this was down from 70% in 2014), commercial

21% and gate receipts 14%. As Elstone said, “Our financial performance, like so

many Premier League clubs, was underpinned by the second year of a TV deal that

beat all expectations.”

That’s certainly the case. In fact, in 2013/14 nine Premier

League clubs had a greater reliance on TV money than Everton with four clubs

getting more than 80% of their revenue from broadcasting: Crystal Palace,

Swansea City, Hull City and WBA.

In 2014/15 Everton’s share of the Premier League TV money

fell 5% from £85 million to £81 million. The distribution of these funds is based on a fairly equitable

methodology with the top club (Chelsea) receiving £99 million, while the bottom

club (QPR) got £65 million.

Most of the money is allocated equally to each club, which means 50% of the domestic rights (£22.0 million in 2014/15), 100% of the overseas rights (£27.8 million) and 100% of the commercial revenue (£4.4 million). However, merit payments (25% of domestic rights) are worth £1.2 million per place in the league table and facility fees (25% of domestic rights) depend on how many times each club is broadcast live.

In this way, Everton were hurt by falling from 5th place to 11th, which cost them £7 million, though this was slightly mitigated by being shown live on one more occasion, which was worth an extra £1 million. There was also £4.4 million of commercial revenue awarded to all Premier League clubs, though I suspect that Everton might have reported this within commercial income, even though most other clubs classify it as broadcasting income.

"Heart and Soul"

This would help explain why Everton’s total broadcasting

income in the accounts was only £81.7 million, even though the total Premier

League distribution was £80.6 million and Europa League prize money was around

£5 million (€7.5 million). Incidentally, this would also account for some of

the reported growth in commercial income.

Either way, Elstone is right to draw attention to the new TV

deal stating in 2016/17: “Of course, we are now less than a year away from

receiving the benefit of the next deal and one that makes the current,

outstanding deal look modest.”

My estimates suggest that Everton would receive an

additional £37 million under the new contract, increasing the total received to

an incredible £118 million. This is based on the contracted 70% increase in the

domestic deal and an assumed 30% increase in the overseas deals (though this

might be a bit conservative, given some of the deals announced to date). Of

course, if they were to finish higher in the league table, they would earn even

more.

Everton’s Europa League experience saw them earn €7.5

million. This was not much reward for their efforts in reaching the last 16,

which included wins against Wolfsburg, Lille and Young Boys Bern, but was at

least the highest sum received by the English entrants in that tournament.

Martinez has claimed that “being a regular team in Europe is

what we want”, but also struck a note of caution when adding that it

“unquestionably affects performance in the Premier League”, as it tests squad

strength to the limit.

The big money is obviously in the Champions League with

English clubs averaging €39 million in 2014/15 and is getting higher, as the

new TV deal from the 2015/16 season is worth an additional 40-50%, thanks to BT

Sports paying more than Sky/ITV for live games.

Everton’s gate receipts grew by £1.1 million (7%) from £16.8

million to £17.9 million in 2014/15 through a combination of higher attendances

and more match day income from participation in the Europa League, offset by

fewer home domestic cup games. Attendances rose from 37,732 to 38,406, the

highest recorded since the 2003/04 season with 12 of 19 Premier League games

sold out.

The club attributed the increase in attendances to

“successful season ticket and hospitality membership campaigns” with almost

28,000 season ticket holders being 4,000 more than the previous season.

Although there were some small increases in ticket prices in

2014/15, these were frozen for the 2015/16 campaign. The club has emphasised

its “commitment to affordable pricing and making football at Goodison

accessible to young fans” with the continuation of the £95 season ticket for

junior school children.

Despite all these encouraging initiatives, the fact remains

that Everton’s match day income of £18 million is miles behind the top six

clubs: Arsenal £100 million, Manchester United £91 million, Chelsea £71

million, Liverpool £51 million, Tottenham £44 million and Manchester City £43

million.

This was acknowledged by Elstone, “The real springboard to

greater things will be the new stadium”, and the club remains in talks with

Liverpool City Council over Walton Hall Park. However, Everton fans would be

entitled to be sceptical about this project, as two other proposed stadium

moves have come to nothing: first King’s Dock in 2003, then Kirkby in 2009.

Most obviously, there is the question of who would pay for a

new stadium? Elstone has already said, “We would need to think very carefully

about a new stadium that adds the burden of significant debt on the club.” The

hope would be that Liverpool City council would put in “a level of investment” as part of a wider regeneration of the area, but this appears a tad optimistic given the spending cuts imposed on the council. Either way, it is clear that little tangible progress has been made with Elstone informing this week's AGM that no agreement had been reached on any partnership.

In that meeting, the chief executive once again spoke of the “fantastic opportunity for the football club”, but described it as “a hugely challenging funding project”. He has been seeking a potential naming rights partner, but these are difficult to secure, and he

admitted earlier this year that this is proving slower than anticipated.

Although Kenwright has admitted that “leaving our beloved

Goodison Park would bring a degree of sadness”, the need for a new stadium is

now more important than ever with West Ham about to benefit from their move to

the Olympic Stadium, while Tottenham and Chelsea have both announced major

redevelopment initiatives.

Everton’s commercial income surged 37% (£7 million) from £19

million to £26 million in 2014/15, comprising £10.4 million for sponsorship,

advertising and merchandising plus £15.6 million for other commercial

activities. The sponsorship growth was due to “the long-term support of key

partners such as Chang and Kitbag, as well as the club’s first year of the new

kit partner deal with Umbro”, while other commercial revenue benefited from

participation in the Europa League.

As we saw earlier, it is not completely clear what the club

has included within commercial income. For example, if we add up the money from

the three major deals (Chang £5.3 million, Umbro £6 million and Kitbag £3

million), we get £14.3 million, which is more than the total of £10.4 million

reported for sponsorship, advertising and merchandising.

Whatever it consists of, Everton’s commercial income of £26

million pales into insignificance compared to heavyweights such as Manchester

United, who generate £196 million from this activity. That comparison might be

a little unfair, but it is worth noting that Tottenham earned £42 million and

Aston Villa and Newcastle United also earned £26 million (in the 2013/14 season).

"All roads lead to Rom"

That said, the comparisons are a bit misleading, as Everton

have outsourced their catering and kit deals. If they were to report these

revenues gross (like most other clubs), their commercial income would rise by

£8 million to £34 million.

This is not too shabby, but could be better, as Elstone

admitted: “Our commercial revenues benchmark well against teams finishing below

sixth in the table, but it is a fact that we lag well behind – and

disproportionately behind – clubs playing regularly in Europe.”

Many supporters have criticised the 10-year Kitbag deal,

which provides a guaranteed £3 million a year plus royalties for running the

retail operation, replacing a deal with JJB worth £1.6 million a year. However, Elstone seems happy enough, "Kitbag is a great deal for this football club. It was from day one." He has also described it as a good arrangement that “de-risks Everton in a

notoriously difficult business sector”.

However, it does betray a lack of ambition, especially when

we look at some of the kit supplier deals secured by other clubs, e.g. Arsenal

– Puma £30 million, Liverpool – New Balance £28 million, Tottenham – Under

Armour £10 million, and Aston Villa – Macron £4 million.

Similarly, while it is laudable that Everton have the

longest running shirt sponsorship deal in the Premier League, having first

signed with Chang back in 2004, this does raise the question of whether they

could get more elsewhere than the £5.3 million from the current deal (worth £16

million for the three years up to 2016/17).

The Umbro deal was described as a club record and is

reportedly worth £6 million a season, which would be twice as much as the

previous Nike contract, though the latest accounts suggest that it might not be

so high in reality.

Everton’s wage bill rose 12% (£8 million) to £78 million,

following continued investment in the squad, with the additions of Romelu

Lukaku, Gareth Barry, Muhamed Besic and Brendan Galloway, together with loan

spells for Christian Atsu and Aaron Lennon. In addition, new contracts were

awarded to Roberto Martinez, Ross Barkley, Seamus Coleman and John Stones.

Furthermore, the average number of employees increased from

247 to 274, including unexplained growth in management and administration from

57 to 71.

The wages growth outpaced revenue growth, so increased the

wages to turnover ratio from 58% to 62%. However, this is still the second best

ratio the club has recorded in the last six years and is well within the norm

in the Premier League with 13 of the 20 clubs grouped in a fairly narrow range

of 56-64% the previous season. Furthermore, the ratio would fall to 58% if the

club added back its outsourced revenue (retail and catering).

Everton’s ability to outperform their financial resources is

underlined by their relatively low wage bill, which was only the 10th highest

in the Premier League in 2013/14, behind Sunderland and Aston Villa. Even

though this has increased to £78 million, to place this into context, it is

dwarfed by the elite clubs, who all pay around £200 million: Manchester United

£203 million, Manchester City £194 million, Chelsea £193 million and Arsenal

£192 million.

Everton’s 2014/15 increase of £8 million is very similar to

the growth reported by other clubs so far: West Ham £9 million, Southampton £9

million and Stoke City £6 million.

One thing that is quite striking in Everton’s accounts is

the £4 million growth in other operating costs from £26 million to £30 million,

especially as this cost category has shot up by 40% (£9 million) in the last

two years without any substantial explanation.

This seems quite high for a club of Everton’s size,

especially as the retail and catering businesses have been outsourced, so

theoretically other operating costs should be lower than other clubs (as net

profits are reported in revenue).

Even though Kenwright has argued, “We’re not a selling club.

Never really have been.”, Everton averaged net sales of £7 million a year

between 2009 and 2014. However, that has changed in the last two years with

average net spend of £26 million, as the club has made no major sales, but

invested significant sums on improving Martinez’ squad, smashing their own

transfer record in the process when bringing in Lukaku from Chelsea.

Elstone accepted that things had changed: “In the past, when

85p in every £1 we earned was spent at Finch Farm, we had little scope to

strengthen the club away from the training ground.”

He underlined the move away from the previous hand-to-mouth

existence: “Increasingly, we’ve also been able to sign talented young

footballers, who join us not as the finished article, but as great prospects

and yet still command significant transfer fees. Players like Galloway, Henen

and Holgate might not have joined with that singular focus on the first team.”

In fact, Everton’s net spend of £51 million in the last two

seasons is the sixth highest in the Premier League. Although this was still a

long way below the two Manchester clubs (City £151 million and United £145

million), it was surprisingly more than Chelsea £40 million and only juts

behind Liverpool £57 million.

Clearly, fans will be concerned that Everton will be tempted

to sell their young stars with Chelsea offering £40 million for John Stones in

the summer and Lukaku and Barkley also worth large sums in today’s market.

However, Martinez says that Everton are no longer forced to

sell their prize assets: “We don't fear that situation. What you fear is when

you have to sell players to balance the books, when the owner says you need to

cash in on two or three star players, that becomes a problem. But it is not the

situation at Everton. That is not to say we are going to sell any player or not

sell any player, but the decisions we make will be for the benefit of the squad

and club going forward.”

Everton’s net debt rose £3 million from £28 million to £31

million, but the gross debt was actually cut by £9 million from £49 million to

£40 million with the real driver being the £12 million reduction in cash

balances, which fell from £21 million to £9 million. Thanks to higher TV money,

not to mention the funds from the Fellaini sale, net debt has improved

considerably from the £45 million level in the years up to 2013, which Elstone

explained thus: “our pursuit of success has stretched our finances.”

There are basically two elements to Everton’s debt: (a)

25-year loan of £21 million, which bears a high interest rate of 7.79%, leading

to annual payments of £2.8 million; (b) an annual loan of £19 million renewable

every August, securitised on Premier League TV money, at a stonking 8.2%

interest rate.

The short-term loan was taken out with Vibrac, a shadowy

offshore corporation based in the British Virgin Islands, which has also

provided funding to other English clubs, including West Ham, Southampton, Fulham

and Reading. This loan was repaid in August, but has been replaced by another

loan with the equally mysterious James Grant (JG) Funding.

Everton also have contingent liabilities of £20 million (£9

million dependent on future appearances and £11 million loyalty bonuses if

certain players are still with the club on specific dates), up from £13 million

the previous season. On top of that, the club confirmed that it has entered

into net transfer agreements since the accounts closed of £22 million.

Like many other clubs, it is clear that Everton are spending

as much as they can, thus building up their transfer debt, in order to give

themselves the best chance of success, though this should not be a problem, so

long as they avoid the nightmare scenario of relegation.

In fairness, Everton’s debt is one of the lowest in the

Premier League with only seven clubs owing less than the Toffees. In fact, five clubs have debt above

£100 million, namely Manchester United £411 million, Arsenal £234 million,

Newcastle United £129 million, Liverpool £127 million and Aston Villa £104

million.

The high interest rate on Everton’s loans mean that their

financing costs are among the largest in the Premier League. Although nowhere

near as much as the interest paid by the likes of Manchester United and

Arsenal, this certainly does not help the club’s finances. Looked at another

way, the £4-5 million paid out each year in interest would fund the wages of

one world class player (or two very good additions to the squad).

The significance of interest payments is highlighted by

looking at the 2015 cash flow. Cash generated from operating activities was

£11m, but the cash balance ended up falling £12 million after a series of

payments: £7 million net on player transfers; £4 million on those interest

payments; £3 million on capital expenditure (stadium refurbishment and a new

pitch); and £9 million repayment of loans.

This unwelcome burden is even more emphasised when reviewing

the cash flow over the last seven years. In that period, Everton generated £61

million of cash, mainly from operating activities £49 million, though this was

supplemented by the sale of the old training ground £9 million and other loans

(net) £3 million.

Nearly half (46%) of this cash £28 million was required for

interest payments, which was more than the £25 million spent on “good” things:

£17 million for new players and £8 million infrastructure investment. The

remaining £8 million simply increased the cash balance.

Of those clubs that have so far published their 2015

accounts, Everton and Southampton are the only ones to have reduced cash

balances. Others have significantly increased cash, notably the “big boys”,

i.e. Arsenal (up to £228 million), Manchester United £156 million and

Manchester City £75 million.

Of course, those hefty interest payments to external finance organisations underline the fact that the

current Everton directors have not invested in their club, in stark contrast to

benefactors at other clubs, who have put in substantial sums without taking a

penny of interest. This helps explain why some supporters are unhappy with the

board, as seen by a hired plane flying over the match against Southampton in

August trailing the banner “Kenwright & Co #timetogo”.

The club claim that they are open to a sale, but it has not

gone unnoticed that they have been looking for a buyer for a long time. Back in

2012 Kenwright proclaimed, “My desire to find a person, or institution, with

the finance to move us forward has not diminished. We will find major

investment.”

"Born to run"

However, since then, nothing, nada, zilch. There were

whispers of American interest recently, but one of the potential buyers, Rob

Heineman, admitted that his Sporting Club group were never close to a takeover.

This has led some to believe that Everton are not entirely

serious in their quest for investment, though to be fair other clubs such as

Aston Villa and West Brom have also struggled to find a suitable purchaser in

the last few years.

Elstone has maintained the party line: “The search for the

funds that will allow the club to leap forward continues without any slowing

down or any less enthusiasm. It is worth stating again, and very clearly, there

are no unreasonable conditions on the sale of Everton. The only condition is

one we think is perfectly reasonable - that the new owner has to want to, and

must be able to, take the club forward.”

Fair enough, but if a club like Everton with the 8th highest

revenue in the Premier League, relatively low debt, a mega new TV deal on the

horizon, opportunities for commercial growth and a much-admired academy, cannot

find a buyer, then something is surely amiss.

"Call me"

It’s not so much that Kenwright and Elstone have done

anything wrong, it’s the fact that they appear to be relatively comfortable

with the status quo,

not showing the requisite ambition to drive the club forward.

The club’s Latin motto, “Nil

Satis Nisi Optimum” (“Nothing but the best is good enough”), may

feel a touch ambitious when competing against the riches of today’s elite, but

as Martinez rightly said, Everton should “strive to be the best we can be.”

The manager added, “We want to build around young players –

our strategy is to build something and keep what we see as the future. We want

to achieve things and see how high we can go.” Spot on, Roberto.

Another calm and excellent analysis of Everton's finances, interesting that you'very picked up on the reasons why their commercial growth by percentage looks better than that reported in previous years.

ReplyDeleteWell done, well done. I was waiting for this one (as the Toffees are my favorite club) with bated breath. A little disappointing I'd say compared to last year, but you've explained the why so well. I'm an accounting & finance guy, so repayment of loans and cash flow interest me way more than they should a normal human, so I love this stuff. Let's hope continued improved finances (and a gigantic TV deal that's put to "good use") can move this club "forward."

ReplyDeleteThanks for all you do.

An absolutely brilliant summary covering every element with a blend of facts and opinion to sufficient detail and understandability for the broader audience.

ReplyDeleteCynics will rightly seek the holes and conspiracies.

As an investor you look for the best return or yield with the minimum amount of risk. Everton are generally well managed and are highly likely to continue to retain their PL status. The PL is highly likely to continue to achieve greater income for its clubs, so Everton is a safe investment, potentially becoming lower risk if costs continue to be contained.

Who would give up the opportunity to lend money to the club at over 8% a year?! It's a cash cow for our board who hide their ongoing gains and methods of milking the cow.

It still might be a case of 'better the devil you know' unless another multi billionaire a la city turns up. At least we have stability. The current fanbase will never deliver significant growth in revenues even with a new stadium. That would only come from global appeal that is generated by success on the field. And that takes a man city level of investment that is currently a pipedream. If we can't have that then personally I'm quite content for stability and not putting the club at risk that a half way house might deliver, eg villa.

I'm not happy with that conclusion, just realistic as far as I read it.

If the council could help with a new stadium then maybe the prospect of a man city outcome wouldn't be so unrealistic.

Outch, didn't realize the interest on those loans was that high! The club really need to get rid of them pronto. Im going to assume (and anybody please correct me, i know bugger all about financial stuff) that we couldn't pay of those loans in one go, just as there's a maximum fee for paying back a mortgage, correct?

ReplyDeleteOuch, that interest on those loans is brutal!. Im assuming that there is a maximum you can pay of every year as well so we could be saddled with it for ages. The rise in other operating costs is concerning as well. Does anybody know what section agents fee's normally come under as well?

ReplyDelete