Many Arsenal fans have been unhappy for the past few years

about the lack of trophies, exacerbated by the club’s seeming inability to

spend its growing cash balance. Therefore, they should have been pleased by the

results both on and off the pitch last season, as Arsenal won the FA Cup (for

the 11th time) after defeating Hull City 3-2 in a thrilling final,

qualified for the Champions league for an extraordinary 17th

successive season and also obliterated their transfer record when buying the

German star Mesut Özil from Real Madrid.

As Chief Executive Ivan Gazidis said when announcing the

financial results for the 2013/14 season, “Our improved financial position has

allowed us to supplement the squad with important new signings.” Indeed,

Arsenal continued to spend big this summer, bringing three World Cup stars to

the Emirates in the shape of Alexis Sanchez from Chile, Mathieu Debuchy from

France and David Ospina from Colombia. In addition, the club’s English core was

again strengthened by acquiring Danny Welbeck from Manchester United and the

highly promising Calum Chambers from the much-vaunted Southampton academy.

However, there remains a nagging feeling that Arsenal are

still not maximising their potential or making use of their bountiful financial

resources, as the squad still looks worryingly thin in defence, while the need

for a powerful presence in midfield seems obvious to all but the most stubborn.

The supporters’ concerns were hardly eased by last week’s feeble capitulation

to a rampant Borussia Dortmund side in the aforementioned Champions League.

Arsenal’s accounts once again emphasised the club’s

financial strength, as revenue exceeded £300 million while the club reported a

profit for the 12th year in a row, another amazing achievement.

Although the profit before tax of £4.7 million was virtually unchanged from the

previous year’s £6.7 million, the way that the club reached this profit figure

was very different.

Revenue from football activity surged £56 million (23%),

largely thanks to the new Premier League TV deal, which was worth an additional

£36 million, plus increasing commercial income (up £15 million), mainly due to

including a full year of the extended Emirates sponsorship deal, and £7 million

higher match day income, driven by three more home games.

This offset a £12 million increase in the wage bill (up to

£166 million) and a significant £40 million reduction in profit from player

sales from £47 million to £7 million. The only meaningful money generated this

season came from the sales of Gervinho to Roma and Vito Mannone to Sunderland,

while last year’s accounts included the far more lucrative departures of Robin

van Persie to Manchester United and Alex Song to Barcelona.

"Don't Let Me Be Misunderstood"

Player amortisation (the annual cost of expensing transfer

fees) was around the same level at £40 million, but profits were boosted by no

player impairment (reducing the carrying value of players in the accounts) this

season compared to £6 million in 2012/13.

Other operating expenses rose £8 million to £70 million,

partly due to an increase in revenue-related costs, such as staging more games

at the Emirates and supporting commercial partnerships.

Profit after tax for 2013/14 was £7.3 million, mainly thanks

to a net £2.6 million tax credit linked to the reduction in the corporation tax

rate to 20% from April 2015, thus reducing the club’s deferred tax liabilities.

That’s fairly technical, but it’s basically good news.

Of course, it’s not unusual for Arsenal to report a profit. In

fact, the last time that the club made a loss was way back in 2002, a virtually

unparalleled feat in the world of football where most success is effectively

bought. Every now and then we see an exception, such as Atletico Madrid’s

glorious efforts last season, but the normal rule is that money talks. In

Arsenal’s case, they have made combined profits of over £200 million in the

last seven years.

The Premier League accounts for the 2012/13 season amply

demonstrate how rare this is, as only eight clubs made money, while many others

reported massive losses. Of particular interest to Arsenal would have been the

figures registered by those clubs that finished above Arsenal in the league

table with Manchester City, Chelsea and Liverpool all losing around £50 million.

That said, Manchester United’s 2013/14 results highlight

that Arsenal still have a long way to go to compete on a level playing field

with the financial elite. As Arsenal’s football revenue approaches the £300

million level, United are already generating a hefty £433 million, i.e. an

additional £133 million every

season, and that’s before United’s spectacular £750 million adidas deal, which

only commences in August 2015.

So what, you might say, but here’s the thing: this ability

to throw off cash allowed United to spend £215 million on wages, which is £48

million more than Arsenal – and they still reported a much higher profit before

tax of £24 million (£17 million higher than Arsenal). The majority of

right-thinking football fans would not endorse the Glazers’ approach to owning

a football club, but without the interest payments arising from their leveraged

buyout (£27 million last season) United’s spending capacity would be even

higher. You can’t rely on the Moyes effect every year.

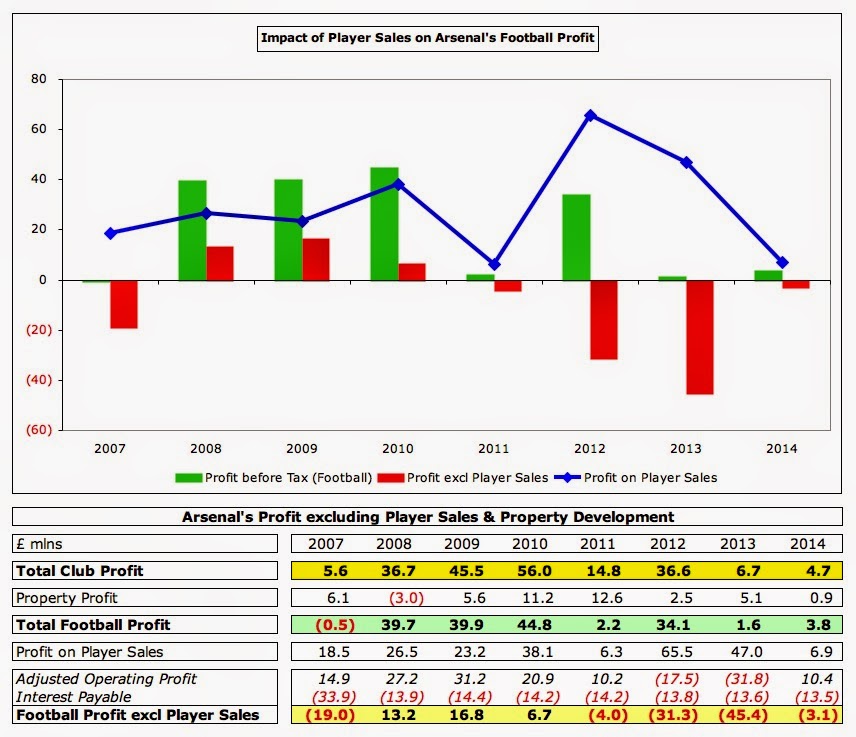

What is encouraging for Arsenal is that they are no longer

so reliant on player sales or property development to make money, so the core

business is improving. In previous years, much of the club’s excellent

financial performance has been down to profits from player sales (e.g. £65

million in 2011/12, £47 million in 2012/13) and property development (e.g. £13

million in 2010/11, £11 million in 2009/10).

Excluding those once-off factors would have meant that

Arsenal actually made substantial losses in the previous two years: £31 million

in 2011/12 and £45 million in 2012/13. This is now down to a far more

manageable £3 million loss in 2013/14.

Arsenal’s role as a pseudo property developer is largely

coming to an end with turnover down to £3 million, compared to £38 million the

previous season, which included the sale of the major site at Queensland Road.

The improvement in the football business last season is

clearly shown by the recovery in operating profit. This had been steadily

declining since 2009 with the club actually reporting operating losses of £18

million in 2011/12 and a worrying £33 million in 2012/13, but last season they

produced operating profit of £10 million.

However, this accounting profit includes non-cash items,

such as player amortisation, depreciation and impairment of player values. If

we add these back, we get yet another form of accounting profit, namely EBITDA

(Earnings Before Interest, Depreciation and Amortization). This metric has its

critics with the legendary investor Warren Buffett once cautioning, “References

to EBITDA make us shudder. It makes sense only if you think that capital

expenditure is funded by the tooth fairy.” That said, it is a useful proxy for

reviewing a club’s operating cash flow.

On that basis, Arsenal’s EBITDA more than doubled to a

highly impressive £62 million last season. On the one hand, this is still less

than half of Manchester United’s £130 million, but on the other hand it is

considerably higher than any other club in the Premier League (in 2012/13 the

next highest was Manchester City with £36 million).

Of course, Arsenal benefit from higher revenue than most

other clubs, though they fell to 8th place in the Deloitte Money

League for the 2012/13 season, as they were overtaken by the nouveaux riches of

Paris Saint-Germain and Manchester City, both boosted by large commercial deals

with the Qatar Tourism Authority and Etihad Airways respectively.

Gazidis has been quoted as saying, “Our revenues will grow

to put us into the top five revenue clubs in the world”, which is unlikely to

happen this season, as revenue also continues to grow at those clubs above

Arsenal in the Money League. In particular, Real Madrid, Barcelona and United

have all reported higher revenue for the 2013/14 season. For the 2014/15 season

Arsenal’s revenue will again rise due to the new PUMA kit deal, but the other

main driver, namely the new Champions League deal, will also help the other

clubs.

The most important revenue stream at Arsenal is Broadcasting

at £121 million, which has overtaken Match Day (£100 million) for the first

time since 2001. In fact, despite the advances made commercially, this revenue

stream still lags the others at £77 million. Over the last 5 years, Match Day

income is flat, while the growth drivers have primarily been Broadcasting,

which is up 65% (£48 million) due to central TV deals (Premier League and

Champions League), and Commercial income, which is up 60% (£29 million) mainly

due to the new Emirates shirt sponsorship.

Arsenal’s TV money increased by £36 million in 2013/14,

almost entirely due to the new Premier League deal, which saw Arsenal’s share

rise by £36 million from £57 million to £93 million. This increase is akin to

the old aphorism, “a rising tide lifts all boats”, as every Premier League club

benefits from this deal. That said, it still helps to be higher up the league

table, as the top club’s increase was £40 million (£57 million to £97 million),

while the bottom club “only” received an increase of £21 million (£41 million

to £62 million). Arsenal also received more facility fees for featuring in more

televised live games (25 compared to 22).

In contrast, Arsenal received less money from the Champions

League: €27 million (vs. €31 million) from the group stages onwards, as their

share of the TV market pool was lower (due to finishing lower in the Premier

League during the qualifying season and other English clubs progressing further

in the Champions League).

Nevertheless, the value of Champions League qualification is

clear, especially when looking at the Media revenue from the 2012/13 season,

where the four entrants earn significantly more than the other Premier League

clubs.

Indeed, the most earned by an English club in the Europa

League was Tottenham’s €6 million. The rewards (and differential) are even more

pronounced for the tournament winners: Champions League €57 million vs. Europa

League €15 million.

This effect will be even more pronounced from the 2015/16

season when the new Champions League deal commences. UEFA recently told the

European Club Association that clubs could expect a 30% increase in revenue,

but the uplift may be even higher for English clubs, as BT’s exclusive

acquisition of UK rights is double the current arrangement.

Although the growth in Match Day income was only £7 million,

the £100.2 million was the highest ever reported by Arsenal, slightly higher

than the £100.1 million in 2008/09. The increase was largely due to 3 more home

games (2 in the FA Cup and 1 in the Champions League), though the Emirates Cup

also returned after a break in 2012 for the London Olympics.

The Emirates stadium might not have the same atmosphere as

Highbury, particularly for those of my generation, but it has certainly been a

financial triumph. In fact, only Manchester United, Real Madrid and Barcelona

generate more money from Match Day income than Arsenal. All of this makes the

decision to raise ticket prices by 3% seem misguided at best, plain greedy at

worst.

Commercial revenue has long been Arsenal’s Achilles heel, as

the figures from the Deloitte Money League clearly demonstrate. Even the

2013/14 increase from £62 million to £77 million still leaves Arsenal back in

12th place and looks low compared to other leading clubs. OK, the

likes of Paris Saint-Germain £218 million and Manchester City £143 million may

benefit from “friendly” deals, but Arsenal are also way behind Bayern Munich

£203 million, Manchester United £189 million, Real Madrid £181 million and

Barcelona £152 million.

Arsenal’s £15 million increase this season is very largely

due to the extended partnership contract with Emirates, which benefited from 12

months in 2013/14, as opposed to only 6 months in the previous season. Against

that the club’s retail business was held back in the second half of the

financial year by lower available stocks of replica kit as part of the planned

transition from Nike to PUMA.

The club’s press release made great play of commercial

revenues rising by “more than 70%” since 2009, but that excluded the retail business.

Once this is combined to give total commercial income, the rise is more like

60%. That still sounds pretty good until you realise that this is essentially a

par performance with other clubs growing their commercial at a similar rate,

while the commercial colossus that is Manchester United has grown its revenue

by 171% in the same period with a veritable plethora of secondary sponsors

(surely Arsenal’s next area to be targeted).

Arsenal have already done pretty well with the new deals for

shirt sponsor and kit supplier. Although these are notoriously difficult to

compare, as they are rarely formally reported and contain many clauses based on

success on the pitch, sales targets, exchange rates, etc, it is clear that

Arsenal’s deals are among the best worldwide.

In fact, I reckon that only Manchester United’s Chevrolet

deal ($70 million or £43 million a year) is higher than Arsenal’s Emirates

deal. The £150 million contract covers a 5-year extension in shirt sponsorship

from 2014 to 2019 plus a 7-year extension in stadium naming rights from 2021 to

2028. This represents a significant improvement over the former deal: £90

million for 8 years shirt sponsorship plus 15 years stadium naming rights. The

club has not divulged how much of the deal is for naming rights, so I have

taken the straightforward £30 million annual figure, though my own estimate

would put the pure shirt sponsorship at around £26 million, which would still

be pretty good.

The PUMA kit deal only starts from 1 July 2014, so is not

included in the latest P&L figures. This is again worth £150 million over 5

years, so £30 million a year, which will represent a £22 million increase over

the former Nike deal. This is still dwarfed by Manchester United’s new £750

million 10-year deal with adidas that starts from the 2015/16 season, though

this would be reduced by 30% if United fail to participate in the Champions

League for two or more consecutive seasons (starting with the 2015/16 season).

There’s an old saying that “it’s an ill wind that blows no

good” which applies to Arsenal’s relatively poor commercial performance to

date. The new Premier League Financial Fair Play regulations restrict the

amount of money clubs can spend from the new TV deal on wages. Specifically,

clubs whose total wage bill is more than £52 million will only be allowed to

increase their wages by £4 million per season for the next three years. However

this restriction only applies to the income from TV money, so Arsenal’s

additional money from the new sponsorship deals can still be spent on wages.

Arsenal’s wage bill increased by 8% (£12 million) from £154

million to £166 million, largely due to the revised, improved contracts for

existing players, notably the “Brit Pack” (Wilshere, Walcott, Gibbs,

Oxlade-Chamberlain, Ramsey and Jenkinson) plus the package required to lure

Mesut Özil. Despite this increase, the wages to turnover ratio has actually

fallen from 64% to 56%, thanks to the higher revenue growth.

It is clear from the trend how much attention Arsenal pays

to the relationship between wages and revenue. In fact, in the last 5 years the

growth has almost been hand-in-hand, as wages growth of £62 million has been

covered by revenue growth of £74 million. If the club is to maintain a “safe”

ratio of 60%, that would imply a wage bill of £192 million on annual revenue of

£320 million (easily achievable once the PUMA increase is factored in), so the

club still has plenty of room to manoeuvre.

That would still be lower than the last reported wage bills

of Manchester City £233 million and Manchester United £215 million, but would

be more than Chelsea’s £173 million and Liverpool’s £133 million. What will be

particularly interesting is the impact that FFP has on clubs like Manchester

City, who admitted this was the reason they loaned Negredo to Valencia in the

summer, and Chelsea, whose wage

bill seems to have stalled and whose manager Jose Mourinho can (incredibly) now

be counted among its fiercest exponents – at least when discussing City.

Enough of the profit and loss account, the main financial

topic on the lips of Arsenal fans these days is that huge cash balance. Guess

what? It’s gone up again, rising another £55 million in the last 12 months from

£153 million to £208 million. For some reason the club’s headline statement

insists on reporting this as net of debt service reserves of £35 million,

giving the widely reported figure of £173 million, but the actual cash balance

is indeed north of £200 million.

To place that into context, the next highest cash balances

in the Premier League in the 2012/13 season were Manchester United £94 million,

Chelsea £26 million and Southampton £14 million. Since then, United’s 2013/14

balance has come down to £66 million, so Arsenal’s cash balance really is in a

class of its own, over three times as much as the next highest figure.

Of course, this figure is a bit misleading and not all of

this cash balance is available to spend on transfers. In fact, this is so

important that I’m going to say it again: not all of the £208 million cash is a

transfer fund.

This is due to many factors, including the fact that most

season ticket renewals are paid in April and May, so Arsenal’s cash balance

will always be at its highest when its annual accounts are prepared, namely 31

May.

In addition, there’s that annoying debt service reserve,

which has been around since the 2006 bond agreements, though it does raise the

question of whether these arrangements could be renegotiated given Arsenal’s

strong financial record, thus freeing up this £35 million.

The club also has to pay a good proportion of its annual

running expenses out of this cash, though other money will flow into the club

during the course of the season, such as TV distributions and merchandise sales

and the fact remains that year after year the cash balance has steadily risen:

May 2007 £74 million, May 2008 £93 million, May 2009 £100 million, May 2010

£128 million, May 2011 £160 million, May 2012 £154 million, May 2013 £153

million and May 2014 £208 million.

"Calum Chambers - Young Guns (Go For It)"

However, there are a couple of reasons why we still need to

be cautious with the cash figure. First, the club clearly stated that the cash

impact of the £64 million invested in new players during the accounts period

has been partially offset by the credit terms agreed with the vendor clubs. In

other words, Arsenal have not paid all the cash upfront, but (sensibly) agreed

stage payments, so part of the cash balance has to be reserved to pay sums due

on those transfers. This is reflected in the £53 million increase in creditors

falling due within one year from £150 million to £203 million.

Similarly, as these accounts were closed on 31 May, that

means that they do not take into consideration this summer’s transfer activity,

so another £50-60 million should be deducted from the reported cash balance.

On the other hand, Arsenal may well still be owed money from

sales of players to other football clubs, e.g. other debtors included £26

million in respect of player transfers as at May 2013.

"Welbz is Dat Guy"

In addition, the club has so-called contingent liabilities,

where payments are made to a player’s former club based on certain conditions

being met, e.g. number of first team appearances, trophies won, international

caps, etc. These amounted to £7 million in the 2012/13 accounts, but are by no

means certain to be paid – that’s why they are described as “contingent”.

There are other once-off factors that have helped inflate

Arsenal’s cash balance, such as property development, e.g. £20 million has come

from the Queensland Road site in the last two years, and upfront payments from

the new sponsorship deals with Gazidis stating that Emirates provided

additional money in advance last financial year in order that it could be

invested.

In short, without knowing all of the internal details, it’s

a mug’s game trying to predict how much Arsenal genuinely have available to

spend. It’s clearly not as much the £200 million in the books, but we can say

with some conviction that there would be enough available in the January

transfer window to cover the glaring weaknesses in the squad, let’s say £40-50

million.

Looking at Arsenal’s cash flow statement, we can see signs

of a change in approach: in the six seasons between 2007 and 2012 Arsenal spent

just a net £4 million on player purchases, while they have spent a net £37 million

in the last two seasons. Baby steps for sure, but steps in the right direction.

That said, most of the money still goes elsewhere. In

2013/14 Arsenal generated an impressive £96 million from operating activities,

spending £11 million on transfers, £19 million on financing the Emirates

Stadium (£12 million interest plus £7 million on debt repayments), £9 million

on capital expenditure (e.g. refurbishment of Hale End youth facilities) and £2

million on tax. What happened to the remaining £54 million? Nothing really, as

it just went towards increasing the cash balance.

This is nothing new. Since 2007 Arsenal have produced a very

healthy £526 million operating cash flow – that’s over half a billion. It’s

instructive how Arsenal have used this spare cash, spending £89 million on

capital expenditure, £135 million on loan interest, £77 million on net debt

repayments and £12 million on tax. Only 8% (£41 million) of the available cash

flow has been spent in the transfer market, though almost all of that has been

in the last two seasons. The other notable “use” of cash in that period is to

obviously increase the cash balance, which has risen by £172 million.

Clearly the debt incurred for the new stadium continues to

have an influence over Arsenal’s strategy. Although this has come down

significantly from the £411 million peak in 2008 to £240 million, it is still a

heavy burden, requiring an annual payment of around £19 million, covering

interest and repayment of the principal.

Although the net debt stands at only £33 million, thanks to

those large cash balances, the gross debt of £240 million remains the second

highest in the Premier League, only behind Manchester United, who still have

£342 million of debt even after all the Glazers’ various re-financings. Arsenal’s

debt comprises long-term bonds that represent the “mortgage” on the stadium

(£213 million) and the debentures held by supporters (£28 million).

Looking at the player trading over the last few years, we

can see that the club is beginning to walk the talk, as there has been a

noticeable change in the last three seasons with Arsenal no longer primarily a

selling club. In that period the club’s net spend was £95 million, which is in

marked contrast to the net sales of £49 million in the previous six seasons.

There’s no doubt that this parsimonious approach has put

Arsenal at a competitive disadvantage, exacerbated by the arrival of foreign

ownership with significant financial firepower. In fact, after the arrival of

Roman Abramovich at Chelsea, Arsenal have been heavily outgunned. Since the

2003/04 season, Chelsea and Manchester City have both splashed well over £500

million, while Arsenal were restricted to just £70 million. They were even

outspent by their North London neighbours, Tottenham (with £100 million), for

heaven’s sake.

But, as Bob Dylan said, the times they are a-changing. In

the last two seasons, Arsenal have spent a net £86 million, only just short of

Manchester City’s £114 million, but ahead of Chelsea and Liverpool. Manchester

United are the new big spenders, as Louis van Gaal attempts to build a new team

following the Moyes experiment (and Alex Ferguson’s retirement).

To sum up Arsenal’s financial condition, we could do a lot

worse than quoting Ivan Gazidis: “The club is in excellent shape, both on and

off the pitch”, adding that “we are well placed to deliver.” That is

undoubtedly true.

While not expecting a club like Arsenal to suddenly adopt a

“balls out, pedal to the metal” attitude, it is clear that something has

changed in Arsenal’s ability (and willingness) to spend.

In the past there has been more money available than the

club has utilised, but 2014 was always going to be the year of major change, as

the commercial deals were re-negotiated and the new TV deal came on line. The

big question is whether the additional money will make enough of a difference

on the pitch to take the club to the next level. Over to you, Arsène.

finally back

ReplyDeleteA Swiss Ramble Blog post, manna from heaven!!!!

ReplyDeleteGreat article... Well done

ReplyDeleteSo next financial year our commercial revenue should be around £100m? - still way behind United, RM, Barca and Bayern, I'm ignoring City and PSG as their deals are a joke (which UEFA should not be laughing at!).

ReplyDeleteWe should really be pushing hard for more secondary sponsors so we can get up to at least the £120-130m mark or beyond considering Liverpool are already on £98m, other than TV money which affects everyone this is the only way to grow our revenue in the short term.

Well done, an excellent financial analysis. Very detailed with some incisive comparisons with the other major clubs in Europe. Enjoyable reading.

ReplyDeleteThanks for your return, swiss. I am sure all gooners around the world have been waiting for your arsenal post, I certainly was. Cheers from pakistan.

ReplyDeleteArsenal will not win prem or ucl under wenger because we waste money on cam wingers when we need dm and defence

ReplyDeleteYet we have conceded less goals that Man ity or Chelsea. Who needs a DM?

DeleteThanks to the gate receipts,otherwise Arsenal will be a distant 2nd. To close the gap,the gunners need to win trophies consistently . .,A cl triumph will be a statement of intent and be an earth shaking movement..

ReplyDeleteThank you so much.

ReplyDeleteit's been some time since your last post but i really enjoyed this long one. I'm not a financial guy and not really in a good financial wise myself (LOL) but reading at how Arsenal manages their finances makes me as a fellow Gooner to pick myself up and look at my financials...and do it the Arsenal way!

ReplyDeleteDear SwissR,

ReplyDeleteHope you are doing well. Excellent piece as always. Was wondering the reason for the hiatus. Anyways, with the new financial reality, Arsenal needs to step up its game on and off the field to bolster its image as true elite. Many secondary deals have been signed and that will continue to grow if we deliver on the pitch. It is truly on to Arsene now...

Cheers from India,

Shubham

Many thanks, more posts please

ReplyDeleteWhat a fantastic read - kudos to you Swiss Ramble

ReplyDeleteIt's evident that commercial deals play the biggest role now in a clubs ability to "buy success" on the pitch - when you look at a paltry $35m differential between winning the CL and finishing in the last 16 - compared with a $120m differential on kit deals, shirt sponsors, secondary sponsors, etc. it's obvious that this is the single most area where clubs need to focus on if they wish to "grow". United's vision in this respect allowed them to stay competitive during the Abramovich / Etihad eras whereas looking at the historicals it's fair to say Arsenal "woke up" late in their attempts to renegotiate more lucrative deals.

The Premier League as a whole has done wondefully well in marketing itself the world over which increases the chances of every single PL team to improve it's commercial deal negotiations. It seems to me that unless leagues in Spain and Germany focus more on levelling the playing field and cease being two horse races, a time will come in the not too distant future that a club like Southampton or Everton will make more commercial revenue than someone like Atletico Madrid or even a Dortmund even though these clubs performed better on the pitch and qualified for and reached the latter stages of the Champions League.

Arsenal has done plenty to secure a very competitive financial future but unless FFP also regulates how revenues from commercial income are spent, clubs like City and Chelsea can in fact go find additional secondary sponsors that allow them to continue spending, since those earnings are not related to broadcasting. That being said the 4% cap is a step in the right direction - and it seems the next logical step needs to be restricting a clubs wage bill as a % of revenues. Arsenal's very healthy 55-60% wages to revenue ratio should ensure that we are completely in the clear and now the platform is truly set for us to compete on the pitch - I am a die hard Arsene fan but he has 3 more seasons to show that he can adapt to the tactics, mind games, and intensity that winning things in football today requires.

Thanks for this

ReplyDeleteFinancial data in human form

Great! Congratulations

ReplyDeleteDetailed, informative and enlightening to a financially dump person like me

ReplyDeleteFantastic job, once again! Thank you.

ReplyDeleteMust reach man utd, real madrid, barca level to truly flush chelski down the toilet.

ReplyDeletegreat article....

Fantastic as per usual. Cheers for the insight.

ReplyDeleteLe-grove that media whore Pedro is misquoting and misleading that there is a 200m sitting there to spend and Wnger does nothing.

ReplyDeleteI read swissramble and got the truth,

Thanks for a great article.

ReplyDeleteDo you have more in-depth data on commercial income? I'm just curious how much Arsenal make on shirt sales and the like, not just the sponsorship deals.

Great article, thank you. Changes my perceptions entirely.

ReplyDeleteSplendid once more, many thanks. Is it ok to link to some of your charts in another blog (with proper credit given of course)?

ReplyDeleteAlcide from Geneva

thanks man, I hope you do a post with Real Madrid's numbers.

ReplyDeleteReturn of the Swiss (to the tune of 'Return of the Mack') is playing in my head right now.

ReplyDeletewelcome back

exceptional read, thank you!

ReplyDelete"In short, without knowing all of the internal details, it’s a mug’s game trying to predict how much Arsenal genuinely have available to spend." and " ...there would be enough available in the January transfer window ... let’s say £40-50 million." Nothing to stop anyone playing a mug's game. I'd have hoped that Arsenal always had £40-£50m to spend in any transfer window for any opportunity that may arise. Cash reserves are a good thing in most sustainable businesses.

ReplyDeleteThank you so much for your careful analysis. Always appreciate you're detailed reports. I hope you're going to publish a bit more regularly again ;)

ReplyDeleteGreetings from Berne.

Progress on the pitch for Arsenal is now as much about the success (or otherwise) of the FFP-enforced changes at other clubs. Chelsea have had to become a selling as well as a buying club and have virtually frozen their wage bill. Man City are investing in bringing more home grown players through in order to cut the transfer bill down but may find that frustratingly difficult to acheive from a standing start. Both of those clubs continue to enjoy the benefits of years of net spend which Arsenal have yet to get - but surely will. Exciting times and a great analysis. Thanks.

ReplyDelete"welcome back". Great article.

ReplyDeleteThese posts are always excellent - thanks for sharing all this analysis.

ReplyDeleteWould love to see a breakdown of the Spurs accounts to see what happened with the Bale transfer, their mad spending and where that has left them in terms of future stadium plans etc. Not so I can boast to the neighbours but it's a good comparison to see how well our team/wenger has done through a clear financially pinching time.

ReplyDeleteWenger loves the business model, but until he accepts that it`s not his money, we will still be outbid for the top players.

ReplyDeleteBloody hell. And to think this is just a "hobby" for you. Were you the kind of student at school who when it came to homework, didn't just do that week's on the weekend but skipped ahead and did the whole term's as well?

ReplyDeleteSuch a surfeit of brilliantly clear analysis boggles the mind how long it must take you and the skill that requires. Fair play.

Missed you SR, welcome back. Hopefully there's more to come on other clubs and leagues in Europe.

ReplyDeleteAll hail the long awaited return of the rambler!!!! And you have returned with the exact article i was looking for. Great read, keep them coming. Good man.

ReplyDeleteBrilliant piece of financial analysis as per usual and well worth the wait.

ReplyDeleteThat said, I wonder if the shortfall in the squad currently is more a footballing issue (particularly with regard a DM bearing in mind Wenger is likely to hold off over a longer view of who may come on market in a season down :

1)We are only slightly short in defense but it could proof significant as Cback cover may have repercussions for fullback cover being. Otherwise (bar injury) we are carrying 7 defenders this season- Per, Koscielny, Chambers, Gibbs, Monreal, Debucchy and (YES) Bellerin.

2)I don't think we are in need of a physically large imposing specimen of a DM. Those touted to have been the answer to our woes in previous transfer windows - Luis Gustavo, Victor Wanyama, Ettiene Capoue, Yann MVilla...none have made significant impact where they have since gone and have in all honesty flattered to deceive. Carvalho is the latest to be touted.

Recent City game, someone praised the impact of Fernandhino at City as the srt of player we need to add energy to cover our defense from midfield and illustrated our concession of two goals as the reason why Arteta or Flamini were not up to task. This negates the fact that City conceded two to us of course.;)

I think the issue in DM is not an issue of a particular type of physicality we need. This is frankly somewhat passe (noting of course we still carry a latent and existential ability with Diaby)

Rather we need to rejuvenate the position because of Arteta's age.

That said he is still good for one more season at very least. Particularly as we have made a number of changes in defense (Introduction of Debuchy, Chambers, Bellerin), it makes sense to retain a level of familiarity in the squad, in particular between DM and the 2 main Cbacks.

The issue of DM can await next summer. There is no rush to enter the market now. This is likely a footballing reason rather than anything to do with ability (or gumption) to purchase the right player for the right price. I remain unconvinced that Carvalho is the be all and end all solution to our DM requirement (Beyond poor performances of Portugal in recent Internationals) and he was in any case over priced. Add to that we have Chambers also earmarked for a possible role in central midfield, clearly this is not an urgent requirement and something to befuddle our more urgent needs elsewhere in the squad which is chiefly :

At Cback.

Wenger is playing a bit of risk having Monreal as potential 4th cover at Cback. This particularly as Gibbs is prone to injury. The assumption I feel he has calculated is to shift Flamini into LB if necessary. Hence the continued presence of Coquelin to back up in midfield DM, clearly not ideal.

This is the perplexing issue at stake as granted we would prefer quality and long term (bearing in mind Isaac Hayden) to the United approach currently, clearly we don't need any where near 50m to secure the service of someone at least short term for cover.

Wenger cites the lack of quality options in market this summer but surely we are looking for cover over capability at the moment. An experienced player on loan would have sufficed and we would not have had to break the bank.

Whilst we are able to be competitive bidding (at least for our marquee target) against some of the more well greased teams now, doesn't wage come into play here?

ReplyDeleteSome of the wages offered at the other teams are still way over our league. Consider the sort of money paid out for Falcao over a season's lone (obviously United have need for immediate impact, PR or otherwise)

Great read. Thanks so much.

ReplyDeleteOne of the things that caught my attention was the TV pool of the CL. This seems to substantially prefer French and Italian teams over the rest. Eg, Marsaille gets 24m for losing every game, and Arsenal gets 11m! Juventus gets 32m for not making it to the last 16!

This is so good, we could call you The Swiss Rambo

ReplyDeleteit was about time, you lazy b@stard ;-P

ReplyDeleteGreat post, thanks.

ReplyDeleteGiven you only post a realistic cash pool of 40-50m, and the disaster that has befallen Liverpool and then ManU, would you not expect Arsenal to horde more surplus against a rainy day?

Spending it seems like a huge gamble given what has happened to other clubs, if we spent a season out of the Champos for instance, that would be the time to spend the surplus.

I wish more fans would read this thread to get a better understanding of what our realistic picture is. All the complaining that we haven't spent is fairly ludicrous when any spending would put the long-term future of the club in doubt.

Today I learned "virtually unchanged" profit before tax means a whopping 30% decrease.

ReplyDeletewell done on the facetiousness Jim.

Deletecontext is so often worth considering - don't you think?

The greatest blogger came back!

ReplyDeleteExcellent work, mate! Always a good read

ReplyDeleteIncredibly detailed post... interest > player transfers?! Who's really winning!

ReplyDeleteThis guy just gets better. They should give him a place on the Arsenal board.

ReplyDeleteExcellent analysis and thoroughly enjoyable! Thank you and please keep going!

ReplyDeleteAwesome analysis. Excellent work. Simply outstanding.

ReplyDeleteAwesome post. Excellent analysis. Amazing job mate ;)

ReplyDeleteIt's meazing analysis.Thank for this excellent work.I talk your analyse in my blog http://soccerfoot.fr/ .

ReplyDeleteGreat work

ReplyDeletei m happy you returned to write back on the financial aspect of the biggest sport business in the world. You are the greatest and only one I enjoy to read. Great work. I hope new articles around statistics as well concerning top teams, like penalties, favours over non off sides position signaled. If it s true or not based on facts only. Financial aspect and articles around statistics would be outstanding.

ReplyDeleteHi there,

ReplyDeleteGreat article and some really good in depth analysis. Very impressive. Really enjoyed reading your blog. I've recently started up http://www.footballphotos.co.uk and was wondering if you'd be willing to do a link exchange. I think your site is an excellent read and would really love to hear back from you about a reciprocal link.

Thanks and keep up the great work!

Stuart

Great article,

ReplyDeletewould be great to have the numbers for the media revenue table